He copper emerges as a different alternative to capitalize on the technology revolution Artificial intelligence. What relationship is there?

The price of copper doubled after the Covid pandemic, due to increased demand for electric vehicles. It is currently rising again, pressured by demand from a new source: large data centers that drive artificial intelligence (AI).

copper 1.png

How are both concepts related? Copper and artificial intelligence (AI) are closely related due to the fundamental need for electrical infrastructure to support the operation of advanced technologies.

AI requires an enormous amount of energy to power data centers that process large volumes of information and to operate smart devices at the edge of the network.

Copper, known for its excellent electrical conductivity, is essential in the construction of cables, transformers and other electrical components that form the backbone of this infrastructure. Without an efficient and robust electrical grid, supported by copper cables, the expansion of AI will be limited.

Furthermore, with the increasing adoption of electric vehicles and charging stations, which also rely heavily on copper, demand for this metal is increasing significantly to support the expansion and continued development of AI and other emerging technologies.

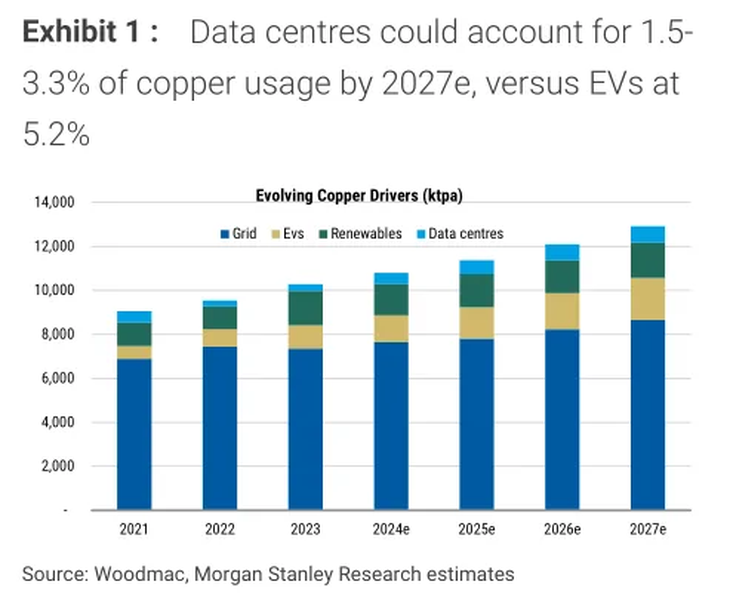

The rise of AI is driving growing demand for data centers, which will need approximately one million metric tons of copper by 2030.

In fact, it is expected that copper demand from AI data centers could account for 3.3% of global demand (for comparison, electric vehicles may account for 5.2%):

copper 2.png

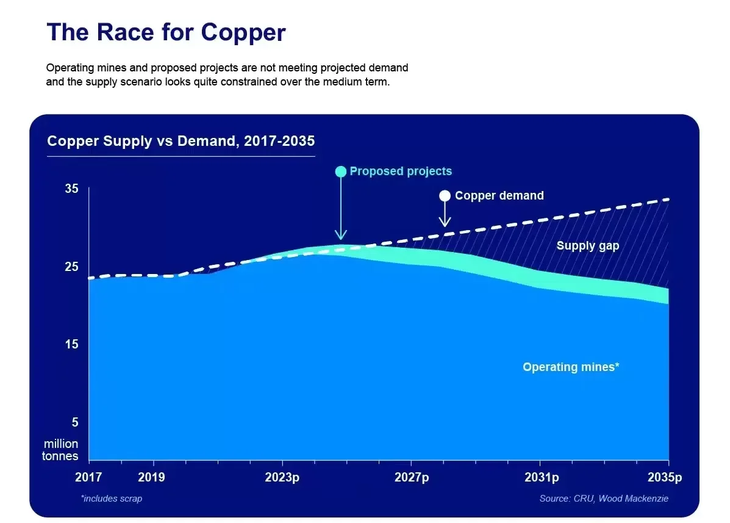

On the supply side, activity at current mines and development of new mines are not advancing fast enough to meet industry needs. Consequently, the deficit of 35,000 tonnes of copper planned for this year is expected to rise sharply to 100,000 tonnes in 2025.

The geopolitical context has also influenced the copper market. Recently, the United States and the United Kingdom banned deliveries of Russian copper, nickel and aluminum to Western metals exchanges.

As if that were not enough, the imbalance between supply and demand is expected to worsen:

copper 3.png

How can you invest in copper? There are three main ways:

- Mining Company Shares

A direct way to invest in copper is by buying shares of companies that are dedicated to its extraction and production. Some of the largest and best-known mining companies that have significant exposure to copper are:

- Southern Copper Corporation (SCCO): It is the largest copper miner in the world, with a Market Cap of USD 92,000M. It operates in Mexico and Peru.

- Freeport-McMoRan Inc. (FCX): It is one of the largest copper producers in the world, with a Market Cap of USD 88,000M. It operates in North America, South America, Africa and Asia.

- Copper ETFs

ETFs (Exchange-Traded Funds) offer a simple way to gain exposure to the price of copper without having to directly purchase individual shares of companies. An example is the Global X Copper Miners ETF (COPX), which includes 40 mining companies.

Futures contracts offer the most efficient way to gain exposure to copper, but require additional complexity due to the associated risks.

All the ingredients are in place for this mineral to be a great investment for years to come. As always, we must follow what the prices do, which, for now, indicate that copper is an interesting opportunity.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.