The decision of the United States government to advance with duty “Reciprocal” more severe than expected unleashed a Catastrophic reaction in financial markets. The 16% correction that accumulates the S&P 500 (SPY) So far this year reflects the nervousness of investors against the risk of a harder commercial policy Encourage operating costs, limit economic dynamism and deteriorate corporate performance.

In this context, uncertainty led many investors to take PGUBBER OSITIONS ON THE MAIN WALL STREET INDEXwhat promoted The volume operated in the local Plaza del Cedear ETF SHHORT (proshares short s & p 500), designed to replicate in reverse the daily performance of the S&P 500. This instrument, which seeks to rise 1% for each equivalent index in a single session, It is a tactical tool for those who anticipate new short -term descents.

This Monday, the drop in the bags extended to the futures of Wall Street: those of the S&P 500 came to transfer 5% and the automatic temporary suspension mechanisms of operations were activated. The debacle occurred after Trump told journalists that investors would have to “prove their own medicine” and not make an agreement with China until the US trade deficit was resolved with Beijing.

Morgan Stanley -In a report on Friday- ensures that although the calm returns to the market, “Tariffs to China”They have as main victims the sectors of discretionary consumption, technological hardware and capital goods. “These sectors represent approximately 20% of the stock market capitalization of the S&P 500, which is not insignificant, but neither relevant enough to determine the index direction in general,” analyzes the Wall Street giant.

The Bank argues that in a scenario in which tariffs deteriorate trust and cause an adverse labor cycle in the US, “the risk for profits in actions of the SPY is closer to the bearish scenario: A 20% drop in projected profits for S&P 500, with a range between 4,500 and 5,000 pointsclose to our bomb estimation of 4,600 by the end of 2025 ”.

CEDEARS: Bets against S&P500

Matías Weitzelpartner of At investmentscomments in dialogue with Scope that, the yield of the ETF SH (Boshares Short S&P 500) operated with record volume last week and aroused the interest of many investors. However, it warns that beyond the movement itself, the macroeconomic and market foundations “No”They justify to start – at least for now – a bearish strategy at this time.

MEGAQM.PNG VALUATIONS

And for Witzel, despite current volatility, the base scenario remains constructive for the equity in general. “The US economy shows resilience, the labor market continues strong, and Expectations point to at least two rate cuts by the Federal Reserve In 2025, which would tend to favor actions, ”says the expert.

STRATEGY IN THE SH SHORT

The independent financial advisor, Martina del Giudiceexplains in statements to this medium that in moments of high volatility such as these days, “where a market drop is expected ETF SH can be a useful tool for tactical coverage”, That is, to shield the portfolio or take defensive positions.

“It is recommended only for specific moments: as partial coverage, for example, 5% or 10% of the portfolio during expected falls,” says Giudice.

The strategist indicates that the SH works best for short -term movements, that is, few days, including weeks. “It is not ideal to keep it for long periods, since the medium or long -term performance will not be perfectly inverse to the index. In volatile and lateral markets it can lose effectiveness even if the S&P low in the average,” he analyzes the Giudice.

The recommended: “Fly to Quality”

In this context, Weitzel analyzes that the rebound of gold and defensive sectors, together with the correction of the “magnificent 7” of Wall Street “does not necessarily mean a panic signal, but rather a sectorial rotation towards quality, liquidity and defensive strategies.”

This, he says, is because there is no clear trend in the market, since it is not known how the countries’ negotiations regarding tariffs and that there could be technical rebounds before confirming a change in tendency will end.

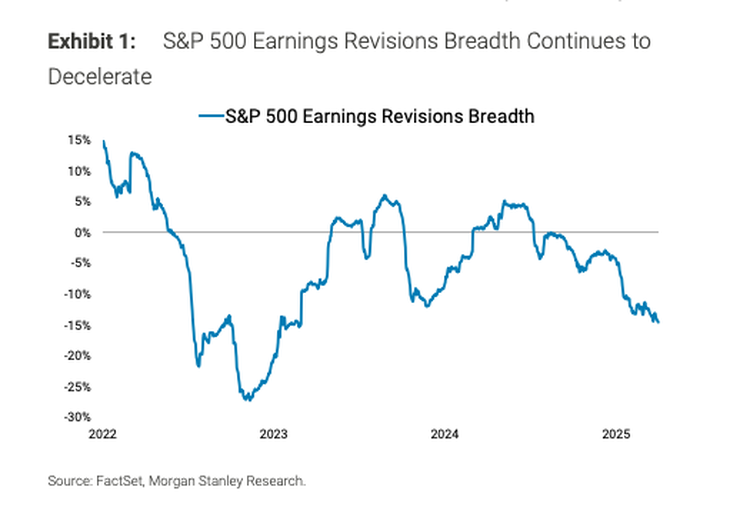

S&P500 Morgan Stanley.png

It should be remembered that discretionary-consumer goods for Morgan Stanley are the most affected- are those products or services that are not essential for daily life, therefore, consumers usually buy them when they have available income or confidence in the economy. This type of consumption includes products such as brand clothes, electronic items, cars, trips or entertainment.

Some companies that operate in that market are: Nike (NKE), Apple (AAPL), Tesla (Tsla), Disney (Dis), Netflix (NFLX), Amazon (AMZN), Ferrari (Race) and retail chains like Inditex (ITX.mc) either LVMH (MC.PA).

While some Yields They show unusual flows and arouse interest among those who seek coverage, Weitzel recommends caution. “It can be a good time to look closely at sectors punished with solid foundations, such as energy, health, financial or technological,” he concludes.

The investor board is redrawn while the global commercial tension persists. In this scenario, defensive strategies take prominence, but analysts agree that decisions must be guided by foundations and not for impulses.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.