At first, it is worth emphasizing that a new presidency of Donald Trump presents both advantages and limitations for the economy and financial assets globally.

First, judging by both his campaign promises and his first presidency, It is expected that the Republican president will lead an important process of tax cuts and deregulation. In practice, this represents a clear tailwind for the stock market and the dollar.both assets historically benefited in similar contexts.

At the same time, the starting point with which Trump takes office on January 20 also looks very propitious. Economic growth in the United States is better than expected, with good employment numbers and in a context of excellent financial health in households. At the same time, there is a rebound in the mergers and acquisitions market, and stocks are at record prices.

Regarding this last point, the valuation of companies in the S&P 500 is stimulated by attractive corporate profits and a healthy economy, but also by long-term trends such as artificial intelligence, the development of which invites us to think about an extended cycle of improvements. of productivity and growth.

However, of course, some of Trump’s proposed campaign policies have historically been adverse to global financial assets and global economic growth. On the one hand, A very restrictive trade policy and the increase in tariffs produces a double effect: a temporary increase in inflation and a prolonged downward impact on global GDP.. In particular, this has in the past been particularly disadvantageous for emerging economies, which could be seriously affected by a brewing trade conflict between the United States and China.

How did global stocks fare during Trump’s first presidency (2016-2019)?

image.png

Evolution of global equity indices.

Criteria

As can be seen in the graph above, stocks in the North American technology sector led growth within the equity universe during Trump’s first presidency. With policies similar to those expected for a second term, stocks in this segment recorded an average annualized return of around 23.2%, followed by the general S&P 500 index with 17.3%.

Global stocks, for their part, recorded an average return of 13.8%, while European and emerging stock markets occupied the last positions, although with non-negligible performances of 10.9% and 9.4%, respectively, in said period.

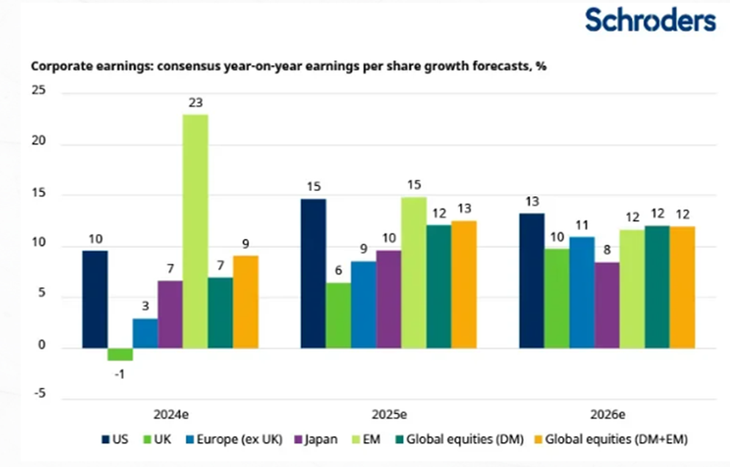

Looking ahead to a new mandate, we think that the United States stock market could once again stand out above other markets, based on a favorable expectation of growth in corporate profits. In the following graph you can see a strong boost of around 15% year-on-year for US companies in 2025, noticeably higher than that of firms in the United Kingdom, Europe or Japan.

Momentum in US stocks could extend

image.png

Year-on-year estimate of corporate profit growth by region/country.

Schroders

In this sense, considering these factors as well as the strength of the United States economy facing 2025, we have increased the probability assigned to a favorable scenario for growth, clearing up at the margin a more adverse recession scenario.

In particular, we imagine a scheme similar to that experienced between 1994 and 2000, characterized by leadership of the United States over the rest of the developed countries and a notable boost from large-cap growth companies. In the medium and long term, the rise of artificial intelligence presents a favorable outlook for the rest of the decade. Despite higher rates, the economy maintains its long-term growth level and if investment causes increases in productivity, inflation can be kept at bay, even with a higher target.

What is the best investment strategy?

The market is discounting, for the moment, that Trump will fulfill his campaign promises, counting on it being easier to promote protectionist measures linked to foreign trade and less easy to soon implement fiscal measures, which require greater political consensus in Congress. If this scenario materializes, it could generate a reflationary impact in the United States, strengthening the dollar, weakening emerging currencies and commodities, with a FED that, having taken note in its last meeting, is no longer so lax regarding its interest rate. of monetary policy.

Proposed tax cuts and economic deregulation benefit the US stock market, while protectionist policies could raise inflation and slow global growth. In this context, the fiscal front continues to be one of the biggest concerns for the markets.

In this way, it is worth remembering that the exceptional performance of the United States economy has been the main driver behind our concentration in stocks and bonds of that country in the portfolios. We anticipate that this trend will continue in the coming months.

However, it remains to be defined more clearly what the new government’s priorities will be. There is a risk that more aggressive policies by Trump will lead the US economy towards stagflation and trigger a global recession, which could accentuate macroeconomic divergences internationally.

In turn, fiscal dynamics are today the market’s main concern, with close to USD 9 trillion of US sovereign debt maturing in 2025, and an estimated deficit for next year in the order of 6.5% of GDP.

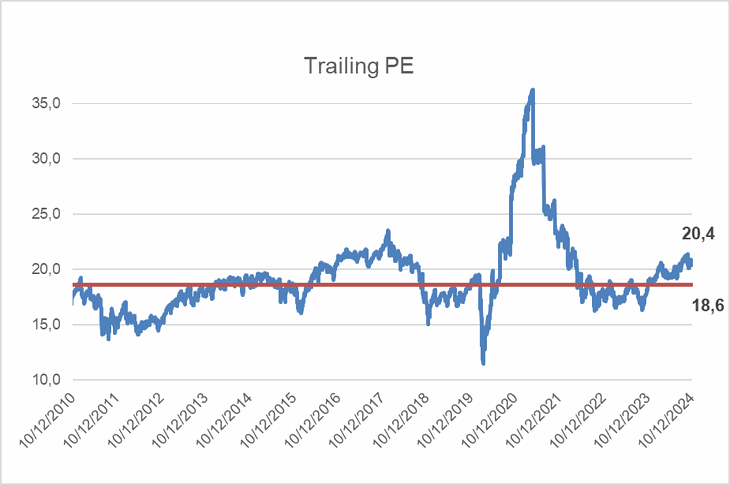

Regarding variable income, Although there are signs that the US stock market could be overvalued — including an earnings multiple slightly above the historical average — we do not currently see a bear market scenario on the horizon as a result of a favorable tax policy for the sector. businessman. Thus, although in terms of multiples the market looks overvalued, We see a bear market less likely after Trump’s victory in the coming months. However, we are not as optimistic at the index level as the main investment banks who forecast expected returns twelve months ahead of around 10%-12%.

Our medium-term vision is a United States economy that will continue to lead economic growth, underpinned by the development of the technology and Artificial Intelligence sector. Therefore, We continue to identify value in technology companies within the growth and large capitalization sector.

US stocks look expensive, but today the scenario remains favorable

image.png

Year-on-year estimate of corporate profit growth by region/country.

Criteria

For its part, we believe that, in the fixed income market under this new rate environment, the strategy focuses on generating income through interest, prioritizing this route over capital appreciation.

We identify value in high credit quality assets, such as Mortgage-Backed Securities (MBS), which offer very attractive returns compared to corporate debt, where rates remain excessively compressed. On the other hand, after two years of double-digit returns, we consider that the tactical strategy of positioning in emerging bonds becomes more risky in the context of Trump’s election.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.