For the former Minister of Economy, the Government must make changes in its policy with the dollar right now, before devaluation expectations are generated.

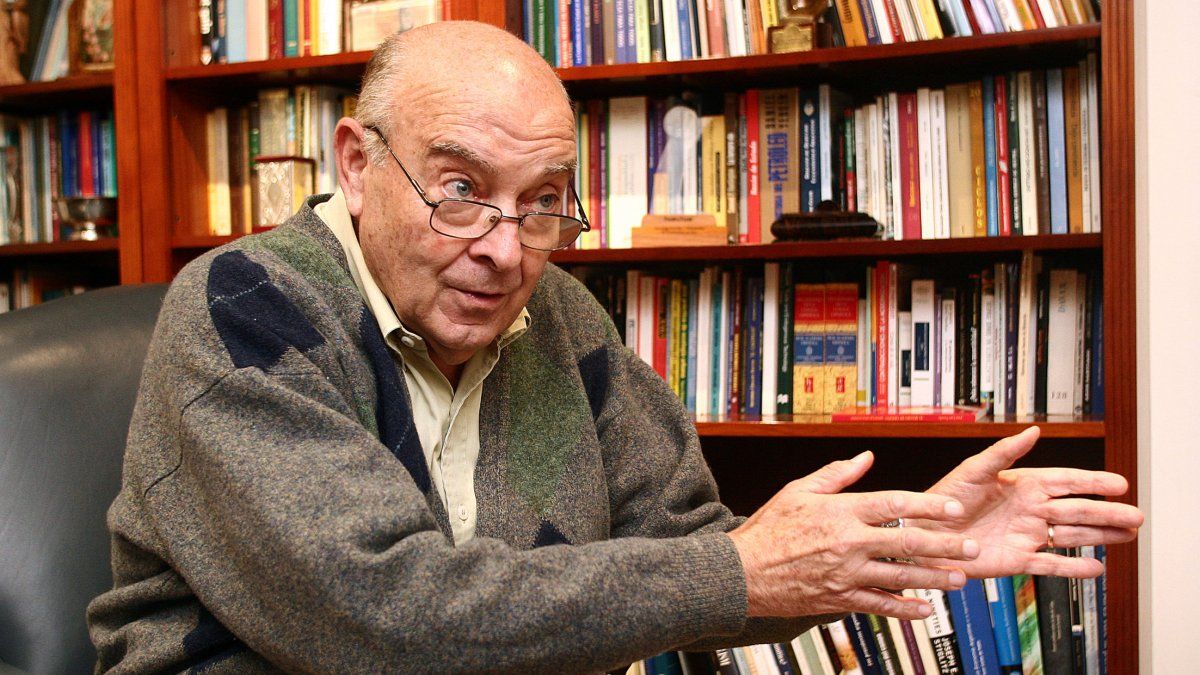

If fear sharpens the senses, anxiety paralyzes them and the future of the dollar claims it. How to avoid a “destabilizing devaluation”? The former Minister Domingo Cavallo He is worried and puts a question that considers imminent. This is, not to doubt it, the nuance that must be taken into account. Cavallo has been marking the Government for several weeks some type of error not forced with exchange policy. Now, precisely at the time the government defends its position regarding the demands of the IMF, the former minister fully gives his criticism.

The content you want to access is exclusive to subscribers.

Why does the economic team insist on Use export currencies to limit the official dollar gap with the CCL if it turns out that for the government there is no exchange problem?, Cavallo wonders. “If at least the CCL dollar is not liberalized and the commercial surplus currencies are still used to control the exchange rate in this market, The announcement of the elimination of the CEPO at the end of 2025 will lead to investors waiting for a significant devaluation jumpeven when there has been an important IMF disbursement, ”he says. Why is the exchange rate not eliminated, at least the one that applies to non -commercial operations?

What will happen to the gap and “dollar blend”

Cavallo’s hypothesis is simple. He says that surely the economic team considers that it is important to keep the gap between the official exchange rate and the CCL for Avoid expectations of a devaluation jump At some point of the future. That is why the liquidation of the dollar Blend. However, he argues that reading is different. “We must consider the possibility that the expectation of evolution of the official exchange rate and The probability of a future devaluation jump, depend much more on the evolution of net external reserves than artificially controlled gap by the Central Bank ”. From this perspective, “the best way to avoid a destabilizing devaluation jump in the future is to find a way to increase net reserves without devaluing the jumps.”

Cavallo’s recommendation to add reservations without devaluing, at least initially, seems to be the usual. On the one hand, The elimination of the Blend dollar for exportsin such a way that 100% of export income is sold to the Central Bank. On the other, the increase in fiscal incentives to exports, that is, an accentuation of the process already initiated from Reduction of agricultural exports withholdings and of regional economies. To this is added the Increase in internal tax export reimbursements and the provision for the payment of tourism services and imports of final consumer goods considered non -essential must be paid for the cash with liquidation and do not require currencies of the Central Bank.

The future value of the dollar depends more on the reserves than on “crawling peg”

Of course, the economist considers the subsequent scenario. “The gap between the CCL exchange rate and the official exchange rate managed by the crawling PEG will tend to increase because 20% of export revenues will no longer enter that market and the demand for payments for non -essential imports will increase,” he says in his article. “Capital should be allowed to finance direct foreign investments can be entered through the CCL market (or the free market that replaces it. Many potential foreign investors who are delaying investments until the stocks are eliminated, could take advantage of this prerogative and contribute to the gap closing in a genuine way and without draining the reserves of the Central Bank,” he adds.

But then, almost rhetorically, the question is asked. Can the stability climate that has been installed at the beginning of 2025 be maintained to the elections? He says: “This is the question I asked myself at the end of the report as of January 31. My answer then was: I think so, because even though an exchange gap that resists going down to increase the `crawl´ rhythm, the true nominal anchor of an economy that has already defeated inflationary inertia is the tax adjustment that allows monetary control and not the exchange rate. As proof that An increase in crawl would not have a significant effect On the monthly inflation rate it is worth observing what seems to have happened during February with the inflation rate after the reduction of the `crawl` at 1% monthly.”

Cavallo risks that the “crawl” rate is ceasing to be decisive for the monthly inflation rate. According to the economist, “the reduction of 1% crawl does not seem to be helping to lower the monthly inflation rate below what was already falling when the crawl was 2%.”

“Since the monthly inflation rate will be mainly determined by the course of fiscal accounts and monetary control, if the Government adopted the measures leading to increase the level of net reserves there should be no increase in inflation. But if the current exchange management is persisted with the risk of what the government itself wants and should avoid, which is a destabilizing devaluation of the deflation process”, Concludes the article.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.