The market of actions and bonuses Argentina has been a roller coaster, with steep drops followed by abrupt rises. These extreme fluctuations are the result of populist policies that have significantly deteriorated the country’s economic fundamentals over the years.

Let’s look at the Merval Index in dollars:

image.png

The graph speaks for itself. The movements are extremely violent for both sides.

And the bond market? Another roller coaster. Let’s look at the historical parity of sovereign bonds:

image.png

Since Milei won, Argentina is undergoing significant economic and political changes that are creating a favorable environment for investors interested in long-term opportunities.

And that explains the great returns that there were in the market. Since before the November 2023 runoff, the Merval in dollars accumulated a return of more than 100%. And the bonuses? The AL30, for example, rose 130%. Awesome.

The question is whether the movement could continue. Looking at stock valuations and the country’s potential, the answer is yes. And looking at the country risk, the conclusion is the same: there is room to continue improving.

Why Argentina could change in a real and profound way now?

There are three key factors that are driving this renewed interest in the country: the return of credit, the lifting of the exchange rate and the reclassification of Argentina as an emerging market.

- Credit return: Argentina is about to regain access to international credit markets, something that had been very limited in recent years. This access to credit will also reach the private sector, allowing companies to finance growth projects and increase their productivity. As credit becomes more accessible, a resurgence of investment and expansion is expected in key sectors such as agriculture, energy and technology, positioning Argentina for sustainable growth.

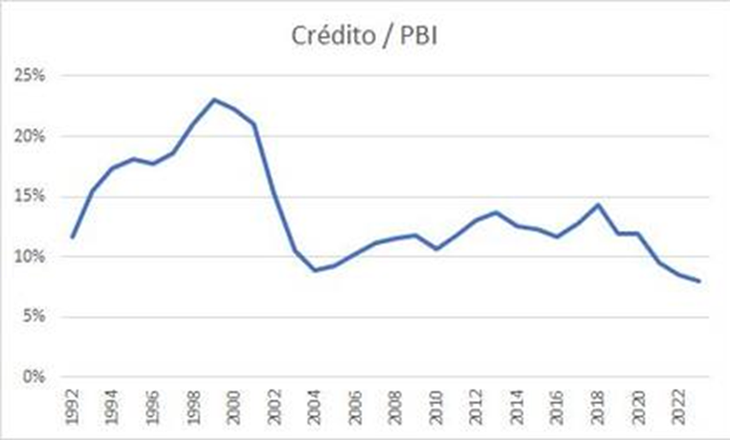

Private credit relative to GDP in Argentina:

image.png

The data clearly show a major problem in the Argentine economy: the ratio between private credit and GDP is at a meager 6.4%, the lowest level in the last 30 years. To put this in perspective, in other countries in the region the ratio is much higher: in Uruguay it is 27%, in Peru 48%, in Brazil 71%, and in Chile 109%.

- Lifting of the exchange rate: Another crucial change is the expected lifting of the exchange rate. This policy, which has restricted access to foreign currency and capital circulation for years, has been a major obstacle to foreign investment. By removing these restrictions, Argentina will open its doors to international investors who were previously hesitant due to the inability to repatriate profits or move capital freely. With a more flexible and transparent exchange market, investors will have greater confidence in the stability of the Argentine peso, reducing exchange rate risk and making Argentine assets more attractive. Furthermore, a more open exchange rate regime will likely stabilize the exchange rate, control inflation, and encourage more investment.

- Reclassification as emerging market: Perhaps the most important factor for future growth is Argentina’s return to the Emerging Markets Index. After years of economic instability and exclusion from markets, Argentina is once again seen as an important player in global markets. This reclassification is crucial because global funds that follow emerging markets are now required to include Argentine assets in their portfolios, which will generate automatic demand for Argentine stocks and bonds. Furthermore, being considered an emerging market increases the country’s visibility to international investors, which can attract more foreign direct investment and strategic alliances.

Argentine assets have been celebrating for a long time. For several reasons, the bullish trend may continue. Obviously you have to take into account the associated risk and control the position sizes well.

If you want to learn more about investments, I invite you to our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.