Bridge Warren Buffet cards game.jpg

ABC.es

Price is nothing more than a variable resulting from the interaction between supply and demand. Stock prices vary all the time based on many factors, though in particular because of the expectations investors have of a particular company.

Value is a much deeper concept. Unlike price, the value of a company at any given time is not exact. In Warren Buffett’s own words, the value that is acquired is related to the price that each of us are willing to pay for it.

The value of a company is given by the future free cash flows generated by the company, discounted at present value. And not only that. The concept of “value” also includes peculiarities that cannot be easily quantified, but contribute to making those cash flows more predictable. For example, intangible assets.

John Deree Field Tractor.jpg

John Deree

Here we could mention the competitive advantages, the trajectory, the vision of the Management, patents, and strength of a brand, among others. If we can identify a company with these qualities, we can only find the moment to pay an attractive price for that business. To do this, there is a simple way to estimate a fair price of a share, projecting future profits and knowing the current price.

A giant that nothing stops him

Deere & Company is one of the world’s leading agricultural machinery manufacturers. This company has an impeccable track record with more than 180 years of experience. Your governing body, especially your CEO John May, demonstrated to its shareholders values such as integrity, quality, commitment and innovation over time.

In this way, it became a leading company within its sector, with a market value of u $ s108,000 million, just below Caterpillar Inc., with a market capitalization of u $ s111,000 million.

John Deere Stock.jpg

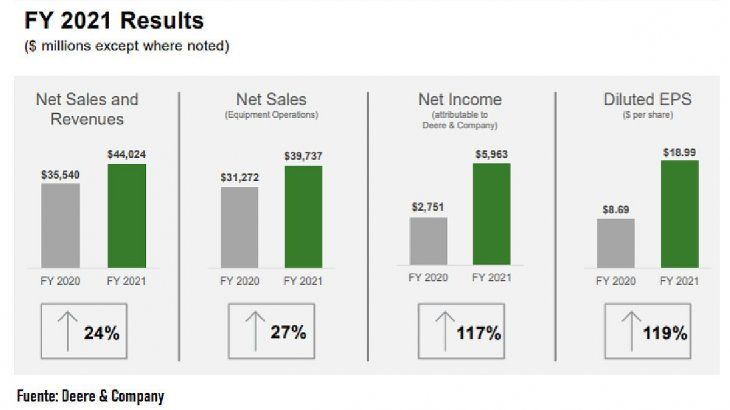

Deere’s most prominent competitive advantage is related to the use of smart technology equipment. This allows the farmer to obtain higher yields using the same piece of land. This week, Deere reported fourth quarter results and fiscal year 2021 annual balance. Numbers say everything.

In this quarter, sales were u $ s11,327 million (+ 16% year-on-year) and its profit of u $ s4,12 per share (+ 69% year-on-year). In the twelve months of 2021, it recorded income for u $ s44,024 million (+ 24% year-on-year) and a profit of u$s18,99 per share (+ 117% year-on-year).

Most interestingly, Deere is not suffering from the global problem of supply chain bottlenecks. While its costs increased by 20% this year, the company increased its net margin to 11% in the fourth quarter (compared to a net margin of 7% in the same period of 2020).

In addition, Deere increased its earnings projections for fiscal year 2022. It expects to make a profit of between u$s6.500 and u $ s7,000 million, or the equivalent of u$s22,57 per share. This would imply a potential profit growth of around 17.4% per annum.

field tractor.jpg

Deere shares trade at a price of u$s367. If we divide those u$s367 about the benefit of u$s22,57, we get a valuation of 16 times your projected profits.

Considering that its historical valuation (during the last ten years) was of 16.5 times your profits, Deere is trading at a fair price. If we take Warren Buffett’s advice, Deere is a high-value business and we would be paying a more than reasonable price today.

In Argentina, you can invest in this company through a CEDEAR, an instrument that is listed on the local Stock Exchange and represents a portion (10: 1) of the share in dollars in the United States.

Remember that, in the end, the simple wins.

Source From: Ambito