image.png

What were the main minerals exported?

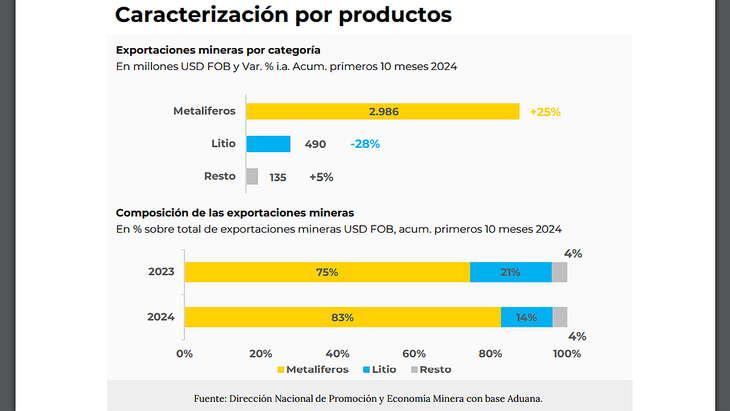

Of the total exported during October 2024, US$365 million corresponded to metalliferous minerals, which represented a year-on-year increase of 91.6% compared to the same month of 2023 for this category.

This type of products represented 82.5% of the total mining exports of the month, highlighting the participation of gold with US$302 million (68% of the total exported) and silver with US$59 million (13% of the total).

Of the remaining US$3 million (0.8% of the total exported) were explained by other metalliferous minerals (mainly zinc).

image.png

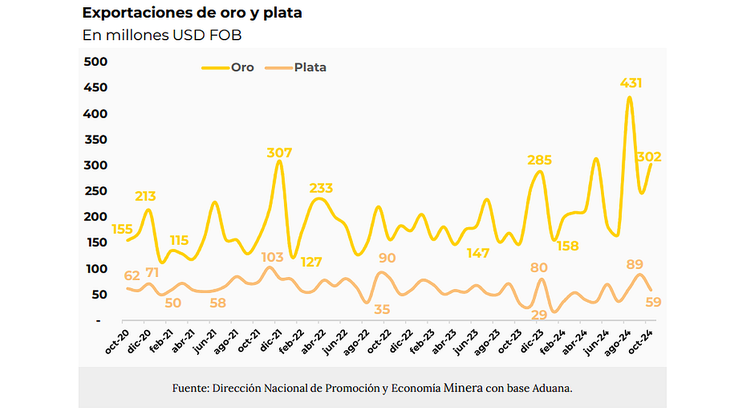

In October, the value of gold exports presented an interannual increase of 101.2% (152 million more than in 2023), explained by an increase in international prices and also by an increase in exported volumes of 38%, a situation that is logically explained by the increase in prices.

The silver exports In the month analyzed, they rose 85.9% year-on-year (27 million more than in 2023), explained by an increase in exported volumes of 91% and also by an increase in international prices.

In the accumulated of the first 10 months of the year, metalliferous minerals added exports by US$2,986 million. This implies a year-on-year increase of 24.7%, where Gold contributed US$2,429 million (67% of total exported), silver US$502 million (14% of the total exported) and the rest of metalliferous minerals US$55 million (2% of total exported).

image.png

The report highlights that these figures allowed this item to “represent 82.7% of total mining exports. “In this way, in the first 10 months of 2024, gold shows a year-on-year growth of 38.3% in the amounts exported, while silver fell by 14.4% year-on-year.”

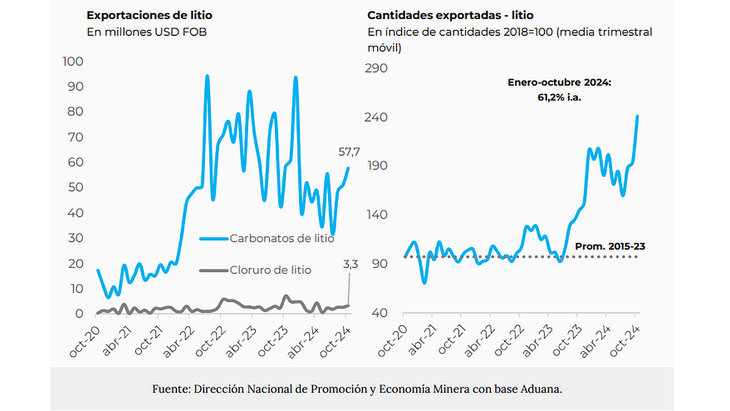

Lithium exports fall due to the drop in international price

The fall in international lithium prices caused the export numbers achieved to not be as expected, where the sector trusts that next year the value will adjust to a price higher than the current one, although far from US$80. 000 per ton that it had reached at the end of 2022.

In the case of lithium, a total of US$61 million was exported in October, which implied a year-on-year drop in exported amounts of 7%.

In that month, lithium, according to the most exported minerals, occupied the number two position, improving compared to the previous month, where it was the number three position. Thus, lithium explained 13.8% of total mining exports in the month under analysis.

image.png

Given this last data, in the first 10 months of 2024, lithium sales abroad reached USD 490 million, decreasing 28.5% year-on-year, representing 13.6% of total mining exports and this export data being in In historical terms, the number three position for the first 10 months of a year, with the cumulative total of 2023 being the largest historical year with the highest exported amounts.

On the other hand, despite the decrease in dollars obtained, the amount of lithium exported increased, with a cumulative increase of 61.2% so far this year.

China monopolizes the national lithium

Regarding the lithiumthe report from the National Directorate of Promotion states that China It is the main exporter and together with the United States, South Korea and Japan represented 92% of lithium exports in the month of October, while in the accumulated of the first 10 months of 2024 the percentage was 91%.

China increased its participation in lithium exports by 74% in the first 10 months of 2024 compared to the same period in 2023, while Japan decreased its participation by 85% in the same selected period.

With this increase, China with 69% is the country that exported the most lithium from January to October 2024, followed at a great distance by the United States.United States with 12%, South Korea with 10%, Japan with 4% and the remaining 5% is divided among several countries.

How did the rest of the exports fare?

The rest of the mining products reached US$16 million exported in October, which represents a year-on-year decrease of 12.3%. US$11.5 million corresponded to non-metalliferous minerals, highlighting borates, orthoboric acid and bentonite.

In addition, US$4.8 million of application rocks were exported, where lime accounts for 78% of the item.

In the accumulated of the first 10 months of 2024, the rest of the exports reached US$135 million, marking an interannual growth of 5.2%.

What are the main export destinations?

Switzerland, United States, China and India In October, they accounted for 81% (US$56 million) of the destinations of total mining exports, while in the cumulative total of the year this percentage reached 79% (US$2,845 million) for the selected countries.

Mining exports to these 4 countries were mainly explained by metalliferous minerals, which represented, for this group, 86% of total mining sales abroad in October and also 86% in the first 10 months of the year.

In turn, these 4 destinations explained 82% of total metal exports in the first 10 months of 2024. The remaining 18% of exports in this category were mainly destined for countries Canada, Belgium, South Korea, Chile and Finland.

Switzerland leads exports with 42% of the October total and 37% of the accumulated total for the first ten months of the year, with gold being the main metal exported from Argentina and silver in second order.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.