The blue dollar touched $500 and is not letting up. Inflation does not stop and the exchange gap exceeded 100%. What can happen?

The different free dollars (blue, MEP and Cash with Liquidation) had a rise of more than 15% in the last week, amid political uncertainty, the lack of dollars from the Central Bank and inflation that continues to accelerate.

Let’s see the graph of the dollar Counted with Liquidation since the current government took office:

B1.png

This week marked a new nominal high. Although in an economy with inflation that runs above 100% per year, it is logical that it is breaking new records.

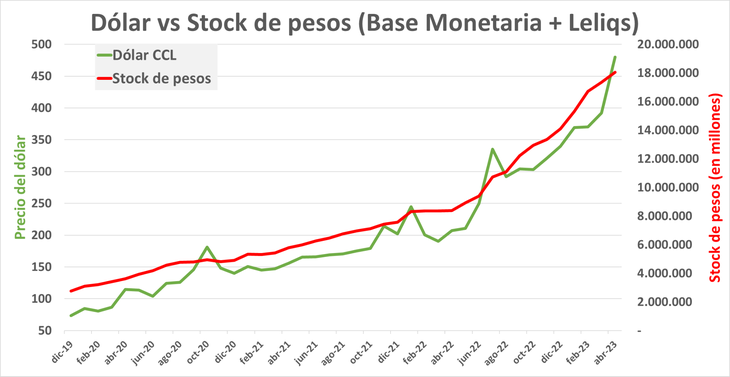

Therefore, it must be analyzed taking into account the pesos that are circulating. One way to look is to compare the price of the dollar with the pesos that are in the economy. Let’s see the relationship between the dollar and the stock of pesos (Monetary Base + Leliqs):

B2.png

The dollar (green line) exceeded, after one year, the number of pesos in circulation (red line).

The dollar was asleep for several months, rising at a slower rate than inflation. It is known that the dollar in Argentina never goes down, it just gains momentum. And that’s what happened: it went up very strongly in a very short time.

To top it off, the currency gap continued to worsen:

B3.png

Currently it is around 110%, that is to say that the free dollar is 110% more expensive than the official one. An increase in the gap does not generate good expectations for exporters, since they have fewer incentives to settle. This could lead to further delays in the settlement, making the vicious cycle of lower dollar income widen. Possible dynamite for the country.

What can happen?

The dollar, in terms of the pesos that are in the economy, now looks at a higher price “fair”. Does that mean you’ll take a breather? Nobody knows.

We are going through very difficult days and it is necessary for the government to bring calm. If there are no solutions and a credible plan in sight, the dollar has no ceiling.

Nor are government interventions to calm the dollar being successful, and on top of that they are wasting resources.

In addition, the drought and inflation that the country is going through puts any hope in jeopardy. As always, and more so in this election year, be careful. The volatility these days can be dangerous, both on the upside and on the downside.

To finish, I want to invite you to download a report where I explain everything about what can happen in 2023 with the dollar. In addition, I tell you the different types of dollars that there are. You can download it here: Financial Letter – Dollar.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.