Credit in pesos to the private sector increased at $4.2 billion in octoberwhich implied a monthly growth of 6.3% without seasonality at constant prices and a year-on-year increase of 14.2%. Thus, it accumulated its seventh consecutive month of recovery from historical minimum levels, a rebound that accumulates 66.8% since January.

The data comes from the Monthly Monetary Report published this Thursday by the Central Bank (BCRA). The organization highlighted that the October increase was verified in practically all loan lines.

“In terms of GDP, credit to the private sector would have amounted to 6%accumulating an increase of 1.6 percentage points in the last semester,” said the BCRA report. In April, the ratio of loans to product had hit a floor of 4.4%.

image.png

Credit: what are the lines that grow the most?

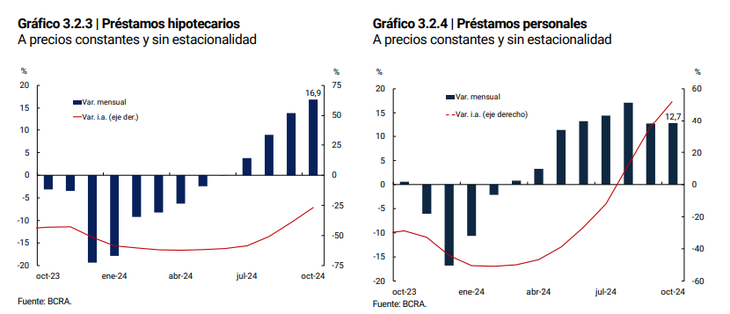

Loans with real collateral led the growth of the month with a real increase of 10% without seasonality compared to September. As had happened in the previous month, the credit line that showed the best performance was mortgagewho experienced a seasonally adjusted increase of 16.9% at constant prices, although it is still 26.4% below the level of a year ago.

On the other hand, collateral loans increased 7.2% in real terms without seasonality in monthly terms and already reflect an increase of 6% year-on-year.

Meanwhile, the business loans They expanded again, although at a more limited pace than in previous months. All in all, they have accumulated nine consecutive months of growth. In October, as a whole, increased in real terms 3.8% monthly in the seasonally adjusted measurement.

The boost in financing for companies came from the documentswhich grew 6.1% monthly without seasonality in real terms and are already 11.5% above the level recorded a year ago.

image.png

Likewise, both single-signature documents and discounted documents showed a favorable evolution in the month with real increases of 7.1% and 3.9%, respectively.

On the other hand, that of Checking account advances were the only line of credit that did not grow in the month: fell 0.8% in real terms without seasonality compared to September, although they are still 13.5% above the October 2023 level.

“Within commercial loans, when analyzed according to the type of debtor, it is observed that The growth of commercial lines is largely due to credit destined for large companieswhich expanded approximately 6% in real terms without seasonality during October and is already 129% above the stock from a year ago. Commercial credit destined for SMEs grew 1.5% in the month in real terms and without seasonality, and is still 17.4% lower than the level of October 2023,” highlighted the BCRA report.

Finally, the consumer credit continued to expand in October and recorded a improvement of 8.3% monthly at constant prices (19.7% year-on-year).

Among them, the personal loans They increased 12.7% seasonally adjusted in real terms compared to September, with a year-on-year growth of 54.5%. Furthermore, financing through credit cards increased 5.8% at constant prices during the month and 5.6% year-on-year.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.