ANDThe BCRA enabled the subscription of Bopreal Series III for the payment of dividends to non-resident shareholders. This operation added demand to a Bopreal subscription process that had already slowed down, with tenders that were systematically below US$100 million. The decision of companies to subscribe generates relevant impacts in both the peso market and the exchange market and becomes an additional step towards solving the problem of stocks (excess pesos and lack of dollars).

In the Bopreal Series II tender, the BCRA awarded a total of US$1,709 millionof which 96% correspond to companies that subscribed to pay profits to their non-resident shareholders.

With this award, there are only US$95 million to complete the 3 series of Bopreales by US$10,000 million that decided to place the BCRA.

This operation as a whole, with the three series, has already allowed the BCRA to reabsorb $9 billion. This figure is equivalent to one time the average Monetary Base of December 2023.

In short, it is a tool that has generated two effects, postponing the demand for dollars and withdrawing pesos from the market.

In this framework and given how quickly the quota would be filled with the transfer of pending profits, the possibility of expanding the program should not be ruled out.

image.png

Implications for the Foreign Exchange Market

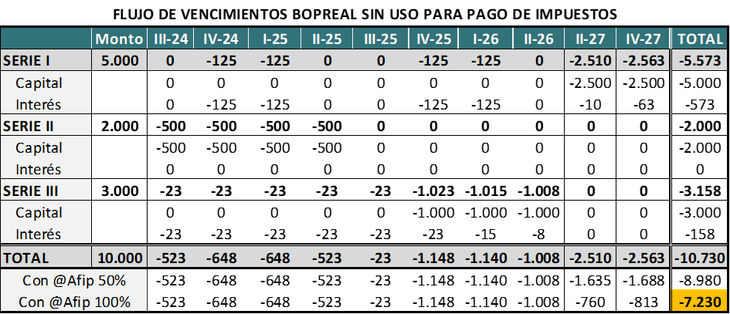

With this mechanism, the BCRA managed to postpone potential demand for dollars for almost US$10,000 million. This commitment only begins to be paid in July 2024, at a rate of US$200 million monthlywith the first significant maturity falling in November 2025.

The proposed flow leaves an important margin for the BCRA to advance with the accumulation of reserves and free itself from this potential demand, which could generate many complications in an eventual exchange rate unification process.

The cost of this issue is at an average of 3.1% annually, therefore, it is below what international reserves currently yield.

image.png

A central factor to take into account is that 70% of Series I can be applied to the payment of national taxes. This implies that the real need for foreign currency that the BCRA needs to meet these maturities falls from US$10,730 million to US$7,230 million. There are US$3.5 billion less, which will be saved in the two periods in which the flows became more negative, which was precisely at the expiration of the Series I capital installments.

From the BCRA’s perspective, these are foreign currency requirements that should be cumulative for the planned dates. But regardless of this, they imply a potential imbalance, since at maturities the BCRA will need to apply reserves without implying a reduction in the stock of pesos. Therefore, the reserve position in relation to the economy’s stock of pesos will worsen.

In the short term, the most relevant effect is given by the additional demand for both the MULC and the CCL segment that those who participate in the subscriptions are obtaining. In the specific case of the payment of dividends, the settlement of these bonds in external markets will be enabled in tranches. For the CCL, this implies more supply of bonds in dollars that will seek interested parties to buy them against dollars in external markets. This could have a short-term impact on the market value of Series III and could also generate greater support for the value of the CCL at a time when the supply of exporters under the current Blend scheme could lead to it being oversupplied.

Monetary and Fiscal Impact

The reabsorption of $9.1 trillion is an already very relevant monetary effect. Together with the liquefaction that has occurred due to negative real interest rates, they have managed to make the total supply of pesos fall very sharply.

The Treasury has also played a very important role, both with the repurchase of debt held by the BCRA and with the purchase of dollars to meet its financial obligations in foreign currency. In total, the Treasury has helped the BCRA reabsorb pesos for $10.9 billion from December to date. Therefore, the consolidated reabsorption effect of Bopreales + Tesoro is $20 billion.

In turn, Bopreal’s tenders have generated revenue for the Treasury for the collection of the Country Tax. The estimated total amount is in the order of $750,000 million.

These figures help to understand the relevance that this operation has for both the BCRA and the Treasury. The question that remains is whether or not, given the success of the last tender, the BCRA decides to expand the Emissions Program. This will be key to understanding if the peso reabsorption process is coming to an end or if they seek to expand it to reach an eventual exchange rate unification process with fewer pesos.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.