The economy showed again in December a ambiguous and heterogeneous dynamics between sectors. Looking ahead to 2025, the prospects are more encouraging for activities that lagged last year, by the hand of credit and the decline in inflationwhich could offset the effect of salaries, growing at the rate of the Consumer Price Index (CPI), which would prevent them from recovering the heavy losses of recent times.

Inside the manufacturing industryin December monthly improvements in vehicle registrations stood out, although In terms of production, a negative variation of 7% was observedaccording to seasonally adjusted estimates from the consulting firm EcoGo. The entity also reflected that, with respect to the constructioncement shipments increased 4.3%, although the Construya Index, which measures the evolution of the quantities sold by the main manufacturers of inputs for the sector, showed a negative variation of 1.2%.

In year-on-year terms, the first month is seen with a general upward trend, which is logical due to the low comparison base.since in December 2023 the devaluation implemented by the Government of Javier Milei generated a deep collapse in most sectors of the economy. The exception was the data linked to construction, since both cement shipments and the Construya Index fell.

image.png

“According to the latest Monthly Estimator of Economic Activity (EMAE) from INDEC, in October the economy was already above the levels prior to the transfer of command; while sectoral indicators and private estimates suggest that the recovery extended into the last two months of the year. In this framework, We expect GDP to close 2024 with a drop of 2.2% and grow 4.5% this year, with activity reaching the cyclical peak of 2017“, they pointed out from the Facimex stock company.

It is worth noting, however, that significant sectoral heterogeneity is still observed. As an example, the latest data from INDEC showed that Industrial production increased 0.4% in November, but still did not recover what was lost during the Government of Javier Milei and accumulated 18 year-on-year falls in a row.

The main annual contractions were mostly linked to the little traction generated by construction. Such were the cases of non-metallic mineral products (which includes items such as sand or clay, which suffered a strong collapse), rubber and plastic products or metal products. Indeed, construction is on track to close 2024 with a cumulative deterioration of more than 20%, which is why it would top the table of sectors affected by the economic policy of the first libertarian year.

“The decline and recovery show heterogeneous sectoral patterns. In general terms, there is a tendency towards the primarization of the economya result of the resilience shown by the agricultural sector based on the recovery from the drought and the dynamism of the hydrocarbon sector. For their part, the sectors linked to the domestic market were affected both by the fiscal adjustment (construction) and by the fall in consumption and trade liberalization (industry not intensive in natural resources and services)”, the consulting firm CP elaborated in a report.

Credit and the slowdown in inflation foresee a better outlook for 2025

Looking ahead to 2025, expectations are more optimistic. in construction Hope is placed in the performance that private work can have thanks to the dynamism that different lines of credit are showing, such as those of mortgages.. According to a recent report by First Capital Group, last year mortgages showed a nominal growth of 200%, much higher than the 120% inflation estimated for the same period. “Unlike the rest of the lines, this segment does not stop growing nominally month after month, demonstrating the great interest it has aroused among the demanding public,” said Guillermo Barbero, partner of the entity.

Along the same lines, indicators linked to credit and consumption also showed positive signs in December. While the consumer loans advanced 5% compared to November, SME retail sales They rose 4% monthly.

“It is likely that the economy will continue with the recovery considering that credit in pesos continues to expand strongly (in December it grew 6.4% in real terms without seasonality according to our calculations and has been rising for nine consecutive months), all this in a framework where The appreciation of the peso continues to be coordinated and the dollars from money laundering are recirculated in the economy through the increase in credit in dollars and the issuance of ONs by companies, which means fuel for lagging sectors such as industry,” Alan Versalli said in dialogue with Ámbito.economist at EcoGo. Regarding construction, the analyst was more cautious because, as a counterpart to the greater credit, the sector is experiencing an increase in costs in dollars.

The role of salaries and consumption in the economic reactivation process

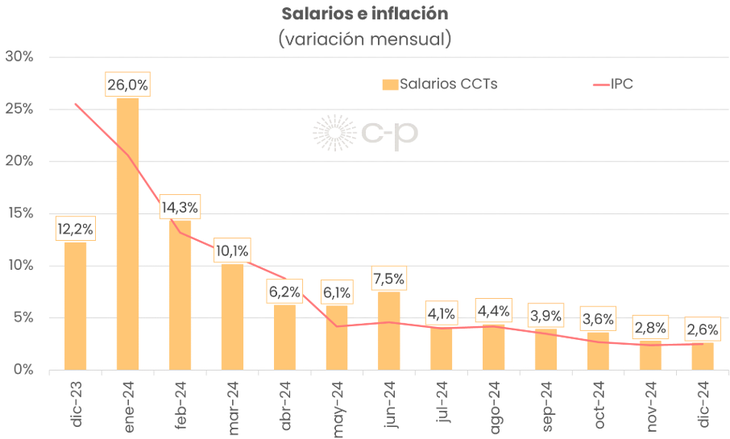

The reactivation is largely influenced by the slowdown in inflation, favorable for the normal development of the credit market and for the recomposition of real salaries. Regarding the latterthe Government is seeking to show how it has achieved the improvement in purchasing power, while salary increases are reduced month by month, in line with the primary objective of limiting the monthly inflation rate and reducing the nominal value of the entire economy..

According to an index prepared by CP, based on the salary adjustments granted by the main Collective Labor Agreements, while in October the increases exceeded the price increases by almost one point (3.6% vs 2.7%), In the two following months the variations were very similar (2.8% vs. 2.4% in November and 2.6% vs. an almost identical estimate for the December Consumer Price Index).

image.png

In that framework, It is still not very clear that 2025 will be a prominent year for workers’ income Argentines. Taking into account that their starting point was the lowest in almost 20 years, this could mean an obstacle to the growth of the Gross Domestic Product (GDP) during the year that has just begun.

“Income starts from a low base in 2025 and the Government will try to validate its budgeted inflation scenario at 18%. Consumption will not be the horse that pulls the cart. That is why it will be important that the dynamic components are investment (which will grow strongly after the liquidation of stocks in 2024) and exports,” Versalli warned in this regard.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.