The activity registered its smallest annual decline since October 2023, according to a report by the consulting firm Orlando Ferreres.

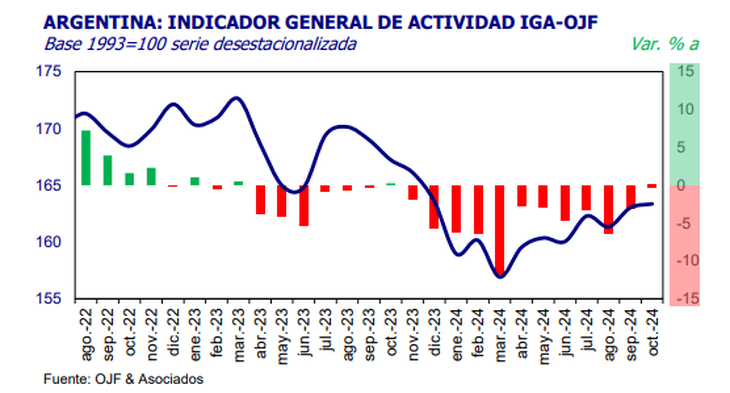

Economic activity slowed its year-on-year contraction to 0.3% in Octoberl lowest drop since October last year. Likewise, in monthly terms there was a slight improvement of 0.2%, the second consecutive.

The content you want to access is exclusive to subscribers.

“Economic activity managed to record a new monthly advance in October and was 4.1% higher than the lowest point reached in March,” says the consulting firm’s report. Orlando Ferreres. And he adds that, in turn, in the annual measurement it was, in the tenth month, one step away from exceeding the level exhibited a year ago.

image.png

With these numbers, in the cumulative figure for the year the contraction of the economy stood at 4.7%. Likewise, compared to November 2023, prior to the assumption of Javier Milei as president, the loss was 1.7%.

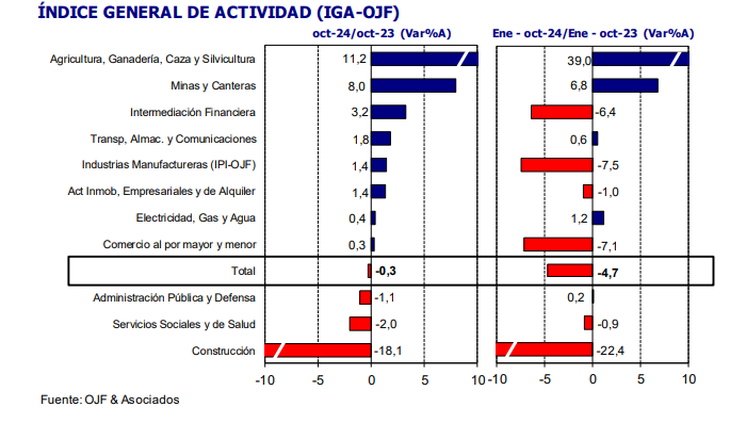

Among sectors, the annual decline was explained almost exclusively by the lower activity in construction (-18.1%)since the other two sectors that delayed activity during 2024, commerce and industry managed to turn positive figures in October (+0.3% and +1.4%, respectively).

image.png

In this way, according to this private measurement, the industry cut 16 consecutive months of declines. However, after the expansion observed in September, The measurement without seasonality recorded a decrease of 0.5% monthlywhich reflects that the sector is still immersed in a climate of volatility.

Within the sector, the dynamics were heterogeneous, with annual growth sustained for the most part by activity in the oil millswhich expanded 110.2% annually, and to a lesser extent due to the activity in refineries (+12.4% yoy). The other side of the coin is the production of non-metallic minerals (-21.1% yoy), an industry that provides inputs to construction and that presented double-digit annual falls during all the months of 2024.

“Going forward we should see a continuation of the current upward trend. The recovery of salaries in a context of sharp slowdown in inflation will help rebuild internal demand, hand in hand with the growth of consumer credit,” Ferreres said.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.