Canada and Mexico will intensify their diplomatic offensive to stop the imposition of 25% tariffs on their exports to the US, While trying to convince Donald Trump to back down. However, the president confirmed Monday that the measure is still standing and set on March 4 as its date of entry into force. Although the extension of a month gave a temporary respite to the market, uncertainty shot and volatility dominates the scene before opening. Before this panorama, Investors take refuge in safer assetsby anticipating the impact of US tariff policy.

Another alarm signal that the market received was the 2024 fourth quarter earnings report that presented Berkshire Hathawaythe company of Warren Buffett. The most relevant document is the amount of cash that the conglomerate now has: A record of US $ 334,000 million. It should be noted that cash levels doubled in the last 12 months.

In his annual letter to the shareholders, Buffett said that “will never prefer the ownership of cash -equivalent assets about good businesses“He added:” Often, nothing seems attractive; We rarely find an excess of opportunities. “His words suggest that, the US stock market as a whole it could be overvalued.

And when Buffett accumulates large amounts of cash, many investors see it as A barometer of the feeling of the market, interpreting it as a sign that times of uncertainty or crisis are coming.

THE MARKET TRANCH

In a report sent to its customers over the weekend, the investment advisor Gastón Lentini He highlighted the growing volatility that dominates the markets today. From uncertainty after Trump’s assumption to the caution posture of the Federa reservel (fed). And it is that investors face a battle of several fronts and the situation demands a well -defined strategy.

Marcelo LezcanoPresident of CatalaxyGlobal investment agency, explains -in dialogue with Scope– And in line with Lentini that the entry into force of tariffs by the Trump administration brings great uncertainty in the financial market.

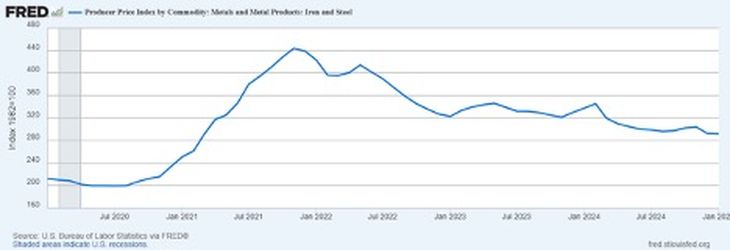

Lezcano slides that, in economic terms, this would lead to the increase in many materials within US borders and imply a drop in demand for products achieved. “If that will happen, there will be export surpluses in countries such as Canada, Mexico and Brazilwhich will result in a decrease in steel prices and their derivatives, ”understands the expert.

Effective wb.png

“These measures would lead to accentuate the trend in the steel market today. Since the end of 2021 steel prices suffer a retraction”Lezcano argues.

For its part, Diego Martínez Burzacocountry manager of INVIUanalyzes that Trump knows that its measures can generate an unwanted inflationary effect, at a time where the economy occurs with some weakness.

“In case this definitely advances, There will be volatility and a lot of risk aversionso if the investor thinks about that as the base scenario has to lower the “beta” of the portfolio, “says Burzaco, who maintains the hope that the US president about the closure of the negotiations with Mexico and Canada de March back at the last moment as it happened before.

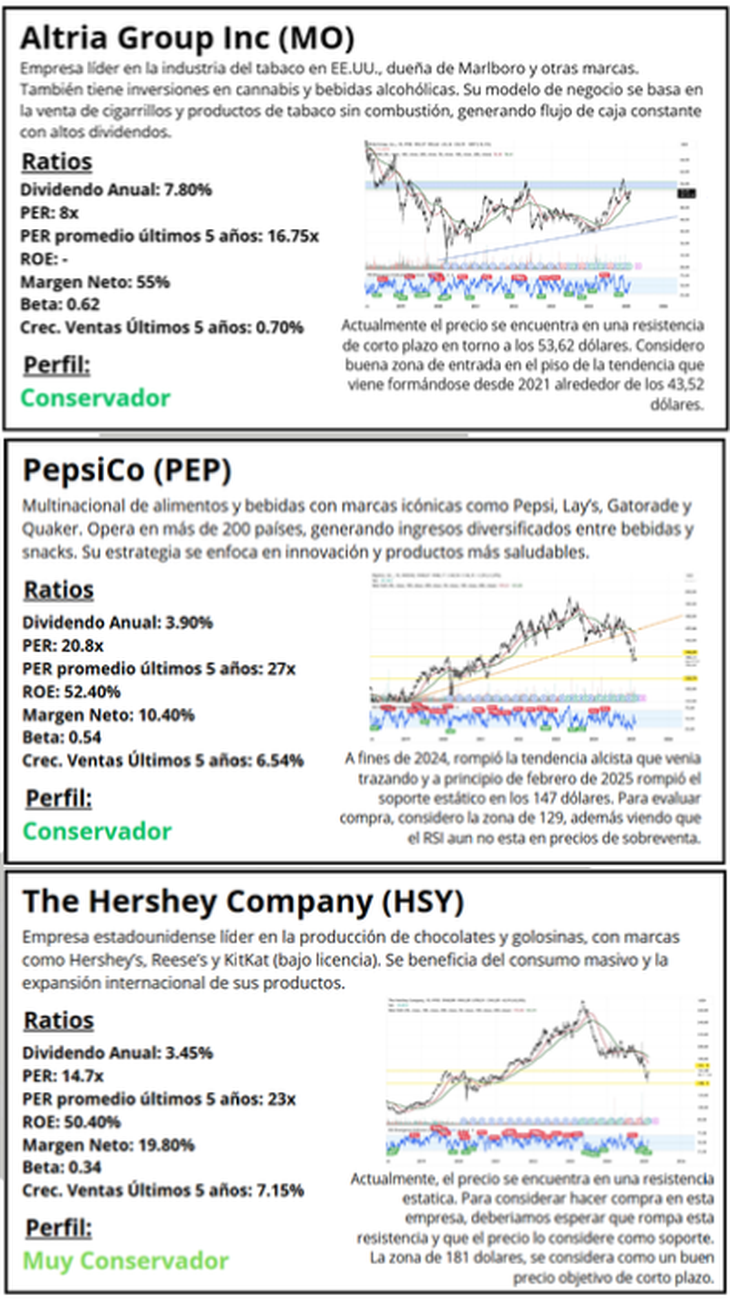

CEDEARS: Basque companies “

The bass companies They are companies whose shares have less volatility compared to the market in general. This means that their prices do not fluctuate sharply due to changes in the stock market rates of Wall Street.

As Lentini explains in his document, These companies have a beta less than 1 which indicates that they are less volatile compared to the general market indexsuch as the S&P 500. “This means that, in times of turbulence or strong falls, these actions usually resist the casualties and offer greater stability,” says the strategist.

Metal prices.jpg

However, Lentini recalls that in periods of strong increases in Wall Street, its growth can be more limited compared to more volatile actions. “Beyond their lower volatility, these companies were selected among all those under betaalso for their attractive history of dividend payments, which makes them solid options for those investors who seek to generate passive income through their investments, ”concludes the strategist.

Yield: sector by sector

- Defensive consumption: Essential goods companies (food, drinks, hygiene, tobacco). Their demand is stable in any economic cycle, which makes them ideal for investors looking for stability and dividends.

Sectors 2.png

- Industrial: Includes manufacturers of machinery, transport and logistics. Its performance depends on the economic cycle, with greater demand in times of expansion. Key sectors: aerospace, defense and shipments.

- Energy: Oil, gas and renewable companies. It is a cyclic sector influenced by the price of oil and global demand. Despite the transition to clean energy, it maintains dividend flow even in crisis.

- Communications and services: Telephone, Internet, Social Networks, media and entertainment companies. Its growth depends on technology and digitalization, with strong long -term potential.

- Materials: Metal, chemical, cement and plastic producers, essential for construction and manufacturing. Its performance depends on the economic cycle and the global demand of commodities.

- Health: Pharmaceuticals, biotechnology, medical devices and hospitals. Demand is constant and inelastic, which makes it a stable sector in crisis, although regulations and innovation impact its growth.

Sectors 1.png

For its part, Lezcano de Catalaxia points out that it bets for example by 7% for Ternium (Txar) despite the challenging context. “Our investments are justified by the valuations that we observe in the company, its management and its strategic positioning in Latin America.”

Today the company quotes 0.77 of its accounting value, a total debt on Ebitda of 1.2 and if we take into account the company of the company, it maintains a net debt of –896,439.00 ars million, that is, you can pay all your debts and this amount is left over in cash. “This gives us a lot of security and we must only wait to harvest the benefits”, Lezcano slides.

For his part, Martínez Burzaco, coincides with Lentini and recommends more stable, traditional and defensive businesses. The basic consumption sector: Coca Cola, Pepsico, Walmart; as health: Johnson & Johnson and CVS They can be shelter. “The ideal is to be carried out by political noise YVIsuualizing compensated long -term strategies”, Concludes the expert.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.