Michael Wilson, by Morgan Stanley, said that the weakness of the dollar will support the profits of US companies, which will help the US stock market to overcome the rest of the world.

Michael Wilson, from Morgan Stanleystressed that betting on USA It is a possible option. In this regard, he mentioned the less volatile growth of profits and the fact that American companies are considered of higher quality.

The content you want to access is exclusive to subscribers.

Wilson expects The S&P 500 remains in the range of 5,000 to 5,500 points. So that a more substantial increase occurs, a tariff agreement with China would be necessarya clear rebound for profits and the possibility of a more flexible monetary policy by the Federal Reserve, he wrote.

Morgan Stanley’s expert also said The weakness of the dollar will support the profits of US companieswhich will help the US stock market to overcome the rest of the world.

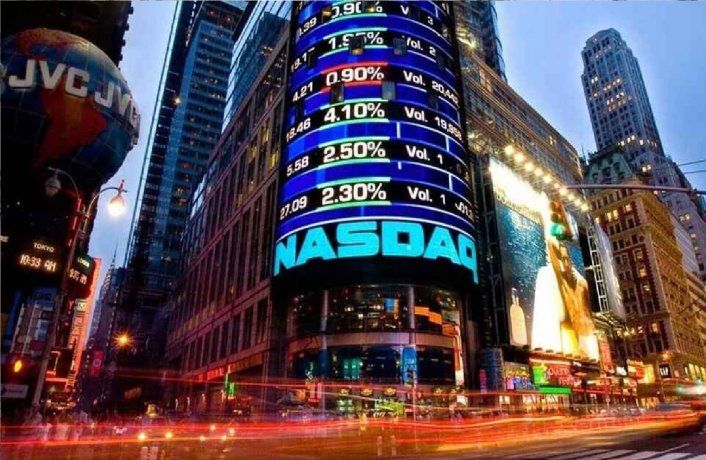

Nasdaq

Positions found

Contrary, Mislav Matejka, by JPMorgan Chase & Co, prioritizes international actions against Americans. In his last note, he said that The risk-reinability relationship is better for non-American actionsespecially if President Donald Trump continues to reverse his tariff policy and the chances of recession remain high.

Matejka is not the only one who is cautious about US actions. The director of Asset Assignment of Societe Generale SA, Alain Bokobza, warned that investors will continue to cut their positions in US actions and in dollars if Trump persists in his commercial policy.

Last week, Bank of America Corp. strategists advised to sell US shares and take advantage of the dollar increasesclaiming that the conditions are not given for the profits to be maintained.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.