Any introductory economics course highlights the importance of any government administration respecting its intertemporal budget constraint, basically that your income trajectory is compatible with your expense trajectory in the short and medium term. This is in order to not lose credibility in the main monetary and fiscal policy instruments that Governments have in the different scenarios of economic activity and not compromise the sustainability of the debt by maintaining adequate levels of public credit.

However, faced with a state that has guaranteed an important floor of rights – a universal minimum benefit, child protection programs such as the AUH, the implementation of public works in the 23 provinces, the contribution to financing of education and health in the provinces, Public Higher University Education, among others – any change in the provision of these public goods and services ends up altering what in economics is known as the Social Welfare.

After the first full quarter of 2024, We can say that the cash flow numbers of Javier Milei’s Government “closed”. The National Non-Financial Public Sector (SPNNF) consolidated a financial surplus of $1.1 trillion thanks to a drop of around 32% in primary public spending.

However, The political and transformational inability of the LLA Government made it impossible for it to carry out fundamental reforms that would improve income. of the State (both in quantity and quality) or being able to reduce its size by reducing spending in a “healthy” way. Even so, following the precept established in any economics manual, the decision was to move towards a fiscal surplus regardless of the forms or consequences.

Government improvised an adjustment that, far from falling on the “caste”, hit the income of the majority of Argentines and induced one of the worst recessions in history.

Regarding the contraction in the level of public spending, The 32% adjustment during the first quarter of 2024 is unprecedentedmore than duplicates any fiscal adjustment attempt in recent years, including those where the government’s stated goal was the so-called “zero deficit.”

santiago perez pons.jpg

There is no doubt that the reduction of a third of public spending in just 4 months is something historic. Spending on retirements and pensions, public works and transfers to provinces contributed more than 70% of the total adjustment.

santiago perez pons 2.jpg

Translating the numbers into reality, most of the adjustment was paid by extremely sensitive sectors whose income levels depended largely on the presence of the National Government.

The effects on the real economy were immediate. Starting in December, Consumption capacities were repressed by more than 20% across the board from one month to the next and triggered collapses in all sectors of economic activity – construction (-42.2%), industry (-21.2%), commerce (-16.7%), among the main ones and with the greatest demand for labor – which They directly impact the collection of central taxes for SPNNF income such as VAT, check tax, social security contributions, among others.

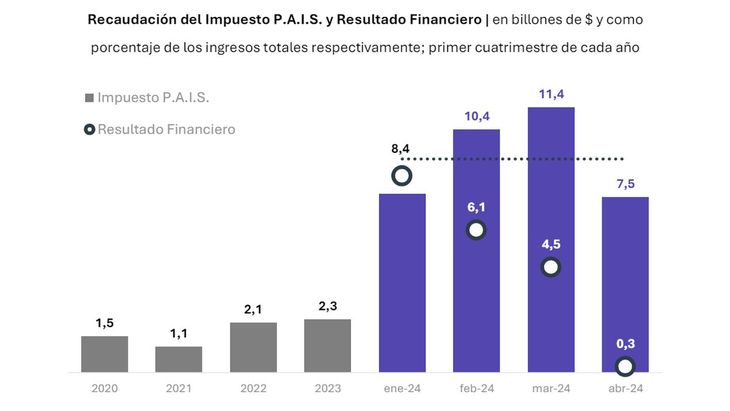

Despite the recessionary effects, the government managed to sustain Public Sector income, thanks to the devaluation jump, which generated a positive effect on revenue linked to the exchange rate (withholdings on exports and import duties), and a regulatory tightening. via uploads of PAIS tax on importers that almost quadruples their 2023 collection.

Paradoxically The self-proclaimed libertarian government saves its fiscal surplus by intervening in the market and raising distorting taxes. Specifically, SPNNF income showed a real year-on-year drop of 4.8% in these 4 months, in the same period that internal collection fell 16.8%.

santiago perez pons 3.jpg

Although the president boasts of having implemented the largest structural reforms in history, today’s reality is different. The surplus achieved is full of sloppiness and lacks true sustainability. Instead of achieving a profound transformation, we can affirm that today we have the same imperfect State, but totally disjointed, abandoned and functioning even more poorly.

The method, or rather, the lack of method, is evident in the way in which this excessive adjustment was carried out without sustainability criteria, of which the consequences are now beginning to manifest. Public opinion and the social impact of the adjustment have raised numerous alarms in the last two months

The excessive liquefaction of retirement assets generated great discomfort in public opinion, leading the government to try to alleviate it with a new mobility formula via inflationary indexation which, however, does not solve the underlying problem and will leave assets stagnant at levels around 20% higher. lower than 2023.

The cuts to public universities and the official discourse against him unleashed one of the largest social mobilizations in recent years. Also, the defunding of the provinces They have strained the relationship between the national government and the governors, compromising the advancement of the Bases law and any type of reform that the executive wants to carry out. The payment hurdle of the subsidies, that put the functioning of the energy system in check, increased the stock of debt with the generators above the fiscal surplus achieved in the 4 months, harming Argentines not only with rate increases, but also with a worse provision of services. These are just a few examples of how the government is beginning to suffer the consequences of its own negligence.

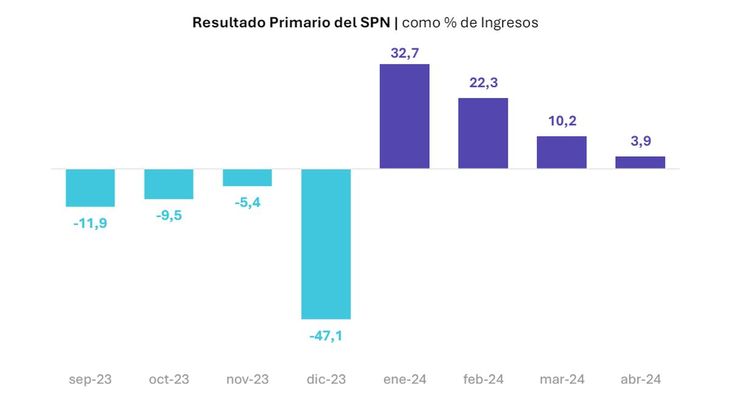

All of this has limited the levels of adjustment on spending and has begun to dilute the achievements obtained in the first months of the year. Public spending, which initially fell 38% year-on-year in the first two months, now only falls 23%, demonstrating the lack of consistency and sustainability of fiscal policy.

santiago perez pons 4.jpg

At the same time that income does not cooperate either, the persistence of the economic recession and the delay in the restoration of the fourth category of profits place the fiscal surplus in a delicate situation, reducing drastically towards the month of April.

santiago perez pons 5.jpg

It is essential to understand that convergence to a medium-term fiscal balance is a necessary but not sufficient condition for sustainable economic development, with a State that maintains a significant role in the economy and whose economic policies have a positive effect on social well-being. The “form” that the current government gave to the fiscal adjustment is extremely costly for the economyas has been reflected month after month in most of the indicators. Instead of obsessing over a number in the accounting books, the real challenge lies in implementing structural measures that allow for efficient and effective tax management. Thus, real fiscal convergence will be promoted, based on deep and sustainable reforms that promote productive investment and long-term social well-being.

Economist

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.