The report -with Monday- emphasizes that the Government plans to close a new program with the IMF before April, which would imply A disbursement of fresh fundswhich added to the fiscal measures advanced by the economic team would avoid abrupt devaluation. In addition, it applauds that the Central Bank (BCRA) reduce the daily devaluation rhythm of the exchange rate (“Crawling Peg”), as it reflects greater stability in the exchange market.

The Bofa document analyzes the impact of the Tariff policy promoted by the US in the region and the countries more and less harmed by the US government. In that sense, rescue Argentina and places it above its neighbors.

Under this scenario, The bank reaffirms its optimism about the national economy and the exalt within the regional context. However, that trust is nothing more than a vote of faith conditioned to a single variable: the concretion of the agreement with the IMF. It happens that the fall of the country risk at levels comparable with those of neighboring countries, the dismantling of the stocks, the return of the appetite by Argentine assets and, ultimately, economic stability themselves seem to depend on a single gesture: that Kristalina Georgieva releases dollars that the government needs to sustain its economic plan.

Reservations under pressure and weight recovery

The Wall Street giant argues that despite the pressure on international reserves-which remains at negative levels at about US $ 6,000 million-the appreciation of the real exchange rate helped reduce the gap between the official dollar and the parallel, which went from 54% last year to a more controlled range of 10-15%.

In addition, it emphasizes that “the fiscal amnesty (laundering) applied since August 2024 added US $1,000 million in tanks in hard currency, which strengthened capacity from the country to fulfill its external debt commitments, ”rescues the bank.

Inflation in fall and projected growth

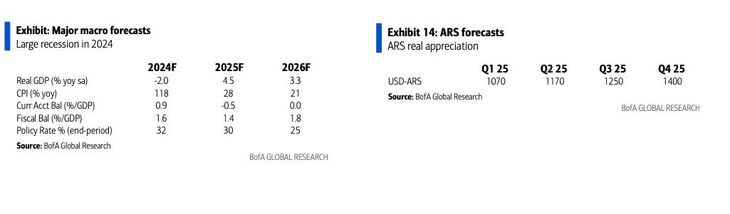

One of the most prominent aspects for the Bofa is “the rapid deceleration of inflation”, which in January fell to 2.2% monthly, well below 10.4% recorded in the first half of 2024 and the 25% peak in December 2023, he says. Bank of America It estimates that annual inflation will be reduced to 27% in 2025, after closing 2024 by 118% and 2023 by 211%.

Bofa 1.jpeg

Source: Bank of America (Bofa).

In terms of economic activity, the entity projects a growth of the Internal Gross Product (GDP) of 5% This year, “promoted by the recovery of bank credit, Salary reactivation and the boom of the energy sector ”.

In addition, the report indicates that the government could accelerate the elimination of capital controls after elections and unify the exchange rate in December. “The Central Bank is expected to adopt a regime of”dirty flotation“, which would mark the end of the controlled depreciation policy,” he says.

Optimism for Argentina

On the stock markets of the region, the Bofa ensures that Latin America is on the rise despite commercial discussions in relation to the US.

“Latin America beat global markets so far this year, despite discussions about tariffs, partly due to a position of depressed valuations and lagging coins. We maintain the recommendation of increase exposure a Brazil and Argentina, ”says the entity.

And he maintains that Argentina is “the greatest overposting in our Latin America portfolioand we have exposure through banks and energy. Despite the correction so far this year, the country has the largest catalysts in the region: elections, disinflation, regulatory disruption and a possible agreement with the IMF, which could be key to lifting capital controls. ”

Bank of America analysts see Argentina at a turning point, with the potential to become one of the most attractive investment destinations in the region. However, negotiations with the IMF and the implementation of key reforms to consolidate macroeconomic stability follow closely. At the same time, other looks warn about risk factors that could generate uncertainty on the horizon.

Trump tariffs and weight pressure

From VT Markets analyze in statements to Scope That the threat of tariffs on the world economy, and the possibility of turning inflation in the US again, central banks globally will be forced to adjust their monetary policies.

International broker strategists anticipate that The Federal Reserve (FED) reduces rates at 50 basic points, which would leave the type of reference at 4% but by the end of 2025. “This perspective shows greater caution than an aggressive impulse towards the flexibilitysince the strength of the labor market and the persistent concern for inflation prevent the Fed from committing deeper cuts, ”they argue.

Bafa 2.jpeg

Source: Bank of America (Bofa).

This is the opposite of what the Government of Javier Milei raises. “This policy could add extra pressure on local devaluation. Although inflation in Argentina continues to decrease, a possible depreciation of the peso could undermine the objectives of the economic team, which has as its main objective to lower the Consumer Price Index (CPI) less than 2% monthly, after closing 117.8% in all 2024, ”they explain.

And it is that a stage of higher rates for longer in the US could limit the flow of capital to emerging markets such as Argentina, which would raise financing and reduce the attractiveness of local assets. In this context, the libertarian government would face a dilemma: to sustain exchange stability without losing competitiveness or allowing greater depreciation of the weight with the risk of rekindling inflationary pressures. This reinforces uncertainty about viability of his economic plan in a global environment that started more than challenging this year.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.