The teacher states that, beyond the theories faced on the exchange rate, the current flotation regime with bands reflects a pragmatic and circumstantial decision of the government, which avoids artificial stability commitments in a context of high uncertainty.

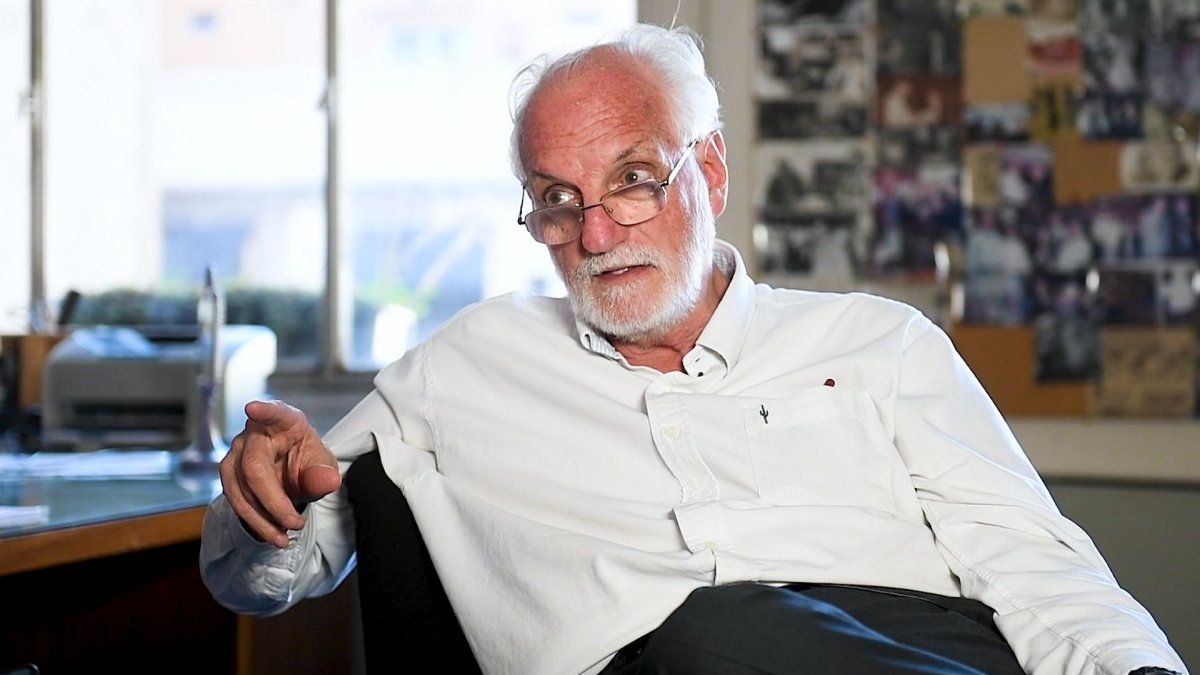

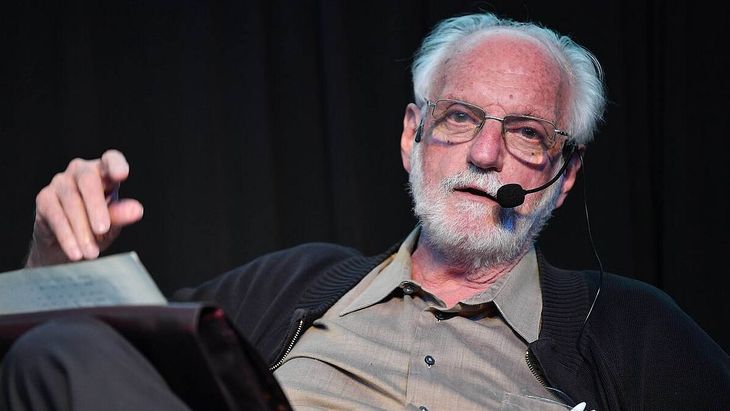

Faithful to its direct and pedagogical style, Juan Carlos de Pablo or “El Prof” As President Javier Milei tells him, he highlights one of the great truths that crosses the theory and economic practice: “Even among the biggest, there is no consensus”.

The content you want to access is exclusive to subscribers.

The economist remembers that the University of Chicago – Epicenter of thought liberal In economic matters – he housed so much Milton Friedmandefender of the floating exchange rate, as to Robert Mundellpromoter of the fixed type. A difference that not only does not invalidate the theoretical formation of the house, but illustrates the essentially pragmatic character of economic policy: “Every decision depends on the moment, the context and the objectives,” he says.

In that frame, De Pablo raises in a column that he wrote in the nation that the debate Between fixed or floating exchange rate it is no longer useful as theoretical discussion. The government made a specific decision: A flotation scheme with bands. As of Monday 14, and as reported by the Central Bank in Resolution A8226, the dollar will move within a strip between $ 1000 and $ 1400, adjustable to 1% monthly. It is not a free flotation or a rigid fixation, but an intermediate solution that attempts to give a certain channel to volatility without compromising reservations in a context of shortage.

For De Pablo, the important It is not so much the announcement itself as its mutable character. It emphasizes that although this government usually fulfills what it says, it can also change course if circumstances demand it. “I would not do it by whim, but out of necessity, which marks a key point: In today’s Argentina, flexibility is worth more than the promise of artificial stability “.

Certainty is better than uncertainty

In this sense, he warns about a frequent error in local economic policy: wanting to ensure the future at all costs. “Certainty is better than uncertainty, but the claim of certainty is worse than uncertainty,” he says. A powerful message for a country with a tradition of tied to the allegedly immovable policy mast, which end up exploding when the wind changes.

Juan Carlos de Pablo.jpg

Certainty, uncertainty and flotation: Paul’s gaze on exchange policy.

The closure is not less. De Pablo suggests that the exchange regime is a derivative of the true core of this stage: “There is no money” and Federico Sturzenegger. That is, fiscal policy as the main anchor, and an economic team that intends to minimize state interventioneven in the exchange market. In that framework, Letting the exchange rate float is not an ideological conviction, but a practical need.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.