For the market, the devaluation rate next year will be close to 3%, far from the expectation that the Government showed in the 2025 Budget. How does inflation influence?

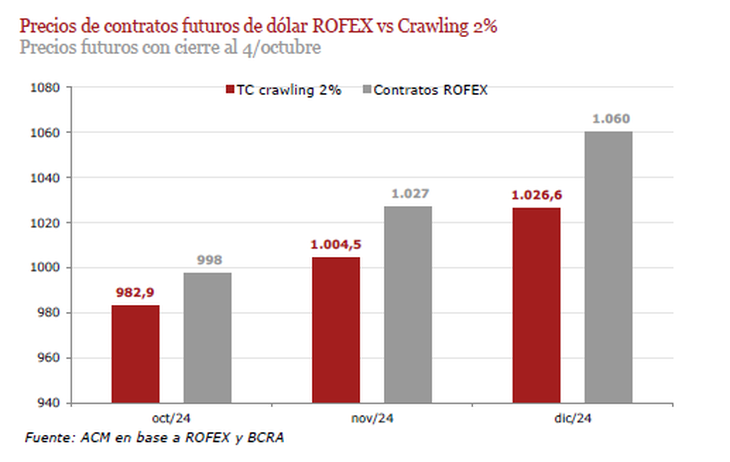

In the short term, the market trusts that the Government will maintain the devaluation rate until December and there will be no exchange rate jump. However, in 2025, the perspective is that the devaluation is close to 3%, far from the Government’s expectation that was reflected in the Budget. An indication of this view was provided by the future dollar contracts.

The content you want to access is exclusive to subscribers.

According to a report by the consulting firm AMC, starting in 2025 the market predicts that the crawl pace carried out by the government will begin to be abandoned. raising the monthly devaluation to an average of 3%.

“When analyzing the prices of the ROFEX dollar futures contracts, it is observed that a acceleration of the devaluation rate starting in October, being 3.7% monthly. a consistent trend in the month of August, but accelerating the devaluation rate starting in September, being 3.3% monthly,” he explained.

“While, by the end of the year, the crawl would continue above the current one, registering an average monthly devaluation of approximately 3.1%. This differs from what is reflected in the 2025 Budget Project (PLP25) presented by the government, where It is expected that towards 2025 the dollar will accompany the monthly inflation rates, projected around 1.4% monthly for all of 2025,” the analysis added. It is worth remembering that the inflation number expected by the Government is $1,207 in December 2025, which implies an increase of 18.3% throughout the year, a modest increase with respect to the progress that the exchange rate had in recent years. Does this suggest that inflation will be higher than what the Government sets? Questions that are not reflected in prices for now.

acm2.png

Wall Street giants price the dollar at the end of the year and in 2025

In a context of maintaining the crawling peg, Focus Economics panelists predict that the dollar will end the year at a value of $1,178 average this year and will reach $1,659 in 2025. This implies a substantial change from the previous report in which the highest value expected was $1,549.

Consulting firms that foresee a highest value of the dollar in December are: Econviews ($1,560), Invecq Consulting ($1,500), Empiria Consultores ($1,452), OJF & Asociados ($1,447) and Fitch Ratings and Santander ($1,400).

Finally, those that see the lowest wholesale exchange rate are Pezco Economics ($973.5), Allianz ($930), Analytica Consultora ($1,032), Aurum Valores ($1,035) and Banco Supervielle ($1,020).

A color data What the report provides is that The Argentine peso may be the region’s currency that appreciates the most in 2024. The Focus Economics report estimates that this year the Argentine peso vs. The dollar will appreciate 31.4% and is only comparable with Peru, where the expectation is an appreciation of the Peruvian sol by 1.6%.

Dollar: what will be the price for the end of the year according to international banks

- BancTrust & Co: $1,021

- Barclays Capital: $1,500

- Capital Economics: $1,300

- Credicoop Capital: $1,300

- Fitch Ratings: $1,400

- Fitch Solutions: $1,200

- Itaú Unibanco: $1,027

- JPMorgan: $1,250

- Moody’s Analytics: $1,023

- Oxford Economics: $1,067

- Pezco Economics: $973.50

- Standard Chartered: $1,050

- UBS: $1,350

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.