The Ministry of Economy will return to the market this week to try to renew maturities of around $7 billion, in the last debt auction in pesos in Septemberthe most challenging month of the year in terms of Treasury commitments. After the conclusion of the transfer of liabilities from the Central Bank to the treasury, despite having contracted in real terms, the stock of public securities in local currency measured at the dollar settled with liquidation (CCL) reached a peak not seen since the prelude to the outbreak of Mauricio Macri’s crisis in 2018. Thusin the market they affirm that the “rollover” of that debt continues to depend on the exchange rate restrictions.

Officials from the Finance Secretariat, which heads Pablo Quirnoare preparing the menu of instruments that they will put on the table for investors. The call with the conditions of the auction will be published this Tuesday. The tender will take place on Thursday and will be settled on Monday, September 30. On that day, approximately $7 trillion of debt in pesos will mature. This is mainly a LECAP (fixed-rate capitalizable bill) for $6.78 trillion, to which are added a little more than $300 billion of the dollar-linked T2V4 bond and other minor commitments.

This will complete a September payment schedule of just over $14 billion, the busiest month of the year in terms of debt payments in pesos. Before the pre-auction (in which $6.97 billion was renewed), Luis Caputo had opened the umbrella on a possible partial refinancing, in a context of recovery of credit to the private sector (from historic lows), although Finally, it approved a slight rate increase to prevent that from happening.The economic team said at the time that they sought to give a “hawkish signal” by prioritizing a total rollover over the possibility of maintaining rates. Will they maintain this strategy?

image.png

Debt and the maintenance of the cepo

The large short-term maturities faced by Finance are, to a large extent, a legacy of the debt handrail from the BCRA to the Treasury The current economic team promoted the migration to end endogenous issuance for interest payments. They are the opposite of the elimination of remunerated liabilities in pesos of the Central Bank. This migration ended in July, with the launch of the LEFI.

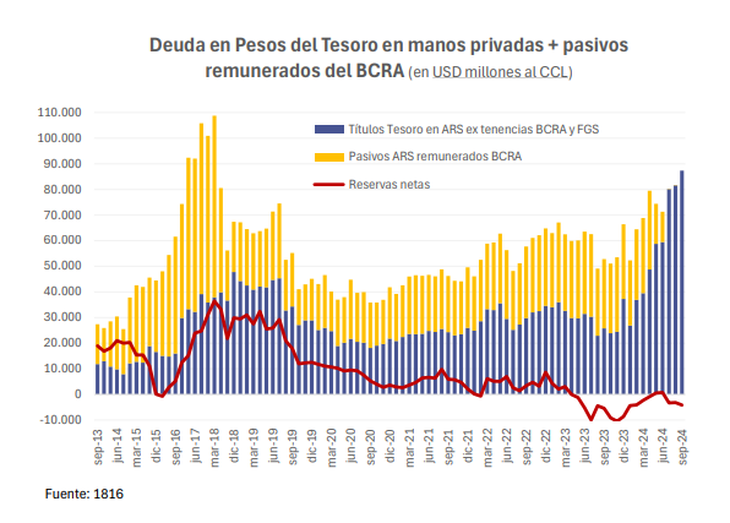

Once this process is completed, a report from the consultant 1816 weighed the importance of that debt in light of the Ministry of Economy data updated through August. The report stated that the stock of public securities in pesos (adding the remunerated liabilities of the BCRA, now eliminated, and those of the Treasury, but not counting the holdings of the Central Bank and ANSES) shrank both in real terms and measured in official dollars from the highs of 2023. “However, measuring the CCL that same stock It is already almost US$90 billion (estimate to September), being the highest record since the run on the peso in the first half of 2018“, they highlighted.

image.png

This is a relevant fact regarding the situation that the Government faces in the face of a possible lifting of the exchange restrictions, with a BCRA that has Between US$5 billion and US$5.8 billion of negative net reservesaccording to various private estimates.

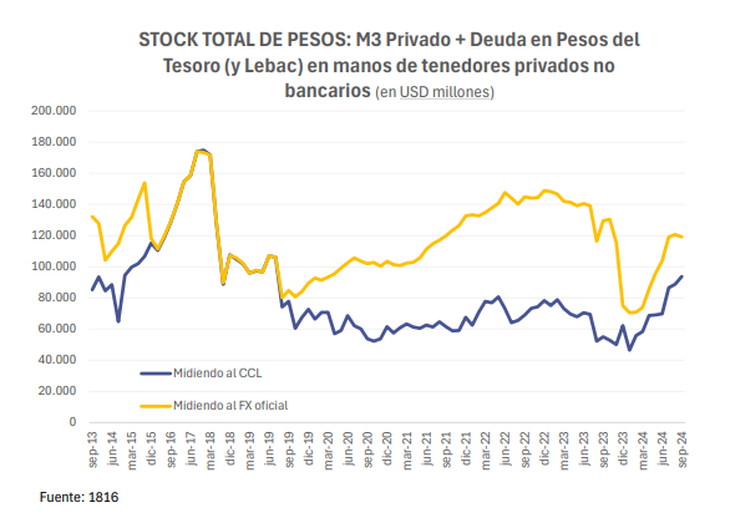

“The credit market in pesos continues to depend on the currency controls”considered the consulting firm in its latest report Eco Go, by Marina Dal PoggettoHe added: “In consolidated terms, the debt in pesos (including Bopreal) has practically returned to the levels of November before the devaluation. That is, the flows are correcting, but the stocks are still taking their toll.”

The 1816 analysis indicated that an attenuating factor regarding the Macri era is that today More than 60% of the peso-denominated securities are in the hands of banks and the stock in non-bank private hands is less than half of what it was at the time of the LEBAC explosion (measured at the CCL). Banks cannot divest themselves of bonds and bills to dollarize because they have regulatory restrictions on their foreign exchange position.

However, the consulting firm run by Adrián Rozanski, Mariano Skladnik and Martín Defilippo added: “We cannot lose sight of the fact that the financial system is, at the end of the day, an intermediary between depositors (the real holders of pesos) and the Treasury (the one that has the debt).” In other words, savers could withdraw their money and run to the dollar.

Along these lines, in 1816 he calculated the amount of pesos in the economy held by the private sector from the sum of the currency in circulation, deposits in pesos and public securities in non-bank hands: measured The value of the CCL is also around US$90 billion. (US$120,000 million at the official rate).

image.png

Debt and interest swept under the carpet

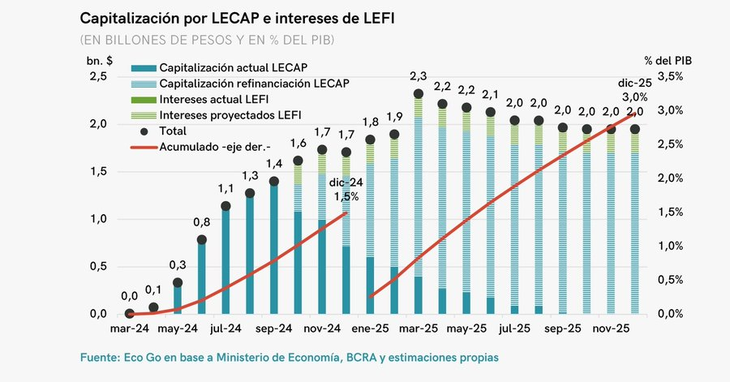

On the other hand, the debt handrail from the BCRA to the Treasury transfers the payment of interest with monetary emission from the Central Bank to the Public Administration. But, as he said Scope, having been channeled into letters with capitalizable interest (LECAP and LEFI), That cost is swept under the carpet of the fiscal accounts: it is not computed “above the line” in the financial result and becomes part of the debt stock. This strategy is key to maintaining the fiscal balance that the Government celebrates.

The report of Eco Go projected that “the transfer of the debt from the BCRA to the Treasury will generate an additional 1.5% of GDP in the interest account for 2024 (which is recorded as debt) and an additional 3% of GDP next year,” with a total renewal of the maturities at the current rate. He stressed: “What previously implied an issue of pesos by the BCRA, if the demand for credit led the banks to dismantle remunerated liabilities, now implies an issue (of the pesos that the Treasury has deposited in the BCRA) to cancel an eventual non-renewal of 100% of the LECAP maturities.”

image.png

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.