As he explains Alejo Rivasstrategist of Capital Balanz In dialogue with Scopecountry risk is at an intermediate level between countries with greater risk and those that have access to markets. The analyst maintains that, with 720 basic points, Argentina is far from credits such as Ecuador and Boliviawith Spreads greater than 1,300 and 2,000 points, respectively. “This is because investors see stability in the economic program, reinforced by the political integrity that the government managed to sustain during the dearest part of the tax adjustment,” says Rivas.

Catalysts for Argentine bonds

However, Rivas is clear and warns that: “The market still receives short -term risksin particular in monetary and exchange policy, which maintains Argentine bound bonds against countries with market access. ”

A point where all analysts consulted by this means coincide is that the closest catalysts so that the sovereign debt resume the upward path are: An agreement with the IMF that includes net financing and The progressive dismantling of the stockstogether with a Political consolidation in mid -term elections. This could reduce the Argentine gap with that of some comparable markets and improve investor confidence.

Along the same lines the investment advisor is expressed, Gastón Lentini, who shares, in dialogue with this medium, that the lateralization of the bonds nominated in dollars responds, first, to one “healthy correction after what happened in 2024 “.

Bs Hard Dollar Delphos.png

The strategist adds that, although public accounts are in the process of ordering, this does not mean that they are already balanced, “And that difference is reflected in prices” Lentini slides that “it remains to see if Javier Milei’s trip to the US manages to unlock the arrival of fresh funds.”

However, for the renowned advisor, beyond the disbursement factorthe priority in Argentina should be the elimination of the stocks, since only then Foreign capitals can recover confidence in the country. “Argentina is much more than its president: for more commitment that Javier Milei demonstrates, investors need legal certainty before betting on our territory,” he says.

Sergio GonzálezHead of Asset Management in Cohenit coincides with Lentini on market catalysts, but adds an optimistic nuance by pointing out possible favorable news on the horizon. Among them, highlights the recomposition of reserves of the Central Bank (BCRA) as a key factor. On the external plane, he mentions that an eventual reduction of rates by the US Federal Reserve (Fed) could generate a positive impact on the bonds.

As for the risks, González unpredictability does not overlook of the Argentine context, reflected in situations such as the $ Libra scandalwhich are aspects that feed uncertainty. “Although there are unforeseen risks (black swans), positive events could also occur, such as advances in Congress, which improve institutionalization and business in Argentina,” he says.

Everything seems to be conditioned to the agreement with the IMF

Mariano RicciardiCEO of BDI Consultantconfirms that, the main factor that could reduce the country risk to more consistent levels with comparable economies is an agreement with the IMF. “In a first stage, this would allow to break the 500 points barrier and then approach the 400”. In this scenario, the bonds of the mid-section of the curve, such as maturities 2035 and 2038, present the greatest potential of “upside,” he says.

Ricciardi ensures that a sensitivity analysis shows that, as the yields are normal in a range of 8 to 10%, The Global 2035 (GD35), 2038 (GD38) and even 2041 (GD41) They would be the most benefited in terms of “Upside”.

Currently, these titles operate with yields around 12-13%, which suggests a significant margin of appreciation in the case of rates compression. And as they explain from Delphos Investment Sovereign debt still yields in line with the most risky credits, even when the international environment has evolved better than expected.

In practical terms, investors receive high risk in the Argentine economy, so they demand greater yields to compensate for it. In this scenario, the broker considers that the sovereign curve maintains attractive at these levels, with margin for additional compression towards the minimum risk risk of 560 points, registered prior to the payment of coupons on January 9.

However, the stock market society remarks so that convergence advances to lower levels of country riskit will be necessary that structural drivers be consolidated, such as “an exit of the stock in the frame Difficult that the Argentine debt reaches the valuation of the best b-.

HD delphos.png curve

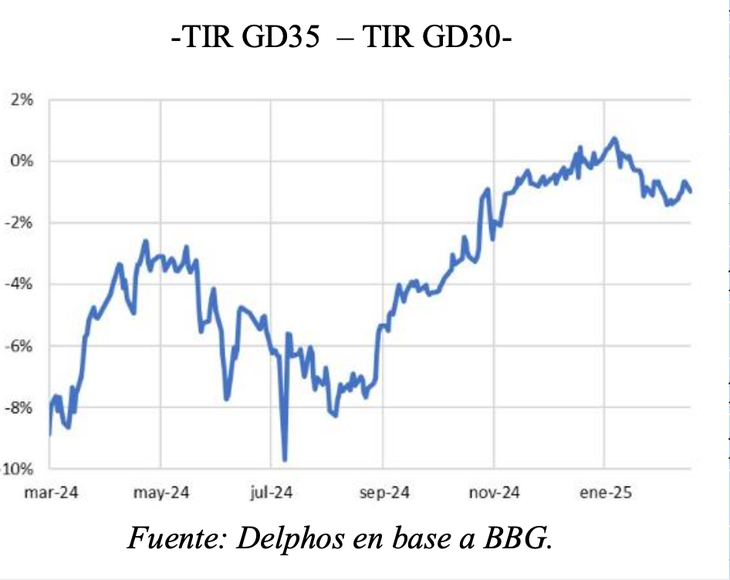

Thus, he points out that since mid -2024, the long stretch of the curve is the best performance, since it surpasses the minor bonds. This trend continued in 2025, with the shortest short section, as it accumulates a 6% YTD drop, while the Global 20235 (GD35) retreated 3.5%.

The curve, which had managed to unintend towards the end of 2024, He shows again negative slopewith a spred of -1 pp between the Global 2035 and 2030. In an optimistic short -term scenario, where the bonds return to recent maximums, those of shorter duration could capture greater relative value, Delphos concludes.

Thus, the perspective on Argentine sovereign bonds It depends on the confidence in the evolution of the country’s economic situation. For those who believe that elections and political context will continue their course without major setbacks, this volatility period could be an entry opportunity.

On the contrary, those who think that the context could get worse, for example, with an escalation of the $ Libra scandal, they should consider alternatives. Although the positive news, such as the surplus or the decrease in inflation, have already occurred, prices have not yet fully reflected these events.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.