The key to these first months with new economic management has gone through a process in which the BCRA has consistently managed to go buying dollars in the official exchange market. This accumulation of reserves has a double effect, it improves the reserves of the BCRA and generates the sensation of balanced economy.

This despite a series of controls that remain in force in the exchange market, both official and in the financial market. The discussion today involves understanding how the genuine supply and demand factors are. And from there begin to analyze two central themes: What possibilities are there of unifying the exchange market? At what level of real exchange rate could this potential unification be achieved?

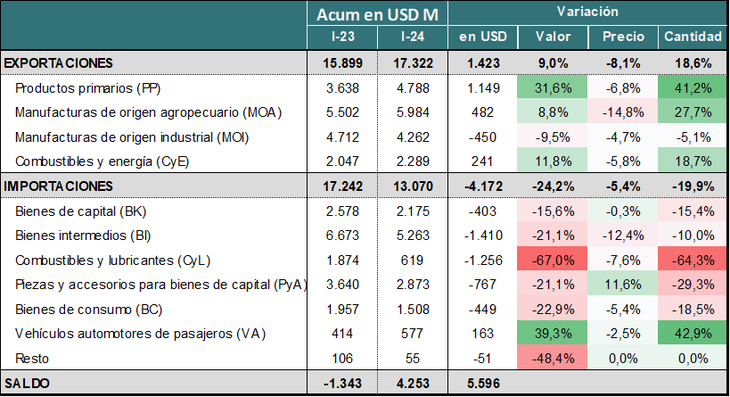

This week the data on the accrued trade balance published by INDEC was released. In March, imports of goods totaled US$4,335 million. This implies a drop in US$2,629 million compared to March of last year. Although it is true that March 2024 had fewer business days, the drop is very marked.

In the first quarter, the total drop in imports versus the average of the previous two years was US$4,536 million (-25.8%).

image.png

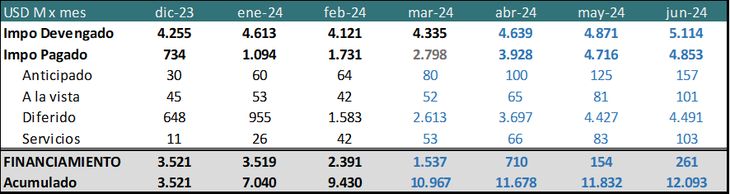

In addition, the deferred payment scheme is still in force for the payment of imports. Although it does not cover 100% of tariff positions, a high percentage is made under the 4-month payment scheme. This implies that, for imports entered in March, the last payment will be made in July.

In short, for imports two axes of analysis are opened that have to do with the absolute level and the moment in which payments are actually made.

Why are imports falling?

The devaluation jump of December 2023 was one of the most anticipated. This meant that importers reached that date with the highest level of stocks they could achieve based on current controls. The level of exchange gap exceeding 150% throughout the second part of the year invited the entry of imported products into the official dollar to be maximized as much as possible. This implied that the new exchange rate level may have been entered with high stocks of imported products.

image.png

Additionally, the forced delay in channeling payments to external suppliers complicated the operations of some companies and limited their purchasing capacity until they were able to regularize their situation.

In parallel with this, a sharp drop in domestic demand was generated as a result of a very marked deterioration in the purchasing power of households.

The combination of high stocks, difficulties paying suppliers and low sales put a natural brake on the pace of imports.

A separate analysis deserves the situation of the energy sector, which had been dragging a strong deficit and as a result of the completion of the gas pipeline works and a lower international price has implied a total saving of USD 1,256 million in the first quarter of the year, explaining almost a quarter of the improvement in the trade balance.

The level of imports for the first annualized quarter is in the order of US$52,000 million. Well below the US$78,000 million average of the last 2 years.

Probably in the coming months we will see a gradual increase in this level, especially if the real exchange rate continues to lag, but given the fall in purchasing power, for now it is unlikely that the volume of imports will recover the pace it had. This implies that the payment of imports as a factor of foreign currency demand will continue to be clearly one step below what it was in recent years. In our base scenario we are working with US$58 billion of annual importswhich would imply a monthly rhythm for the remaining 9 months in the order of US$5,000 million monthly.

For exports, however, we imagine a scenario in which they evolve above 2023, especially due to increased agricultural production and the boost in oil and gas sales. Although still with sales of industrial products that continue at a slow pace, especially due to the delay in the real exchange rate. Our base figure includes sales of US$80 billion, which would leave an accrued trade surplus of US$22,000.

And how are the supply and demand of dollars?

To understand how imports will be paid, it is necessary to analyze the current scheme of 4 consecutive monthly payments between 30 and 120 days after the product is received.

The deferred payment schemes They generate savings when they are launched and when the volume of imports increases. On the other hand, they require more foreign currency when they are dismantled and when imports have a negative trend.

Given that March has shown a very low level, possibly in the coming months we will begin to see a gradual increase in imports. This implies that the financing effect (more products entered than paid) will remain in force. Only in the second semester could it begin to balance.

image.png

Looking at these figures, two questions arise. The first has to do with what part of these imports may have been canceled through the financial dollarwhich is operating at very similar levels to importing dollar (Country Tax).

The second is to understand if at some point there is the possibility of beginning to shorten the payment period, especially if the foreign exchange supply for the second half of the year meets the expectation of an increase due to the liquidation of the heavy harvest.

Without a doubt, that will be the variable that will define the greater or lesser foreign exchange surplus. Because in the coming months the trend of BCRA currency purchase, because the positive seasonality of agricultural liquidation coincides with the still contained demand for imports. Furthermore, with payments for tourism and hoarding still strongly retracted by a card dollar that is more than $300 above the financial dollar.

The question is whether the BCRA takes advantage of the context to accumulate reserves or gradually begins to relax some of the controls that are still in force, in order to move towards a gradual exchange rate unification before the real exchange rate continues to appreciate.

Chief Economist at MegaQM.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.