The carry incentive is one of Luis Caputo’s key strategies to maintain a flow of currency, which compensates for the red current account exchange rate. Juicy hard currency returns and reversal risks.

The “financial bicycle” of Luis Caputo and Javier Milei is already the most profitable, at least, in the last 32 years. It’s no coincidence: The Government was in charge of guiding the incentives of his economic policy to encourage bets on the “carry trade” as a way to attract a flow of currency that offset the current account deficit and allows the Central Bank (BCRA) to buy dollarsas happened in recent months.

The content you want to access is exclusive to subscribers.

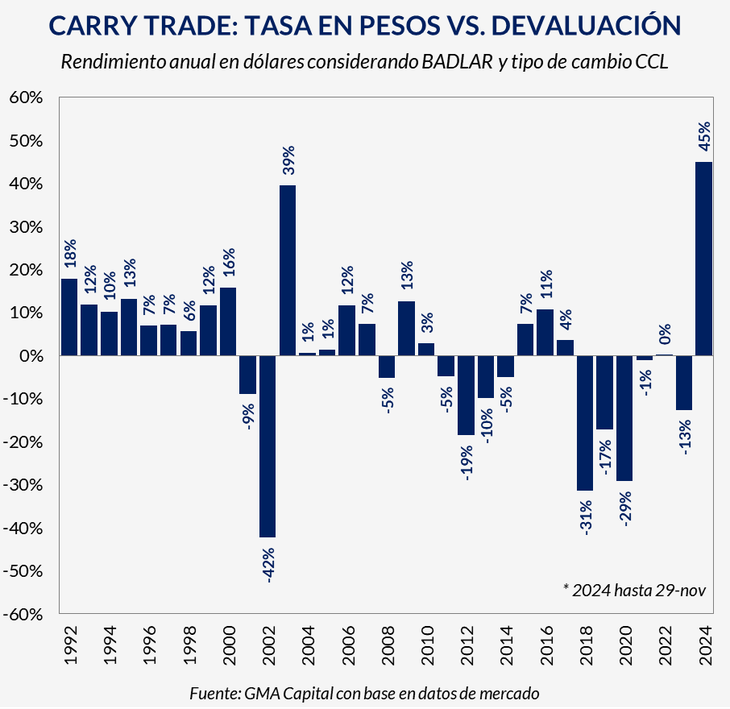

The economist Nery Persichinifrom GMA Capital, estimated the profits in dollars left by the “financial bicycle” in the first eleven months of the year, calculated based on the Badlar rate (which remunerates fixed terms over $1 million for 30 to 35 days) and the CCL exchange rate: “The ‘carry’ accumulates 45% in dollars. Thus, we have the best year, at least, since the beginning of convertibility.”

The number would be even higher calculated based on the performance of other instruments in pesos, such as Lecap or Boncap.. But the Badlar makes historical comparison easier. The GMA chart (see below) shows the accumulated dollar return in each year since 1992: with one month left, The 2024 gain surpasses the previous peak, 39% of all of 2003, and is well above any of the other years of positive returns.

image.png

“Carry trade”: a bet by Luis Caputo

The combination of the “exchange table” in the official one, the compression of the gap and interest rates in pesos Always sustained above the rate of devaluation are the incentives that the Government seeks to keep active. Because? A credible “carry” encourages companies to take credit (banking or capital market) in dollars and liquidate it in the official market and then be able to repay it. It also affects the desire of exporters to advance settlement and of importers to delay payments to their suppliers to join the cycle.

All of this contributed to inflating the supply of foreign currency in the official market and allowed the BCRA to buy some US$3 billion between October and November.an atypical amount for this time of year. Above all, explained by the placement of negotiable obligations and the growth of bank loans in foreign currency (together, they contributed US$4.9 billion in the two-month period), from the ceiling generated by money laundering.

Although there is agreement that the Government has room to extend the scheme for at least a few more months – based on the large loanable capacity left by money laundering and the anchoring of devaluation expectations – the truth is that The bet is not without risks. A change in expectations or an eventual external shock could reverse the flow of capital if part of the “carry” positions were unwound.

November earnings

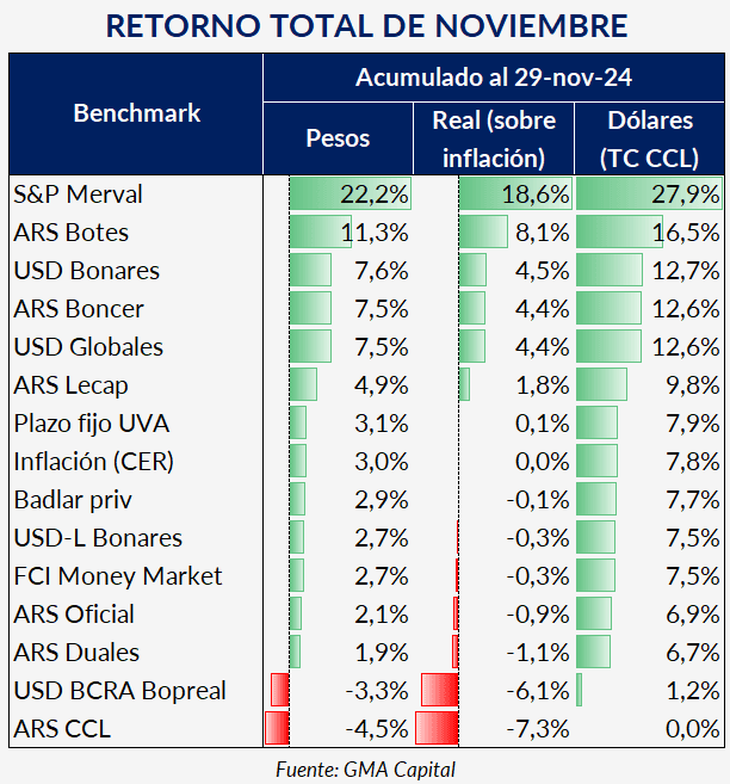

GMA also evaluated the most profitable investments in November. “Stocks were the best of November. They gained 27.9% in dollars and they took 18.6% off inflation,” said Persichini in reference to the performance of Merval papers.

Treasury bonds in pesos left 16.5% in dollars; the Bonares, Globales and Bonceres, just over 12%; and the Lecap, 9.8%; and the fixed term, 7.7%.

image.png

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.