It is interesting to see the evolution of the BCRA reserves, the deposits in dollars measured as the sum of deposits in checking accounts, savings accounts and time deposits, and the price of the sovereign bond maturing in 2030 under Argentine law.

The first thing we have to highlight is that the reserves show us a high level for December, due to the fact that the government encouraged the liquidation of soybeans via dollar soybeans one and two, which raised the reserves and allowed the government to close an agreement with the IMF. This left the government with little income in dollars in 2023, and this can be seen in the evolution of gross reserves, something that will be difficult to reverse as a result of the dismal agricultural campaign that is taking place.

As for the dollar deposits the drop is US$1,562 million in 2023, which reveals that there is no massive flight of deposits from banking entities, on the other hand, this amount is insignificant if we take into account that GDP adds US$466,612 million, which represent 3.8% of GDP. A misery.

He AL30 bond in dollars under Argentine law shows a significant rise in January when the Ministry of Economy announced a repurchase of this title, something that was left aside due to the lack of dollars, and it shows in the price. As long as we do not see a rise in reserves and deposits, it will be difficult for the AL30 bond have a significant recovery in prices, but if the world takes pity on us, and the IMF advance disbursements, the rise is possible. If this happens, we would not be surprised if this bond trades 20% above current values.

image.png

We have taken the gross reserves of the Central Bank, and we have compared it by the sum of two items of the Central Bank balance that are Monetary Base and Securities Issued by the BCRA, this gives us as a result a reference dollar that arises from comparing both items . To complete the analysis, we show the price of the MEP dollar.

If we look closely at the entire series, we see a sharp decline in reserves that fell in u$s9,596 million in 4 months of the year 2023, and liabilities that grew $3,456,780 million.

The ratio of liabilities versus reserves step of $351.7 to $547 which represents a rise of 55.5%, in the same period of time the MEP dollar rose 33.0%. The estimated inflation for the first 4 months of the year (expecting inflation of 8.0% for April) would be 31.5%.

The blue dollar as of December 2022 closed at $348and on April 28 it closed in $472, with which in the year it increased 35.6%. It would give the impression that the blue dollar better copies the relationship of liabilities versus reserves of the Central Bank.

The conclusion of these numbers is that it is very likely that the blue dollar or MEP will trade above $500unless the IMF disbursement arrives and we have to recalculate the scenario, of course with a momentarily lower dollar.

image.png

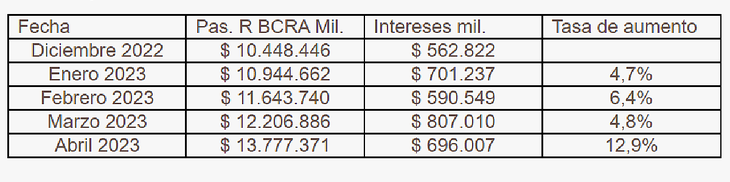

An interesting topic is the evolution of the remunerated liabilities of the BCRA, which increased 31.9% so far this year, with a strong acceleration in the rate of increase in recent months. As data to take into account, we show what interest is paid per month for BCRA liabilities, which are growing at a very high level today, and if the increase in liabilities continues, interest will soon grow at a rate of $1 trillion monthly.

image.png

Conclusions:

- The blue dollar increased 35.6% until April, the remunerated liabilities of the BCRA grow at a rate of 31.9%, the MEP dollar increased 33.0% in the same period and inflation in 4 months would be 31.5 %. Any resemblance is mere coincidence.

- The expectation of a rise in the dollar would be 55.5%, with which we must be observing some factors that are causing the rise of the dollar to grow below its potential, as a result of State intervention in the economy, the high rate of interest, and the great recession that makes many economic agents have to sell dollars to finance their structural expenses.

- Reserves in 4 months fell 21.5%, and the AL30 bond in dollars under Argentine law fell 14.6%, deposits in dollars fell 8.5%. It is clear that there is not a great drop in dollar deposits in this context, and that if there is a recovery in reserves, sovereign bonds could have a substantial improvement.

- The rise in international rates has not helped the government at this juncture, nor has the sustained drop in the price of oil and agricultural raw materials, let alone the drought. Nor did it have successes in economic matters, ignoring the structural problems that the macroeconomy has, which does not generate incentives for investment.

- The government has a bullet, get the mercy of the IMF, that a saving disbursement arrives, and that the peso does not sink in the next wheels, this would give us the opportunity to see a rise in bonds and shares.

- Without the arrival of funds from the IMF, we can see a comfortable dollar above $500 as shown by the ratio of monetary liabilities versus reserves. Inflation 2023 heading for levels above 100% per year, in 4 months it will exceed 30% and is going for more.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.