In the last week, it took place in Criteria he Global Investment Committeein which our team analyzed the portfolio strategy for the last quarter of 2023. Below, we share the main conclusions, along with the recommendations to adjust the portfolio in response to a new landscape in global markets.

The main developed economies today show divergent paths. While Europe and China show weak signs of growth, in In the US, activity looks resilient, and declining inflation that invites us to think about convergence to the goal.

Core inflation in the United States, which peaked at 8% last year, has consistently fallen to around 3% in the annualized quarterly measurement. This is close to the objective of the Federal Reserve, which despite having raised interest rates sharply, still fears about prices in a relatively strong economy.. A solid labor market and an important fiscal impulse have repeatedly postponed the recession scenarios projected by the market.

Sharp decline in core inflation

Annualized quarterly variations

criteria 0.jpg

Source: BlackToro Global Investments, BEA.

The consensus today is for a “soft landing” of the economy in the first half of 2024, and asset prices today reflect some optimism regarding more challenging scenarios for GDP.

However, although growth has to some extent sustained the expectation of returns for S&P 500 companies, the Federal Reserve is not taking its foot off the accelerator, and is still showing its teeth despite declining inflation.

Even with risks of a recession on the horizon, the central bank is in no rush to begin the reverse process: interest rate cuts. The FED’s communication has generated a consensus in the market that they will remain high for longer. The expectation now for a cut has only been postponed from July 2024.

This has resulted in a drop in equity values in recent weeks, and a significant increase in the interest rate on US Treasury Bonds, thus also affecting fixed income.

All of the above invites us to reconfigure our strategy.

Treasury bonds already offer yields that average 5% annually across the curve. We consider this rate attractive in light of declining inflation and unattractive equity valuations.

As a result, we continue to favor a positioning in fixed income over equities, incorporating Treasury bonds into the portfolio.

The aforementioned risks of recession that are not fully incorporated into asset prices, and the growing war conflicts reinforce the appetite for assets considered safe and protective. A positioning in quality fixed income seems reasonable to navigate this period.

For risky assets in general, a situation has emerged in which certain assets show an unfavorable risk-reward ratio. Earnings projections for companies and their valuation multiples leave little room for appreciation, particularly when contrasted with expected returns on fixed income.

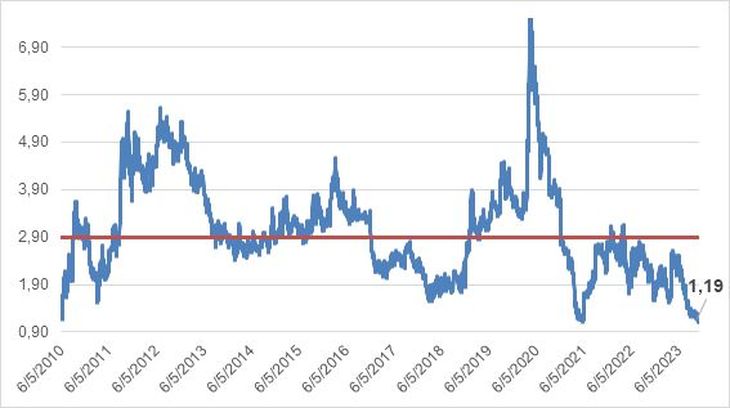

As can be seen in the following graph, the remuneration for the investor for tolerating the risk inherent in an investment in variable income over fixed income is below the median of recent decades. The risk premium today is 1.2% above the risk-free rate, something we consider insufficient to justify a weighting biased toward stocks.

Relative valuations favor bonds

S&P 500 Stock Risk Premium vs. 10-year risk-free rate.

criteria 1.jpg

At the same time, we believe that fixed income is the ideal instrument for this phase of the Federal Reserve’s rate cycle. Historically, during periods of stagnant or declining interest rates, fixed income has outperformed stocks.

Stocks perform better when a bull cycle is paused, but bonds perform better over the entire cycle.

Average returns on stocks and bonds in different phases of the interest rate cycle

criteria 2.jpg

Source: Guggenheim Investments.

Finally, although it is losing attractiveness compared to quality bonds, the variable income component continues to present attractive opportunities in some cases. We privilege actions from the United States over emerging and other countries, fundamentally sectors related to Artificial Intelligence.

Consult your advisor to determine the correct configuration of your portfolio according to your risk profile.

Asset Management Director of Criteria.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.