He gold remains in the zone of historical maximums in the midst of a rise in rates due to high inflation.

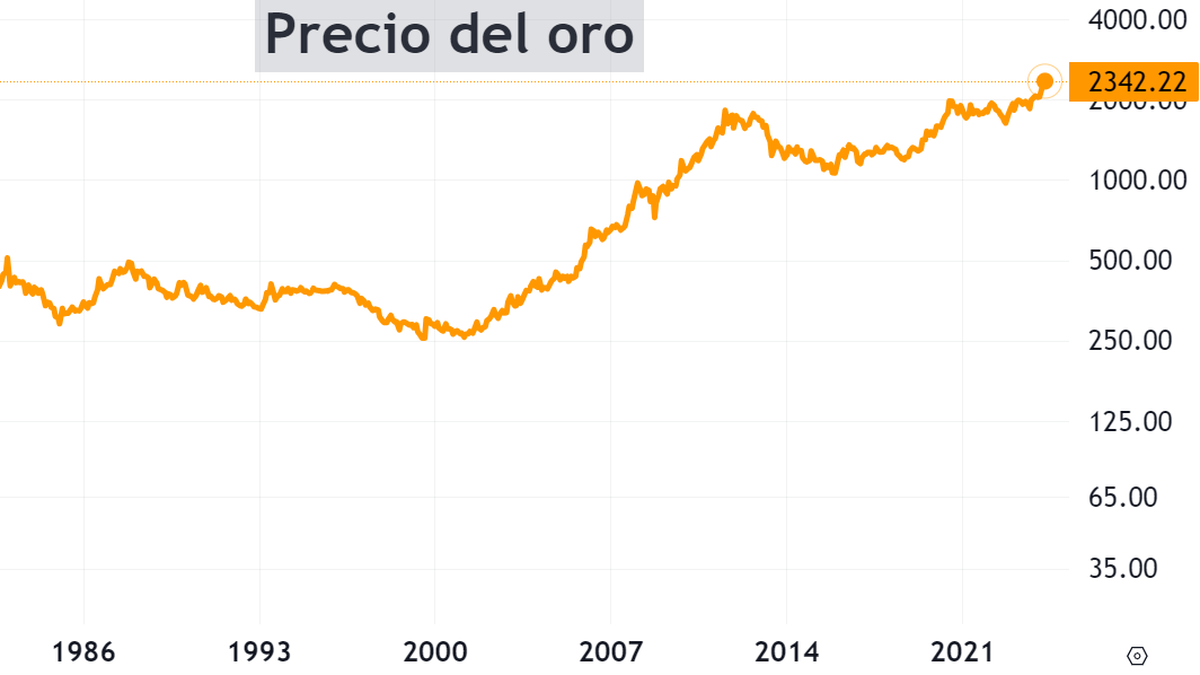

Let’s look at the long-term graph to understand other increases it has had:

From 1972 to 1980 it rose more than 1500%. From 1982 to 1985 it rose 82%. Between 2000 and 2008 its price quadrupled. In 2015, a 100% rally began that culminated in 2020.

And now? Since the last lows in November 2022, it has risen “only” 44%. It seems that there is an upward trend.

I want to describe the behavior that gold has historically had with the real interest rate.

Gold has been directly influenced by real interest rates, that is, nominal rates adjusted for inflation. When real rates increase, the price of gold tends to decrease. On the other hand, when real rates fall, the price of gold tends to rise.

What has been notable has been that in recent months, with real rates rising (the graph is inverted for simplicity), gold has shot up:

‘

gold2.png

In the graph you can see how gold (orange line) marked new historical highs, despite the fact that the real interest rate (blue line) has also risen (it is inverted in the graph) during these months.

This paradigm shift can be attributed to several factors. On the one hand, the growing geopolitical uncertainty (Russia/Ukraine and the Middle East). And this has increased demand for safe assets, such as gold, regardless of fluctuations in interest rates.

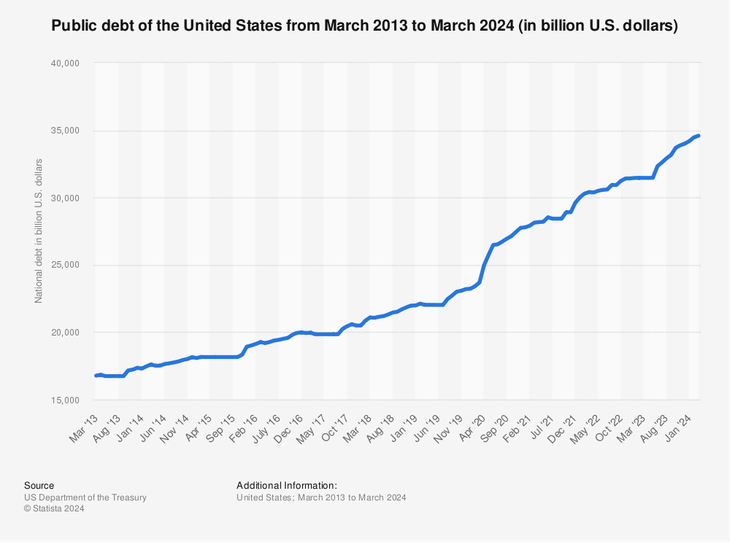

Furthermore, the continued accumulation of US Treasury debt, which exceeded USD 34 Trillion, has raised concerns about financial stability.

gold3.png

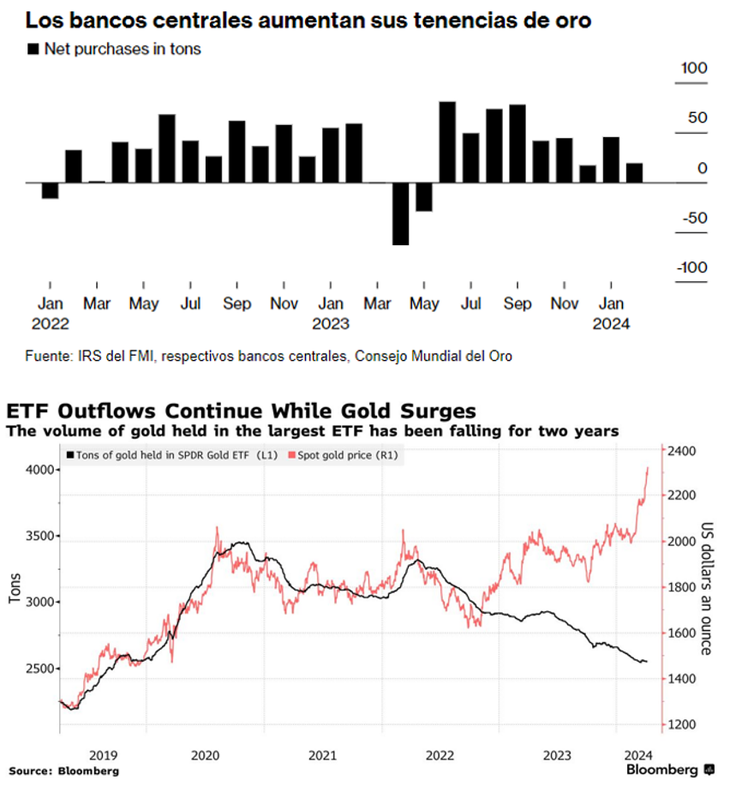

Another important factor to consider is the trend in the acquisition of gold by central banks, particularly notable since 2022. This trend has persisted through 2023 and extended until 2024, which has contributed to maintaining the demand for gold at a high level.

gold4.png

Central banks are choosing to reduce their dependence on the US dollar, leading them to consider gold as a more attractive alternative, especially in a context of geopolitical uncertainty.

Let us remember that, since the pandemic, extremely expansive monetary policies were applied followed by very aggressive increases in the interest rate. In this context, and in the midst of geopolitical conflicts, classic correlations lose their magic, just as happened with gold.

At the end of the day, what matters is what prices do. And gold has been in a clear upward trend for several months now.

How to invest in gold? There are 4 main ways:

- Physical gold: It is the least practical way to buy gold. It has very high spreads and storage costs.

- Gold ETFs: The best known is the SPDR Gold Shares, whose symbol is GLD. What this ETF does is invest in physical gold and can be purchased from any international broker.

- Gold Futures: It is the most efficient way but requires other complexity.

- Related companies: You can invest in gold mining companies individually or buy, for example, a mining ETF (GDX), which includes the main companies in the sector.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.