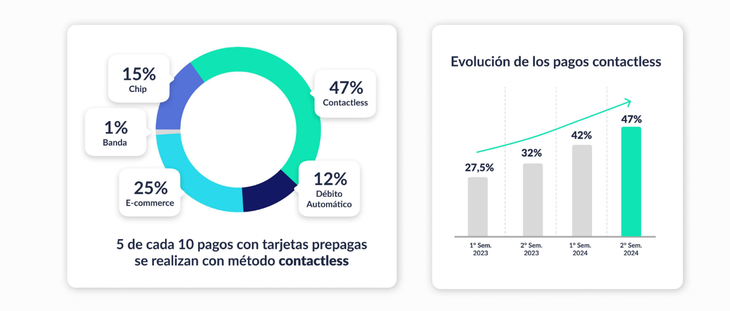

Contactless payments continue to gain ground, and 5 of the 10 transactions with prepaid cards were made through this technology. How its use is modified according to generations.

Although it is not the most used means of payment, Prepaid cards They continue to show an upward trend in its use with a significant increase in the operated volume and the amount of transactions.

The content you want to access is exclusive to subscribers.

The growth in transactions was 39% compared to 2023, while the volume operated with these cards recorded a growth of 234% in the same period. It is also observed, a Contactless and Virtual Cards Payments Growthdriven by younger consumers. In addition, the geographical distribution of transactions shows a concentration in the main urban regions of the country, with a low participation of international transactions. The data belongs to a semiannual report by Global Processing.

“The growth of transactions with prepaid cards during 2024 reflects the Consolidation of this means of payment in Argentina. The digitalization of payments, accelerated by the preference of younger consumers for contactless options and virtual cards, is marking a key evolution in the Fintech industry, ”said Patricia Furlong, CEO and president of Global Processing.

The contactless is consolidated and virtual cards continue to rise

As for the payment methods, the report indicates that Contactless payments continue to gain ground. During the second semester of 2024, 5 out of 10 transactions with prepaid cards were made by contactless technology. In addition, el 95% of the volume operated with prepaid cards corresponds to national transactions, with the main consumption items concentrated in supermarkets, fuel and gastronomy.

For its side, Virtual prepaid cards continue to gain prominence in the face of physical. Compared to the same semester of 2023, the issuance of virtual cards grew by 75%. Gamming and entertainment (27%), professional services (14%) and TV and streaming (14%) are the items that lead the use of this type of card.

consumption1.png

As for payment methods, the report indicates that contactless payments continue to gain ground. What items stand out?

Young people continue to lead the use of prepaid cards

The report also highlights that generation Z and Post Z continue to lead the use of prepaid cards, with a strong presence in items such as supermarkets, gastronomy and gaming. 60% of the transactions made by generation Z and Post Z occur in the non-present world, through automatic debit and purchases in e-commerce. In contrast, generations and, X and those over 60 show a greater preference for transactions in the present world, using cards in chip purchases, magnetic band or contactless.

As age increases, the average ticket grows, with Baby Boomers registering the highest value, despite representing only 4% of the total cards issued.

Lamiral.png

The report also highlights that generation Z and Post Z continue to lead the use of prepaid cards

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.