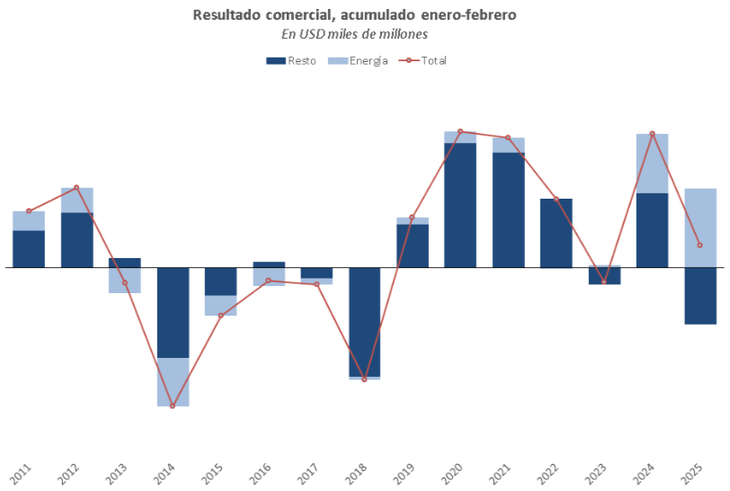

In the first 2025 bimester, the commercial surplus slowed down considerablyfollowing the greatest openness to the world, the exchange backwardness and the rebound of economic activity. In that framework, The “blend” dollar scheme further erodes the current account of the Central Bank (BCRA)a sensitive point in the government’s discussion with the International Monetary Fund (IMF).

Last January, the commercial balance, as accrued, gave a positive balance of just U $ S142 millionwhile in February it rose slightly to U $ 227 million. Both numbers were located well below the average of almost US $ 1,370 million registered in the second semester of 2024.

image.png

In addition, The February result could have been deficient if it is not for a series of particular factorssome conjunctural and other structural ones.

On the one hand, the “Boom” of Vaca Muerta The surplus is keeping afloat, since, Net of the energy sector, the commercial exchange had its worst result since 2018 in the first two months of the year (-U $ S930 million). In parallel, compared to a year ago, the terms of exchange improved for Argentina, so, at 2024 prices, we would also have seen a “red”.

image.png

Source: Economic Studies Management of the Province Bank.

The current context encourages companies to bring products from abroad, given the reduction in the price of the dollar, the lower regulations and the recomposition in the income of some sectors of the population that generates a positive impact on the demand. The aforementioned combo is generating a strong import growth; According to an analysis of the Economic Studies Management of the Province Bankfor each point of improvement in the internal gross product (GDP), external purchases are advancing four, a relationship that exceeds the historical average (which is three import points per point of GDP).

In the same vein, the greatest demand for imported products has been One of the factors for which the Central Bank (BCRA) has to sell currencies in the official change market. According to sources from the monetary authority to Scopethat was the main reason for the negative result of almost US $ 200 million observed this Friday, March 21.

The IMF questions the government exchange scheme

This deterioration in commercial exchange is one of the causes for which the BCRA has suffered a deficit in your checking accountin conjunction with the growing deficit in the balance of services for foreign tourism and the use of currencies to intervene directly in the contributions of financial dollars. To this is added the fact that 20% of exports continue to be liquidated to the CCL dollar and do not enter reserves, a scheme known as “dollar blend.”

All these elements are given In the context of exchange delay and the obsession of the ruling party with keeping the exchange gap at bay, issues criticized by the IMF. That is why in this last week the rumors on a request for adjustment in the exchange scheme gained groundas the agency’s requirement to seal a new agreement to refinance the debt.

Does the deficit return to the balance of assets of the BCRA?

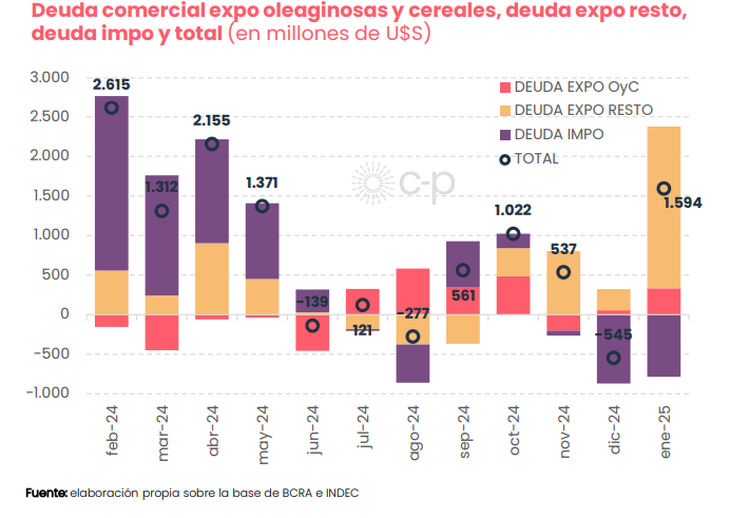

It is worth remembering that the last balance of goods of the central, corresponding to January, gave a favorable balance of US $ 425 million, due to the Prefinancing of exports by companiesin the middle of the strong expansion of credit to the private sector. Pablo Moldovandirector of the CP consultant, said in dialogue with this medium that, depending on the purchases made by the central in the official market during February, it is possible that in that month that dynamic has been held.

image.png

However, he sees a totally different situation for March. “The uncertainty that the negotiation brought with the fund implied disarmament of Carry Trade positions linked to foreign trade that make us expect a exchange deficit“He deepened.

Regarding exports, the economist Lorenzo Sigaut Gravina He said “tends to compensate throughout the year.” In that sense, he explained that possibly during the thick harvest the products already liquidated in the exchange market are sold.

The specialist also predicted that In March the prefinancing of external sales will be stoppedat the same time that the payment of imports will continue to exceed the accrual. Consequently, it is expected a negative effect for the current account.

Chau dollar “blend”?

As for the “blend”, Moldovan explained that eliminating it today implies “a higher parallel dollar that discourages the demand for tourism and treasury that today is supplied through the MEP-CCL to be able to release those dollars and bring them to the official market.” “In the current context, politics decisions require costing costs and probably a greater exchange gap and a reduction in the ‘blend’ is one of the most benign scenarios faced by the government here to the elections“He said.

For its part, Sigaut Gravina said that the ruling could anticipate the eradication of the “blend” at the end of June, in tune with the period scheduled for the decrease in retentions, as an export incentive mechanism in the officer, before the elections. Their Estimates indicate a commercial surplus of US $ 10,000 million in 2025, lower than the US $ 16,000 million so that, with “Blend”, the BCRA assets account balanced at 2025.

The agreement with the IMF, which seems to be imminent, made the possibility of the disarmament of this scheme latenta measure that many economists suggested to swell the reserves of monetary authority. However, if the government will have to take the cost of a higher gap, something that so far was not arranged.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.