Gold is offering the best investment opportunity of the last 20 years after having surpassed very important levels.

Let’s look at the long-term graph:

Since the last low, marked in November 2022, gold has risen 48%. So it’s already gone up a lot? I wouldn’t dare say it. Because? Between 1972 and 1980, the price of gold increased more than 1,500%. From 1982 to 1985, it rose 82%. Between 2000 and 2008, its value quadrupled. In 2015, a 100% rally began that reached its peak in 2020. Investing in gold at certain times has been very profitable.

In recent decades, high confidence in credit instruments has caused the global financial system to grow enormously. However, tensions between East and West, debt overload and inflation are eroding this confidence.

And that confidence was won by gold. An example of this is explained by the latest increase. Historically, when real interest rates rose, gold tended to fall. However, now that relationship has been broken: gold set new highs in a context where real interest rates also rose.

Let us remember that the debt in the US reached USD 35 Trillion:

gold2.png

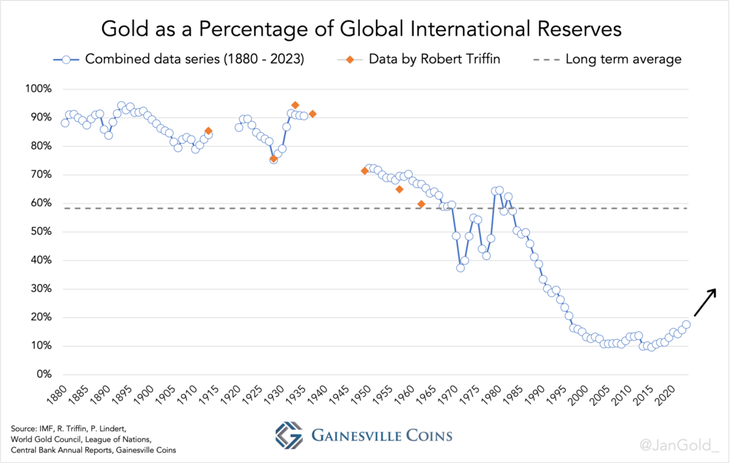

The dollar’s status as a reserve currency is declining. Historically, the classical gold standard of the 19th century backed the monetary base with gold reserves. After World War II, the use of the dollar as a reserve reduced the proportion of gold in international reserves, especially in the 1980s.

Currently, the proportion of gold in international reserves is increasing due to the loss of confidence in the dollar, influenced by the enormous growth of the US public debt, which the Federal Reserve cannot control while fighting inflation.

Let’s look at the proportion of gold in relation to total international reserves:

gold3.png

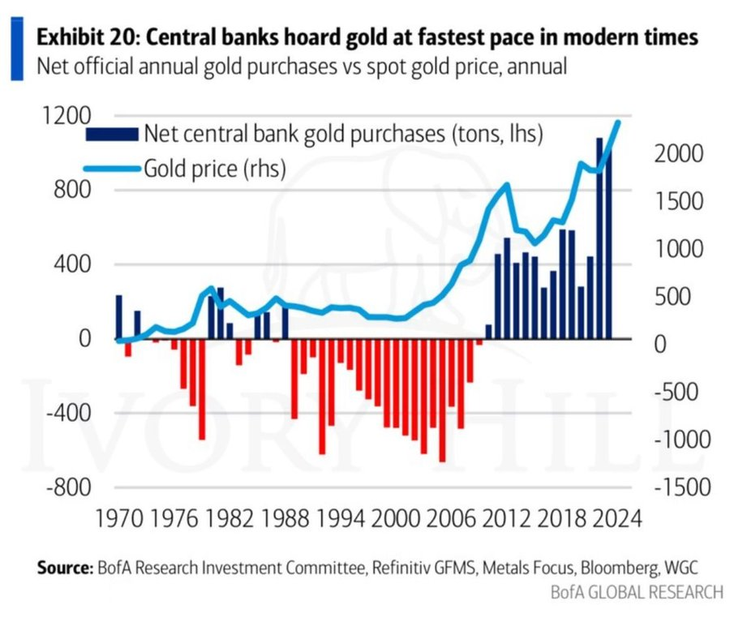

In response to this, central banks are buying record amounts of gold. In the last two years they bought more than 2,100 tons.

gold4.png

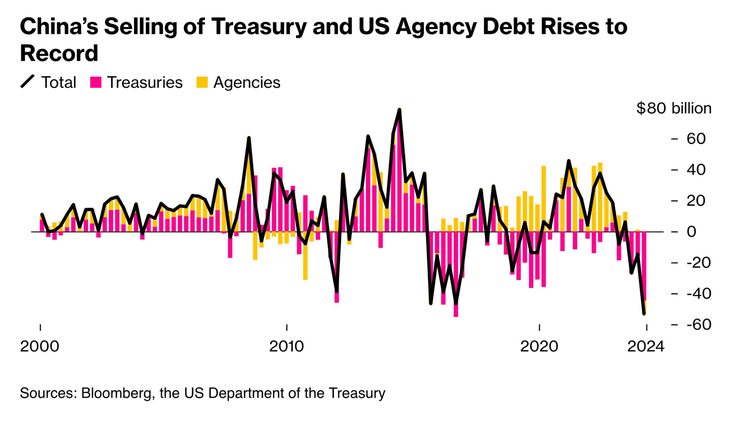

China has been the largest buyer of gold during 2023. And not only is it buying gold, but it is also dumping US bonds at record speeds:

gold5.png

With global debt levels reaching unsustainable records, inflation has become the most convenient and common way to restructure debt. Currently, global debt (governments, companies and individuals) amounts to USD 313 Trillion, equivalent to 330% of global GDP, and there are few alternatives to reduce this burden. Inflation, along with an increase in the price of gold, would help reduce the leverage of the financial system and restore its stability.

There are many signs to think that we are going through a new long-term gold bullish cycle. At the end of the day, investing is still a probabilistic activity. In fact, a year ago I commented on the good odds that gold had (https://www.ambito.com/opiniones/momento-comprar-oro-n5717028), suggesting that it was a great time to buy, in the area of USD 2,000.

Is it still a good time now that it’s already up 20% in the last year? Yes, without a doubt. Can it fall in the short term? Also. Does it have grounds to be one of the best investments in the coming years? Absolutely.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.