Unlike 2023, this year Fixed-term deposits are no longer so attractive in the face of inflation. However, in recent weeks, this traditional market instrument has regained interest due to the slowdown in prices and a gradual upward adjustment in the rates offered by banks, driven by an improvement in credits. Even so, there are investment alternatives that do not force the user to immobilize their money, such as Mutual Funds (FCIs) that also allow for a projection of the financial strategy.

During July 2024, the FCIs Industry showed a positive performance despite the economic context. With a 6.6% increase in its assets Compared to the previous month, reaching $43.4 billion, the industry managed to maintain its resilience, even in an environment of high inflation and market volatility.

This growth in the FCI occurred in a framework in which the CER-adjusted bonds They appear to be the preferred option for local investors in the medium term. “The strategy of investing in these inflation-adjusted instruments responds to the need to protect capital in a scenario where inflation, although slowing, remains high,” holds Leo Anzalonedirector of the Center for Political and Economic Studies (CEPEC).

Keys to investing in mutual funds

In dialogue with Scope, Eduardo Herreradirector of IEB Funds Investmentsexplains that when it comes to selecting an investment fund, it is important to distinguish between the needs of an institutional or corporate investor and those of an individual. The former usually have a clear idea of what they are looking for. “For example, a corporation may be interested in a Money Market fund (immediate liquidity), while an institutional investor might be looking for an FCI that offers inflation coverage (CER), dollar hedging (Dollar Linked), or a dollar fixed-income fund.”

Individuals, on the other hand, often require a higher level of advice. They often have clear objectives, “but do not know the ideal instruments to achieve them,” says Herrera. The strategist adds that a “retail” investor may be interested in creating a retirement fund, saving for a child’s education abroad, or planning a trip.For these cases, it is essential to start by understanding the investment horizon.“, he slides.

“The investment horizon is crucial to determine which fund is suitable,” says Herrera. He exemplifies that “If a client tells me that their horizon is only ten days, the most advisable thing would be a Money Market fund.This is because investing in stocks with such a short horizon could result in losses, if the market experiences a rough patch. On the other hand, if the horizon is one year, an equity fund could be considered, as these types of FCIs are designed for the medium to long term. However, it is also important to assess the macroeconomic situation and the state of the stock market at that time.

The risk that each one is willing to take

In addition to the investment horizon, the individual’s level of risk aversion is another key factor. “If the horizon is two years, but the investor has a high risk aversion, an equity fund may not be the best choice. Instead, a long-term fund might be more suitable.” fixed-income fund in dollarsor even one that invests mainly outside the country,” Herrera recommends.

Regarding the performance of the funds in recent days, the specialist stresses that it is essential to consider the investment horizon again. During the last month, the funds of Capitalizable Letters in Pesos (Lecaps) are the best performers. While equity funds also performed well this month, it is important to remember that measuring their monthly performance is not entirely useful due to the inherent volatility of these funds. “What is showing good results today could be reversed next month. On the other hand, Lecaps funds, which are short-term fixed-income funds, show less volatility,” Herrera analyzes.

In this last month, in addition to the Lecaps funds, the T+1 funds (today plus one business day) also performed well. In contrast, the CER and dollar linked funds have not performed as well, “mainly due to the exchange rate stability following the measures adopted by the Government in July, which included the zero emission policy and intervention in the foreign exchange market.“This stabilization reduced the demand for instruments for both exchange rate hedging and the decrease in inflation did the same for inflation hedging instruments.

Which funds does the market recommend?

Rodrigo Benitezchief economist at MegaQM, tells this newspaper that, given the continuation of exchange controls, local investors are divided into two groups. “On the one hand, those who have dollars or can buy them and, on the other hand, those who need to invest pesos.”

Funds in dollars

In recent years, dollars have been used in Argentina as a reserve of value, but without seeking a return on them. The reality is that, given the inflation that has existed worldwide, dollars without a return imply a loss of purchasing power. “That is why we believe that the fund industry has to offer tools to give these funds a return. MegaQM’s offer for investing dollars is very broad and is based on 4 alternatives,” explains Benitez.

MegaQM.jpeg

- MegaQM Liquidity Dollar: first Money Market fund in dollars with yields close to 2% per year. It is low risk, redeemable on the day, and It is ideal for those involved in money laundering.since it invests in assets without price variation.

- Megainver Fixed Income LATAM: conservative dollar fund that invests in debt of private companies in Latin America (Brazil, Chile, etc.), mainly in strategic sectors such as Oil & GasIt offers an annual rate of 5.5% to 6% and is ideal in a context where transferring dollars abroad is free.

- Megainver Fixed Income Dollar: Higher risk and profitability fund that invests in Negotiable Obligations (ONs) of Argentine companies listed abroad and a small proportion in sovereign debt, seeking a good combination of liquidity and profitability.

- Megainver Sovereign: fund that invests exclusively in dollar-denominated debt of the Argentine government and the BCRA, with greater volatility and long-term yield. It is the most volatile option, but also the one that accrues at the highest rate, ideal for investors seeking to maximize long-term returns.

Funds in pesos

For those seeking investment alternatives in pesos, MegaQM currently focuses on three products within the range of options offered by the broker. “We have a short-term outlook where we prioritize fixed-rate options. Meanwhile, when we extend the planning horizon, we are beginning to see interesting opportunities in the segment of assets that adjust by CER.”they add.

MegaQM 2.jpeg

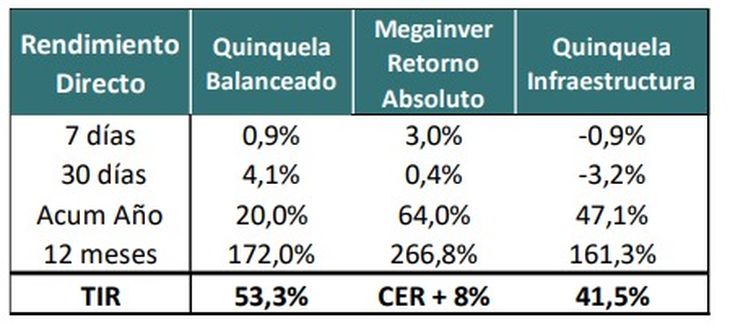

- Quinquela Balanced: fund that invests in short-term Lecaps with low volatility. It pays redemptions on the same day, after the market closes (17:30), which places it between Money Market funds and T+1 funds. Ideal for those involved in money laundering.

- Megainver Absolute Return: fund that invests in CER assets to preserve the purchasing power of pesos. Despite the recent decline in inflationary expectations, these assets offer an inflation yield of +10%, making them an attractive option for inflation hedging.

- Quinquela Infrastructure: long-term investment fund in pesos, focused on local companies with infrastructure projects (mainly oil and gas). Although it is subscribed and redeemed in pesos, it offers currency coverage through hard dollar and dollar-linked assets. Ideal for long-term investors interested in participating in money laundering.

These funds are designed for specific objectives and can be combined to create a diversified portfolio according to the liquidity needs and risk/return profile of each investor, he concludes. Benitez.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.