The city’s euphoria is not only reflected in the large gains made by the increases in Argentine bonds and stocks in recent days or in the compression of the exchange gap to the lowest level since 2019. It is also reflected in the optimistic inflation prospects that emerge from the price of debt securities in pesoss. Market bets exhibit an implicit expectation for the consumer price index (CPI) increasingly closer to the forecast included by the Government in the 2025 Budget project.

The 2.7% inflation for October recorded by the INDEC fed back to the growing optimism in the city’s expectations and relaunched the bets on the “carry trade” and compressed the yields of the fixed-rate bill and bond curve, whose slope deepened its investment tendency. Although this Monday, both Lecap like the Boncap They were operating with slight losses at the close of this note.

image.png

Inflation: what does the market expect?

In line with this movement, they also compressed the expectations of the evolution of the CPI implicit in investors’ bets. Personal Investment Portfolio (PPI) estimated that, at the close of Friday, the call “breakeven inflation” averages 1.8% for the next 12 months. This “indicates that “The market incorporated inflation into prices that would be around 20% annually towards the fourth quarter of 2025.”PPI noted in a report to its clients.

This implies that the increasingly optimistic market forecasts They are aligning with what is budgeted by the Government. The Fiscal Year 2025 project that the Executive sent to Congress in mid-September predicted inflation of 18% top-to-bottom by December 2025which would imply a monthly CPI average around 1.4% over the next year.

When the project was submitted to Parliament, this projection was seen as very optimistic by both analysts and the majority of investors. Although most consultants (despite having cut their forecasts) still foresee inflation higher than budgeted, the numbers emerging from financial assets are beginning to resemble the official forecast.

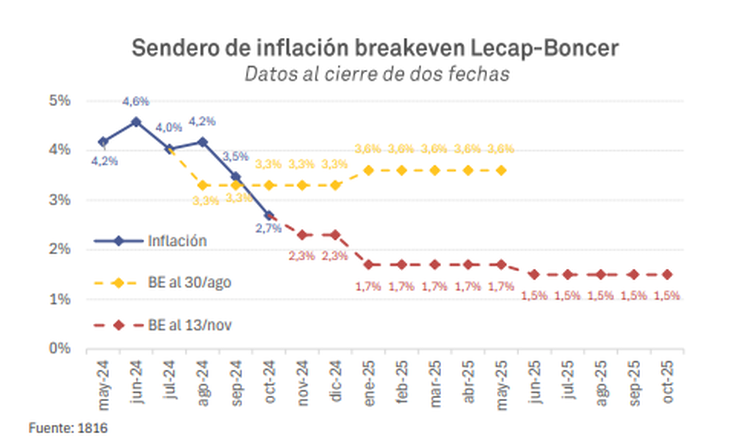

The consultant 1816 reflected in a recent report the compression of the “breakeven inflation” between Lecap (fixed rate bills) and Boncer (inflation-tied bonds). At the end of August, the prices of these securities discounted a CPI of 3.3% for the last four months of 2024 and one of 3.6% for the first five months of 2025. By November 13, that had changed: The expectation became 2.3% for the last two months of this year, 1.7% for the January-May period and 1.5% for June-October.

image.png

“Breakeven inflation” is that which arises from comparing the returns of different financial assets. It is obtained by establishing as the “equilibrium point” the level of inflation necessary for a fixed-rate bill and an indexed bond to yield the same after a certain period of time (for example, at maturity) based on market values. current.

Is it advisable to bet on a fixed rate or on inflation-linked bonds?

“The compression of the “breakeven inflation” curve in recent months, which led Boncap to yield 2.4% TEM (monthly effective rate), is nothing short of impressive,” the 1816 report described.

The Boncaps for October and December 2025 ended last week with a TEM in the secondary market of 2.4%, while the shorter Lecaps yielded around 2.9%. That slope inversion (shorter duration securities yield more) shows the appetite of investors to lock in longer-term returns in the expectation that the slowdown in inflation will further lower future rates.

Anyway, this tuesdayafter the National Sovereignty Day holiday), fixed rate securities fell 0.1% in the shortest section and 0.6% in the longest before taking profits. Thus, the question that arises is whether, at these limited returns, Lecap and Boncap continue to be a good alternative for investors launched into the “carry trade”.

“Even being constructive with the dynamics of the CPI, In terms of the risk-return ratio, we prefer Globales (which still have room to compress if access to credit by the sovereign is normalized) and CER titles (because even after the rebound of these weeks the real rate they offer is still attractive and because they no longer yield so much less than the Global ones) over bonds and bills at a fixed rate”, analyzed 1816.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.