In short, they are fixed income instruments since we know in advance the flow of funds that we will receive.

image.png

The main advantage of LEDs is liquidity: they can be sold before expiration. They do not have minimum investment amounts, so they are interesting for the retail investor.

What other alternatives do I have?

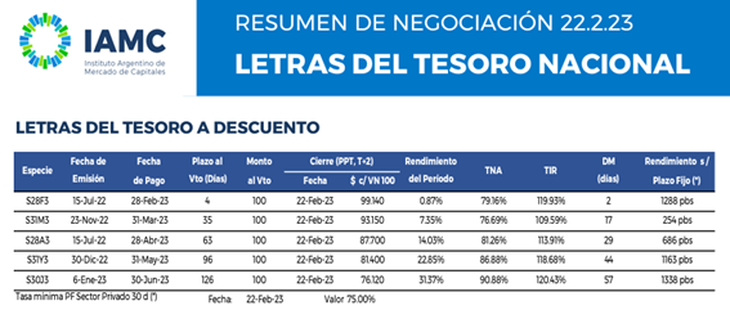

The IAMC publishes its report on Letras del Tesoro on a daily basis. The options can be seen in the following table:

image.png

How are they bought?

They can be purchased in the bidding process, called the primary market, or in the secondary market (through a broker). Periodically, the Treasury offers to the market securities, which may be currently at discount, CER-adjustable or dual.

Thus, investors, through their brokers, make their purchase offers, with quantities and prices/rates and the book is formed, where they are ordered from highest to lowest price.

Once the Treasury indicates the cut-off price, all the offers that were above that maximum price (that is, those that had the intention of paying more) are awarded.

In short, it is a competitive process, where the rate or performance is tendered, which guarantees that the highest bidders interested in buying them (that is, those who seek lower discount rates or higher prices) have a better chance of acquiring them.

When are the tenders?

You can consult the bidding calendar available at Treasury page.

That cost has?

The broker’s commission is paid, which varies between 0.25 and 1% of the traded amount.

What risks does it have?

- Default or reprofiling, something that constantly resonates.

- Loss of purchasing power if inflation exceeds performance. To avoid this, we can buy LECER, bills that adjust principal and interest according to CER, which incorporates INDEC inflation.

- Investment liquidation if there is devaluation.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.