The official signals were completed, at the end of the week, Federico Furiase and Martin Vauthier (directors of the BCRA and BICE, respectively, and both advisors to Caputo) during a presentation at the Torcuato Di Tella University. “For us, there is room for appreciation given that monetary and fiscal duties are done,” said Furiase, who once again ruled out a devaluation and confirmed that the intention is dismantle the trap “in layers”.

On this point, SBS pointed out that, in any case, the dollar futures They fell, but still “they do not discount that decline with 100% probability.” At the close of Friday, the Rofex January position was still priced at a monthly rate of 2%. That of February did pierce that floor and was around 1.3%.

The consultant 1816for its part, He attributed high possibilities of realization to the perspective that the official dollar will begin to travel at 1% per month at some point next month. In a recent report, he stated that, although the date has not yet been announced, the next Treasury debt tender in pesos could take place on January 15 to renew a maturity of $1.7 trillion. In this case, it would be done one day after the publication of the December CPI. “We assign high chances that this auction will either have a crawl of 1% and with a LEFI rate of less than 32% (which is equivalent to 2.7% monthly),” he said.

Dollar, crawling peg and appreciation

Furiase’s reference to the sidelines to appreciate is not coincidental. It happens that, after the megadevaluation of December 2023, the 2% monthly table that the BCRA maintained (always below inflation) and the devaluation of several key trading partners (such as Brazil) ate up almost all of the exchange rate effect of that depreciation. So, The real multilateral exchange rate is practically the same as it was when Milei took office.one of the most appreciated since the exit of convertibility.

image.png

It is clear that a new devaluation would reheat inflation (and the Government’s primary objective is to avoid it since the slowdown is its main political asset), with evident social costs. Although economists believe that the option for a “cheap dollar”, with negative net reserves and no significant trade dollar flow, it has a important cost for industrial activity (opening of imports through) and for the BCRA coffers.

Regarding this last point, the most obvious symptom will be tourism boom abroad of Argentines who have the possibility of affording a summer trip. With prices in Rio de Janeiro that in some cases are even lower than those on the Buenos Aires coast, the consulting firm Epyca estimated that more than US$3 billion will be spent on card expenses in dollars during the summer. The Central pointed out that half of those dollars come from the “cushion” or the MEP and the other half puts pressure on the reserves.

“The Government’s exchange rate policy had a clear priority: use the official dollar and the parallel dollar as an anchor for inflation, regardless of the cost in reserves. net international. The result is clear: they are still at negative US$3,313 million and, if we also subtract the National Government’s deposits in foreign currency and one-year Bopreal payments, they drop to negative US$9,291 million. , just above December 2023,” described the consulting firm Vector.

Dollar and “carry trade”

Yet, The official signal on the reduction of the rate of the exchange rate seeks to reinforce one of the tools that it used to attract the currencies that entered the money laundering as a bridge so that the BCRA can buy a significant amount of foreign currency despite having four months of foreign exchange current account deficit: the incentive to carry trade.

It happens that, to extend the bets of economic agents to get on the so-called “financial bicycle”, they need to show the rates in pesos will continue clearly above the rate at which the dollar rises. This differential is what allowed generating juicy profits in hard currency.

In recent months, The growing bets on the “carry” increased the supply of foreign currency in the official market and allowed the Central Bank to maintain the purchasing balance. The thing is that this mechanism (which consists of getting rid of dollars, starting to make the rate in pesos and then dollarizing again in time) encouraged exporters to advance settlement, importers to delay payments to their suppliers and companies in general. to take financing (bank or capital market) in foreign currency, which they then liquidated. This circle is the one that seeks to provide feedback in the coming months to compensate for the outflow of foreign currency from tourism and other expenses abroad.

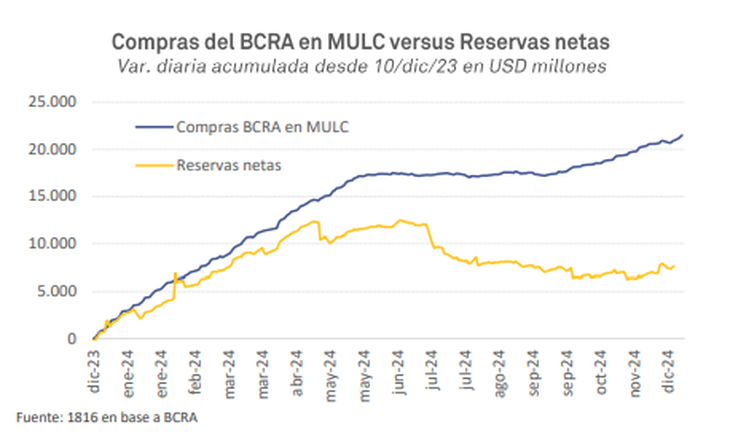

Net reserves on the decline and next steps

So far this month, the BCRA has already purchased US$1.15 billion. On that level, it is the best December since 2011. A report from the Economic Studies Management of the Province Bank stated that “the atypical position of the BCRA “It is not explained by the current account, but by the capital and financial account.”. And he pointed out that placements of negotiable obligations are close to US$1.2 billion so far this month, while between December 1 and 9 (latest data available) bank loans in foreign currency grew US$260 millions. “The debt of companies more than compensates for the foreign exchange needs to import goods and services,” the report said.

image.png

In any case, these purchases (which total about US$3.5 billion at the end of August to this point) have no correlation in the Central’s coffers. The Provincial Bank indicated that, Due to external debt payments and other factors, during that period net reserves fell by around US$700 million. and, according to their calculations, today they are at almost negative US$4.7 billion.

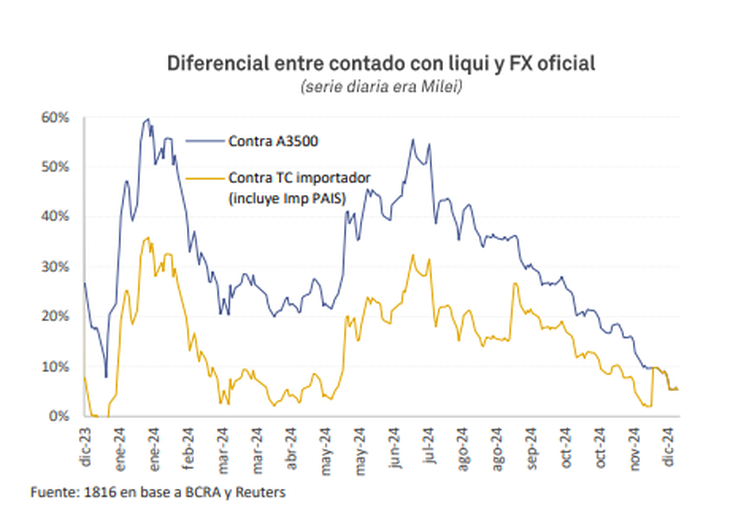

“While this does not ‘tarnish’ the good streak described at the beginning, nor the virtual disappearance of the gap, which closed below 5% for the second consecutive week, it does put some points into consideration,” the entity’s report noted. financial. Thus, he stressed that, even though the Government considers “to have eliminated the excess liquidity that could exist in the Argentine economy”, there are stocks that will maintain their pressure on the reserves, such as large external debt maturities.

“Next year US$16,000 million expire between the IMF (US$3,000 million), public securities (Globales and Bonares, US$9,000 million) and swap and Bopreal (US$4,000 million between them), half of current gross reserves (US$32,000 million). Although a part of these payments will be covered with new issues from companies – in recent months, Argentine oil firms have placed ten years at a lower rate than the average of the national States of the region: 8% vs. 8.5% -, a growth driven by exchange rate appreciation would bring some tensions on the side of the current account and the real economy -especially if the blend dollar is not eliminated-”, considered the Bapro document.

However, the slowdown in inflation and the virtual elimination of the exchange rate gap fed back into optimism in the city. And they set their sights other decisions that could arise on exchange mattersin addition to the reduction of the “crawling peg”. In the pipeline of the Government is the promoting local payments in dollars with debit cards and other means of payment. It also flies over the question about the future of the “blend dollar”which helps to compress the gap since it directs 20% of exports to the CCL market.

image.png

The consultant 1816 He also suggested other possibilities: “The Government can take advantage of the almost zero gap to begin to release the financial exchange rate on the margin (the risk is that it will generate sales of securities in pesos) or to lower rates further. (the argument for the last cut was not the inflation data, but the better expectations of the REM).”

Regarding the administration of rates, the SBS Group stated that it is important to take into account the seasonal cycles of the demand for money. Now it has entered a time of high demand, but, “Towards February, this dynamic reversesso monetary policy will have to be carefully calibrated to prevent a very lax posture (e.g. lower rates) can eventually play against”he warned.

Finally, while pointing to the removal of the stocks in layers, in his last message Milei himself made the total lifting subject to an agreement with the IMF with new debt (in addition to the US$45,000 million that Mauricio Macri took in 2018 and that the country still owes) or financing from private banks. In search of this, while awaiting the inauguration of Donald Trump in the United States, he decided to accelerate the negotiation with the Fund.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.