After two of the most important bankruptcies in the US, there is another bank that is a candidate. During this week alone, its shares fell more than 70% and have accumulated a 97% drop so far this year. Meanwhile, federal regulators are racing against the clock to find a buyer.

The bank in question is called First Republic Bank and is based in San Francisco. This year it began to falter when Silicon Valley collapsed. And in the last week, after his balance sheet, investors fled.

Let’s see its graph during 2023:

bog1.png

At the beginning of the year, it was worth $123. After the bank collapse in March, it was worth $12. It spent a month with relatively calm movements, until it presented balance this week. From there, it fell more than 75% in a few days.

Reported deposits were $72Bn, a 41% drop from last quarter. But it is worth clarifying that within these deposits, there are US$30,000M that a group of large banks granted him, a few weeks ago, to avoid contagion.

Let’s remember that many investors, in the face of panic, began to withdraw deposits from small banks (such as First Republic Bank) to go to large banks with greater support.

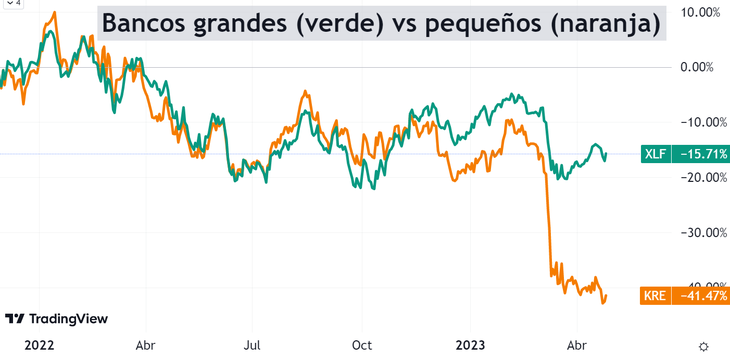

Let’s look at a chart showing how the large bank sector (XLF) vs. the smaller bank sector (KRE) has fared.

bog2.png

They have moved pretty much the same until the banking disaster in March. From there, investors fled the small banks and the big ones benefited.

To avoid bankruptcy, First Republic Bank pooled a large amount of cash to cover the current run and to meet a future run. But it comes at a high price: You have to borrow from the Federal Reserve. And that money is very expensive.

Banks were paying virtually nothing to depositors. This was the era of free money, which is over. If a bank wants to attract deposits, or even retain them, it must offer better returns. First Republic Bank currently pays 2.2% on your deposits. And the 1-year interest rate is around 4.8%. Clearly there are not many incentives to leave the money in the bank.

For this reason, the bank is at a great crossroads. If you start paying more interest, your profit margin will drop dramatically. And if you don’t, you’re going to continue to bleed into your repositories.

So. what can you do? For now, they already announced that they were going to lay off 25% of the staff, reduce office space and cut expenses. And later, financial engineering to improve its balance sheet. Will it suffice with that? We will see.

The bank is on the verge of collapse. There is already talk of potential buyers (for example, JP Morgan). In that case, it would take over First Republic Bank’s deposits, saving the federal government from having to take over. If an agreement is not reached, the FDIC (Federal Deposit Insurance Corporation) would have to decide whether to intervene.

The banking situation in the US is by no means resolved. This is just the beginning. How to know if a bank is a candidate for bankruptcy? The best way is to follow its price on the stock market. And looking at that, we can conclude that First Republic Bank has a very good chance of failing. Prevention is better than cure.

Finally, I invite you to download a report that I prepared with “7 Investment Ideas for 2023”, an extremely challenging year. Download it here: Financial Letter – 7 investment ideas for 2023.

Note: The material contained in this note should in no way be construed as investment advice or a recommendation to buy or sell any particular asset. This content is for educational purposes only and represents the author’s opinion only. In all cases it is advisable to consult a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.