The Minister of Economy, Luis Caputo, decided to take advantage of the last debt tender in pesos of the year to carry out a double operation this Wednesday. In addition to auctioning six fixed-rate and inflation-indexed securities to try to renew the maturities of the coming days for more than $6 billion, it launched a early exchange of a bill maturing in January with the aim of beginning to decompress a portion of the swollen commitments of early 2025.

The city will make its bets on the placement, waiting for the November inflation data, which will be key to future financial movements.

Debt tender in pesos

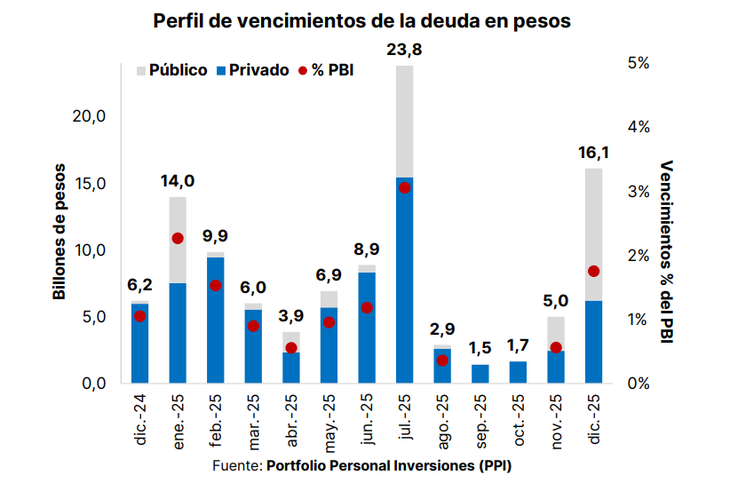

About $6.2 billion expires this Fridayconcentrated in a Lecap (for around $5.15 billion) and a Boncer (for the remainder). In the second half of December, some smaller maturities fall for which the Ministry of Finance (which will continue to be led by Pablo Quirno, despite his new temporary position in the Foreign Ministry) did not schedule a specific auction since this Wednesday’s is the last tender scheduled for this year. In total, monthly commitments amount to about $6.5 billion.

After its reappearance in the last November placement, the economic team chose to repeat the strategy of offering titles to fixed rate along with options tied to the inflation (CER). Specifically, on this occasion he put six instruments on the table: he will reopen the broadcast of three Lecap (capitalizable bills with fixed yield) to April, July and September 2025; a Boncap (capitalizable bond with similar characteristics) as of February 2026; and two Boncer (CER-indexed bonds with zero coupon) as of March 2026 and March 2027.

This is the combo with which it aims to renew at least the bulk of the remaining maturities of 2024. “The instruments offered by Economía come from two positive wheels after the BCRA decided to cut the monetary policy rates (LEFI) from 35 % to 32%” annual nominal, he pointed out Personal Investment Portfolio (PPI) in a report for your clients.

In this sense, PPI considered that The reduction in BCRA rates “was aimed at supporting the decline in market ratesin a context where the fixed rate curve remained under pressure since mid-November.”

image.png

Exchange of the Lecap S31E5

In parallel to this operation, the Treasury decided to offer a early voluntary exchange of a Lecap that expires on January 31 next (S31E5). In exchange, it offers the possibility of choosing one of the following instruments: Lecap maturing in May 2025, a new capitalizable letter in October of next year or the Boncap in January 2026. All of them with a significantly longer duration.

The eligible title (the S31E5) will be taken at market value, which will be announced this Wednesday before the opening of the auction. The calculation will be done by price in the case of the shortest Lecap and by rate in the other two available instruments. The settlement of the exchange will be made next Monday (T+3).

“The Treasury seeks to clear part of the heavy maturities that it will have to face in January”said PPI. These are debt commitments in pesos for about $14 billionaccording to estimates from the financial firm itself and the Congressional Budget Office, and for more than $16 billionaccording to calculations by the consulting firm 1816 and Adcap. In both cases, these are payments considerably higher than those in December. In that framework, “will seek to convert $3.3 billion of technical value from the S31E5,” added PPI. For February, maturities are around $10 billion.

image.png

The expectation of the city, waiting for the CPI

Both operations will be carried out hours before the publication, by INDEC, of the November inflation data. The reception of offers closes at 3 p.m. and the CPI will be released at 4 p.m. Thus, the expectation regarding that indicator will play a important factor when placing bets at the different tables in the city.

This is how he put it Javier Casabalstrategist Adcapin dialogue with Scope: “We expect the CPI to come out slightly above the previous 2.7%, very much in line with maintaining the idea of lowering the ‘crawling’ to 1% in the short term. A figure of 3% could be taken as negative and it would raise some doubts about that premise and could bring some losses on the bid positions. On the contrary, a figure of 2.5% would be very well received by the market and would generate relevant profitsespecially for longer positions. Therefore, the inflation data will be fundamental when choosing where to position itself.”

Also in conversation with this medium, Diego Martínez Burzacocountry manager and head of research at Inviu (firm belonging to Grupo Financiero Galicia), considered that There will be “a lot of demand, especially in anticipation of a probable future rate cut”. And he argued: “There are few alternatives that have attractive rates. I also think there will be a lot of acceptance of the exchange. It is true that little by little banks are going out to look for pesos in the market to lend, but I don’t see that it’s going to be left out too much. “It is not such a relevant amount that they have to roll over.”

Casabal qualified the expectations: “We expect that the greatest demand will be concentrated in the shorter maturity (April 2025) and then in the longer alternativesas has been the dynamic in past tenders.” And he noted that, as the Treasury faces large maturities in early 2025, it could grant “a prize for extending ‘duration’ of at least 10 basis points above the effective monthly market rate, consistent with previous tenders”, something that could also happen in the exchange, according to its forecasts.

“Even so, we believe that, due to the seasonal demand for pesos usual for this time of year, and given the growing structural shortage, “Possibly the Treasury will only be able to roll 80% of the maturities”projected the specialist Adcap.

In this framework, PPI pointed out that the operation will be a good thermometer to observe “the appetite of investors to extend ‘duration’, since, beyond the exchange, the shortest instrument offered in this auction expires in the second quarter of 2025”.

The truth is that Recently, the debt market in pesos has moved in line with bets on the “carry trade”the strategy known as “financial bicycle”, which consists of getting rid of holdings in dollars, placing them in instruments in pesos that pay an interest rate higher than the rate set by the exchange rate table and then becoming dollarized again before the exchange rate moves abruptly to become juicy hard currency profits. These returns, in the accumulated to November, have left returns in dollars greater than 45%, according to calculations by economist Nery Persichini.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.