Strictly speaking, lowering inflation has now become an almost imperative condition for the Government, which assigns it a top priority to maintain firmness in its social support base. Indeed, official data suggest that it is slowing down, mainly due to the collapse of the core component.

Specifically, success in the disinflationary program may be enough to sustain the electoral base for a time, but financial markets now also seem to demand political achievements that make the fiscal path and the deregulation of the economy more durable. The greater tension in this field has put on pause the recovery of Argentine assets, after the great boost received in recent months by a monetary and fiscal adjustment without precedent in Argentine economic policy.

Sovereign bonds in dollars win the Peso Race in the first stage of the year, followed by long CER Bonds

Return by type of asset, in PESOS, according to period.

image.png

Source: Criteria. Estimated returns as of 7/6/24.

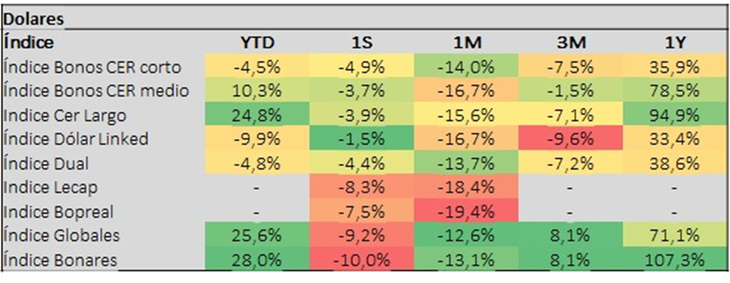

The Globales and Bonares generate a capital gain of almost 30% in dollars in 2024

Return by asset type, in USD, according to period.

image.png

Source: Criteria. Estimated returns as of 7/6/24.

As can be seen in the first table, the sovereign bonds in dollarsmeasured in pesos, continue to win the weight race so far in 2024. Very close behind, completing the podium are the long-term bonds that adjust by CERwith a performance of almost 70% in the first five months of the year.

Although all of them lose against inflation, which accumulated more than 115% in the period, at least these two groups of bonds have been able to generate positive returns in dollars.

The bond boost Bonares and Global It is largely due to the recovery of their dollar values so far this year. The gain has been 25.6% and 28%, respectively. There was, yes, a stumble in the last month, when these instruments – a thermometer of long-term investor appetite – saw their recovery interrupted and even suffered falls close to 10%.

The other participants of the Weight Race, bonds that adjust by CER of the short section, Duales and Linked dollar have had a much more modest return of between 22 and 29%, well below inflation and the MEP. That is, to sustain the loss in value of the Peso it was only possible to assume risks by taking the longest-term (most volatile) options available.

LECAPS, a new member in the Weight Race

Recently, a new instrument has been incorporated into the weight race. In the attempt to rebuild the balance sheet of the Central Bank, the Government, in addition to completely eliminating the financing of the Treasury deficit via the issuance of pesos, has offered new Capitalizable Treasury Bills, with strong regulatory and rate incentives for banks. These bills have gained notoriety and have formed, until now absent in our market, a fixed rate curve in pesos.

Strictly speaking, LECAPS are financial instruments issued by the Treasury, designed to offer a fixed return in a certain period, generally short-term. Today they yield between 3.2% and 4.2% monthly, which, although they are below inflation levels, become a superior alternative to other instruments such as fixed-term or surety bonds.

How does the Weight Race continue?

Outline a new exchange and monetary regime by the government emerges as a necessary condition to complement the task carried out until now. This is in view of eliminating the exchange regulations imposed by the stocks, which in practice discourage investments and hurt economic growth.

While the BCRA improves its level of reserves by purchasing more than USD 17,000 million in the market since the devaluation, it continues on its path of drying up the peso market with surpluses and debt placements above its needs that it then deposits in the BCRA, canceling its circulation as long as the fiscal commitment is sustained. This, added to the drop in the interest rate, reduces in real terms the amount of money and the remunerated liabilities of the BCRA in pesos, contributing to rebuilding the value of the currency.

Getting out of the stocks, a possible alternative?

The accumulation of reserves is a necessary condition to get out of the stocks, especially while going through the high foreign exchange settlement season. The amount of reserves needed for departure will depend largely on the government’s intentions the day after. If the goal is to stabilize the value of the dollar in a certain nominal range, greater firepower (reserves) will be needed. However, this need will be less to the extent that the enemy’s ammunition (amount of pesos in circulation) is reduced.

Dollar exchange rate.jpg

Having eliminated the financing of the Treasury deficit as the main source of issuance, with a healthy BCRA and prohibited from issuing, a fair “currency competition” proposed by President Milei. In this sense, it is expected that the BCRA will formalize a new scheme where the current interest rate becomes positive in real terms, helping to rebuild the demand for pesos.

But at all times, the center of the program remains a good execution of the fiscal adjustment, something that is clearly challenging in a context of social and political vulnerability, and with growing doubts about support for its implementation by Congress. Putting the disinflation path – the Government’s main support anchor – at risk could have negative consequences for the program. On the other hand, to the extent that fiscal and monetary signals allow expectations to be anchored, and society together with investors perceive the benign effects of the program, disinflation and growth, it will become sustainable.

Beyond the recent nervousness in the market, we believe that devaluation expectations will remain contained and the BCRA will continue with the monthly devaluation of the official exchange rate around 2%, and the process of lowering inflation will allow obtaining records below of market expectations expressed in the yield curves and the REM survey.

In this context, The new Lecap with a fixed rate should be the predominant instrument in the portfolio of those seeking to maximize the return on their working capital or liquidity pesos.

For longer term positions, In order to benefit from the sovereign’s credit improvement, we see still attractive opportunities in dollar bonds maturing in 2035 and 2041.

Director Asset Management of Criteria.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.