The context changed several months ago, since inflation ceased to be transitory. The cycle of zero fees and free money is over. The Federal Reserve had no choice but to be more aggressive and confront the inflationary scourge by raising interest rates.

In tune with this new tougher stance, the Federal Reserve announced last week a 0.50% rate hike (the biggest rate hike in the last 20 years) placing the interest rate within the 0.75% – 1% range. . It is the second of seven increases planned for this year. In addition, you will gradually reduce your bond holdings.

I want to leave you the monthly chart of the S&P 500, so you can see why the fall is just beginning:

Boggiano1.png

The S&P 500 had its worst start to the year since 1939. If you look at the long-term chart, it’s just a slight correction for now.

Stocks that suffered the most were technology. Why? Simply because the increase in the rate harms them more.

For your reference, these were some of the landslides so far in 2022: Netflix (-70%), Facebook (-40%), Amazon (-33%), Spotify (-57%), PayPal (-58 %), MercadoLibre (-30%).

Surely many are tempted to buy and many advisers are recommending that. But it is exactly what they do not have to do, since the trend is decidedly bearish.

Looking to the future, the context is not very favorable. The increase in the interest rate will cause more expensive loans for companies and individuals, tending to cool down the economy. The GDP fell by 1.4%, a situation not seen since the start of the pandemic, and the recession begins to hover over American lands.

In addition, inflation has not been resolved and set a record (8.4%) in the last 40 years. As is known, this scourge affects the profit margins of most companies. And the main solution (increase in the interest rate) causes lower stock valuations.

Nafta so that the fall continues

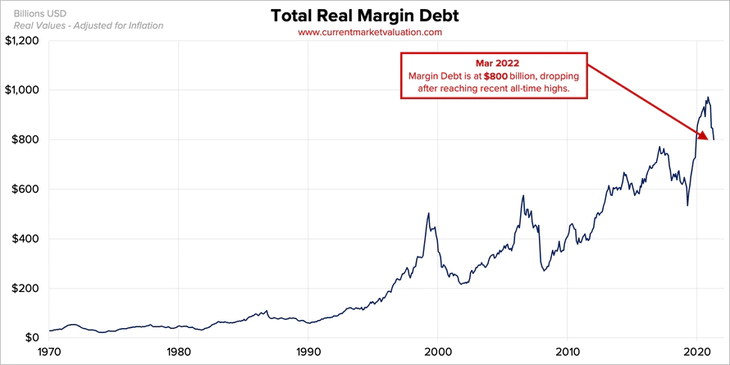

Without a doubt, the “Margin Debt” plays a major role in the markets. It is the money that is borrowed to invest in stocks. It has the power to amplify market movements. A high level of Margin Debt implies a high risk in the market.

If the shares begin to fall, the collateral value of those loans also falls, so investors must pay off the loan (margin call) by selling the shares. This sale of shares causes a further price collapse. That is to say, more gasoline that feeds back the fall.

Let’s see the evolution of the Margin Debt:

Boggiano2.png

Levels remain sky-high, so the risk of the decline accelerating is huge.

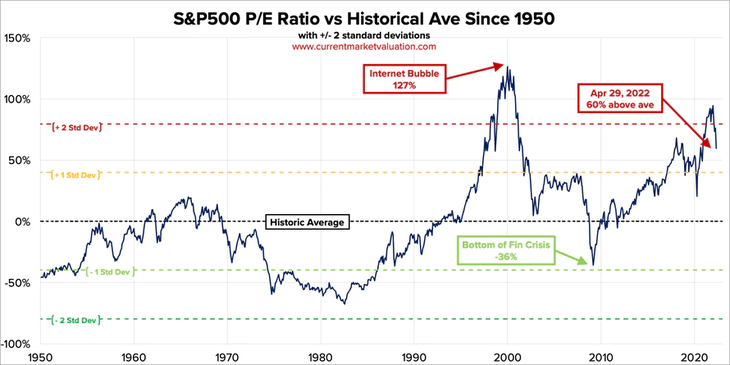

Another argument for the market to remain bearish is stock valuations. The Federal Reserve, by injecting money since the pandemic, has fueled a bubble that has led to stratospheric valuations.

The market has corrected and refined (if you don’t ask Facebook, Netflix, Paypal, MercadoLibre, Amazon, Spotify, and many others, which accumulate spectacular falls), but the general valuations continue to be high.

Let’s see the ratio Price-to-earnings of the S&P 500, showing the relationship between stock price and company earnings:

Boggiano3.png

At current prices and in relation to the ratio Price-to-earningsthe market is 60% more expensive than the average of the last decades.

Also, using the indicator Warren Buffet (Market Cap on GDP), the market is 38% more expensive than the average.

Whatever the valuation metric, the conclusion is the same: the market is still expensive. And the chances of seeing an acceleration of the decline due to the level of leverage are high.

To finish, I want to invite you to download for free a report that I prepared so that you can face the next crisis and have the tools to know how to beat the market. I think it will be very useful to you. You can download it at the following link: Financial letter – double capital.

Source: Ambito