Earlier this year, we stated that investors were not yet out of the woods when it came to economic or financial market risk. A few months later, the probability of a soft landing in most jurisdictions has increased. Central banks like the Federal Reserve (Fed) now face a dilemma: if they cut too soon, inflation could stabilize at a higher level than desired; an overly restrictive policy, on the other hand, could further burden economic activity, increasing the likelihood of a hard landing.

In a new twist, the likely policy path behind a soft landing scenario could increase the odds of a fiercer, rate-driven contraction later. And as this year’s divergence between sovereign debt and global equities demonstrates, which it’s already discounted should be an essential consideration when trying to obtain excess returns in the short and medium term.

With divergent economic – and therefore political – trajectories, it is important to ask not only which asset classes to prioritize, but also where. Following the trend of 2023, The US, in our opinion, remains the best in its class in terms of economic growth. Consumption has remained strong as real wage growth – thanks to falling inflation – has taken over from the pandemic-era savings glut.

In Europe Signs are emerging that the period of pronounced economic weakness may be changing. New orders in major regions are outstripping stocks, and German exports have picked up. The eurozone economy could soon receive help in the form of lower rates from the European Central Bank (ECB). This is possible thanks to a considerable drop in inflation, although it is partly due to the weakness of consumption.

Inflation is declining in almost all major jurisdictions, meaning we have almost certainly reached peak interest rates in this policy cycle. Despite progress, many countries will find it harder to move from current levels to their inflation targets than it was to move off cycle highs.

In any cycle, interest rates serve as both a barometer and an instrument to gauge economic health. With the start of rate cuts delayed, the consensus view that sovereign yields would inevitably fall has collapsed. This is mainly due to the resistance of the United States. Consequently, at Janus Henderson we have a neutral view towards global sovereign bonds and a negative bias towards US Treasuries.

The euro area and the United Kingdom face conflicting prospects of keeping rates at restrictive levels due to wage-driven inflation and lowering rates to offset sluggish growth. If inflation continues to fall and the expected cyclical recovery proves slow, the eurozone is likely to be in first position for a rate cut among advanced economies. Therefore, we maintain a neutral stance towards the region’s sovereign markets.

Clipboard01.jpg

Variable income: mixed results

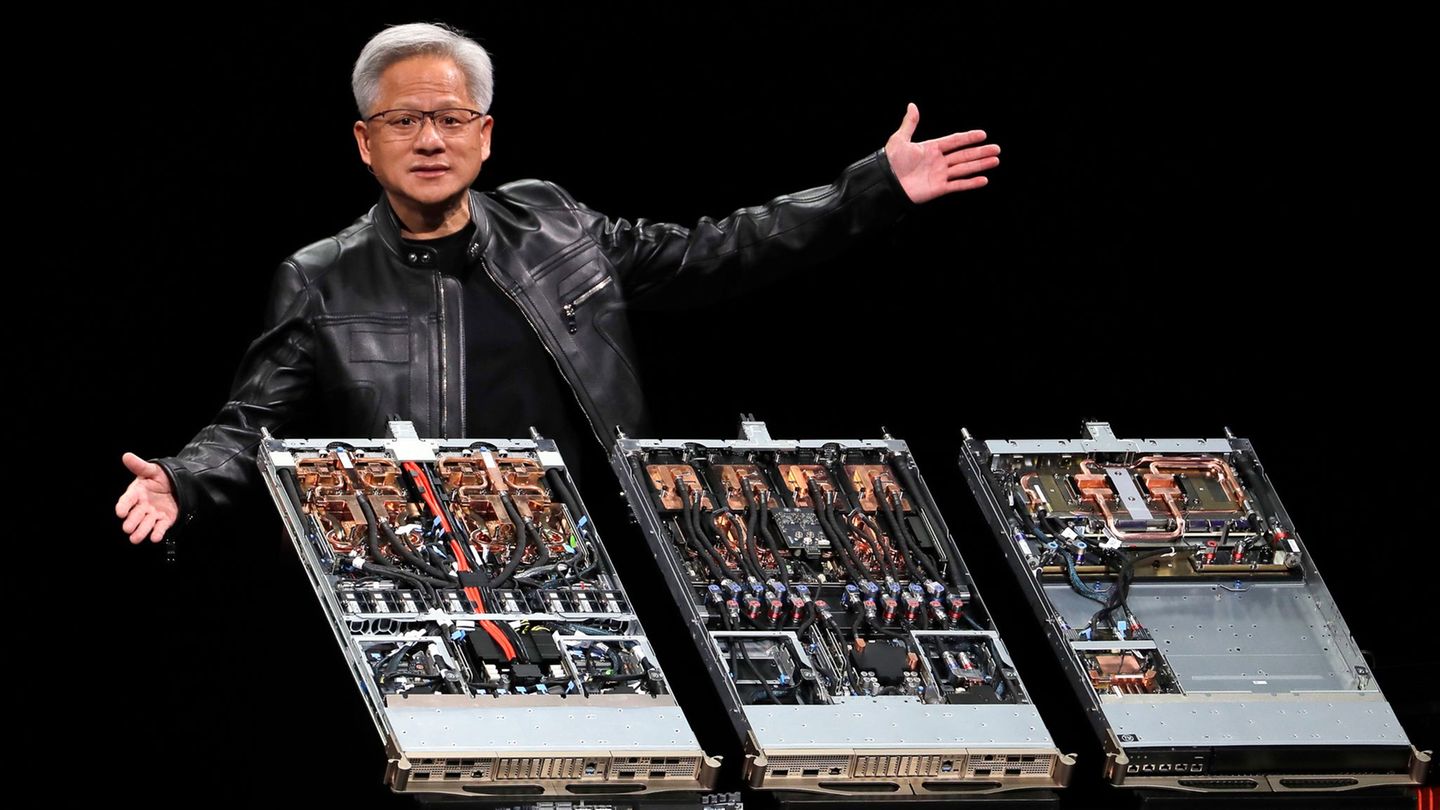

We have no doubt that many US large-cap stocks leveraged on secular themes such as artificial intelligence (AI) are capable of compounding returns over a long period. However, overall, US corporate profits may have already reached their cycle high. Without that tailwind and with the delay in falling rates, especially beneficial for growth stock valuations, the prospects for further hikes appear limited. On the other hand, an extended cycle should benefit more cyclically oriented value stocks as their earnings path lengthens.

Recent claims that major central banks intend to cut rates for the rest of the year, despite above-target inflation and still-solid growth forecasts, are a good omen for smaller companies.

However, a decrease in financing costs in a context of economic recovery could translate into an improvement in profits. Additionally, valuations of small caps appear less demanding than those of large caps. There is significant application risk in this space, given that the proportion of unprofitable companies in the small-cap benchmark index has reached 40% higher than usual, making stock selection paramount. Midcaps are equally promising and generally have better fundamentals due to their lower debt load.

Portfolio Manager in the Multi-Asset team at Janus Henderson Investors

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.