He Ministry of Economy launched this Monday The call for the last debt tender in February pesos, in which it will offer the reopening of three Lecaps and a bonus tied to inflation, all short -term, with maturities of 2025. The auction, which will be held this Wednesday, arrives After the outbreak of the scandal for the alleged scam with the token $ librain which the president appears as involved Javier Milei and part of your surroundings.

Yes ok The title curve in local currency did not receive a greater impact from this caseThe Treasury, anyway, decided to place all very short -term instruments.

Thus, it will offer the reopening of three LECAPS, with maturities to the March 31, 2025 (S31M5), as of April 28, 2025 (S28A5), and as of June 18, 2025 (S18J5). In turn, it will make available to investors A CER Zero coupon bonus, expiring May 30 (Tzxy5).

“At first glance, the Treasury seems not wanting to validate the rates of the long stretch of the curve at a fixed rate. In this sense, all the instruments of the menu correspond to the short section: the shortest option expires in June of this year”analyzed from PPI.

This week, they will overcome about $ 2.7 billionaccording to market calculations. The most bulky is that of the LECAP S28F5 for $ 1.73 billion. Although It is not a particularly high amountthe City will be attentive to the percentage of refinancing obtained by the Treasury and the movements that the Treasury performs to face the payment.

For example, In the last tender, Economics got an “Roll Over” less than 80% and decided to refund his account at the Central Bankthat he had gone considerable, To show solvent Faced with the incipient doubts which manifested the City regarding the lower liquidity of the treasure and the future of the monetary program.

Debt in pesos and the $ pound scandal

The truth is that, unlike the dollar bonds that had significant oscillations throughout last week, The debt curve in pesos did not particularly suffer the effect of “cryptogate”. “Despite recent local political and economic fluctuations, the pesos market showed remarkable stability,” Portfolio Personal Inversiones (PPI) said in a report for its customers.

What happened? PPI He stressed that The long stretch of the fixed rate curverepresented by the Boncap and Bontam (the latter pay the best between fixed or variable rate), It remained practically unchanged in their yields with respect to the end of last Friday. Thus, the monthly effective rates (TEM) in this segment continue to oscillate between 2.1% and 2.2%.

Meanwhile, the Short section Fixed rate (until May) showed an increase in marginal prices (up to 0.6%), placing the TEMs in Between 2.3% and 2.4%. For its part, the Lecap from June to November experienced slight falls which led their them to the range between 2.4% and 2.2%.

What does the market expect?

The Consultant 1816 analyzed those movements. “The fixed rate curve in pesos had another rate cut in March or April again”given the negative slope of the yields of the short section.

image.png

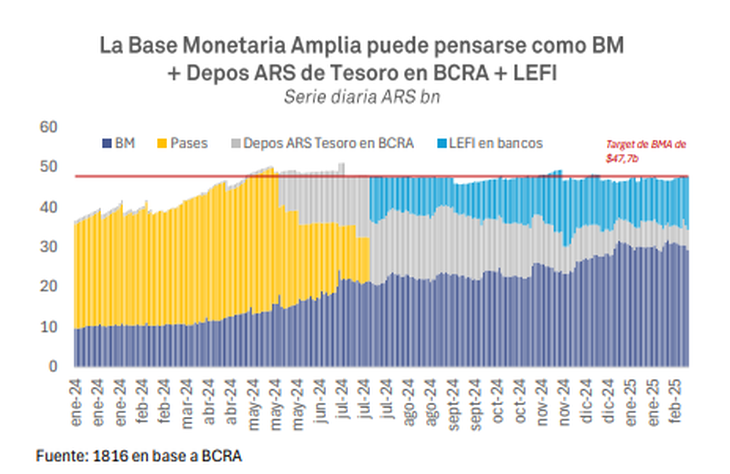

However, the fact that the middle and long section has been flattened, while the expectation of Breakeven inflation continues to indicate a downward path, implies that “the market assigns it relevant chances to a scenario of real rates up to rise during the second semester of 2025like the one that could occur if the ‘phase 2’ extends over time and weight becomes an increasingly scarce good. ”

As he said Scopethat scenario responds to the perspective that the broad monetary base limit (BMA), to stay rigid and not have a significant remumination in dollars, is not too much margin to re -have -peso in the face of low percentages of renewal of the treasures of the treasure, As stated 1816. That would make the public and private sector compete to obtain scarce weights, which would press the royal rates up.

“To the rhythm that the demand for money and the expansion of credit in local currency, unless people get used quickly to make their transactions with dollars, We talk about a few months for the fixed weight stock to become an important problem for the macro For the upward pressure of real interest rates, ”warned the consultant.

Thus, he considered that it is likely that an agreement with the IMF contains news on the monetary scheme: “We will see if the ‘phase 2’, with a wide -based base, was called the phase because it was transient or if the government accelerates with the idea of moving towards what calls endogenous dollarization. ”

image.png

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.