The energy sector has had a good year, but there are certain companies that have had spectacular returns. Here I tell you which ones they are.

I want to start by showing the XLE, the leading US Energy ETF:

It has returned 9.7% so far this year. Although it is worth noting that it is highly concentrated in just two stocks: Exxon Mobil and Chevron represent 41% of the fund. And 10 companies account for 75%.

How is XLE composed?

Let’s see:

energy2.png

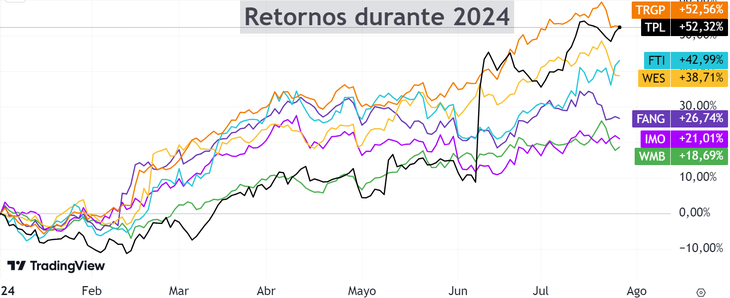

Outside of this Energy ETF, there were other stocks that stood out. The ranking is made up of companies with a market capitalization (Market Cap) of more than US$ 10,000M.

Let’s see what they are:

energy3.png

- Targa Resources Corp. (TRGP) – Midstream Oil & Gas: +52.6%

Targa Resources has had an exceptional year, with a return of 52.6%. The company focuses on logistics and natural gas processing, and has been able to capitalize on the increase in demand for clean energy. It has a market cap of US$ 29.2 billion.

- Texas Pacific Land Corporation (TPL) – Oil and gas exploration and production: +57.4%

Texas Pacific Land Corporation tops our list with an impressive 57.4% year-to-date return. TPL is primarily engaged in land management and sales, as well as natural resource exploitation in Texas. It has a Market Cap of $18.8B.

- TechnipFMC (FTI) – Oil & Gas Equipment & Services: +43%

With a 43% return, TechnipFMC completes the podium. This oil and gas services company has continuously innovated in production technology and expanded its global presence, resulting in strong sales growth. It has a market cap of US$ 12.5 billion.

- Western Midstream Partners (WES) – Midstream Oil & Gas: +38.7%

Western Midstream Partners has achieved a remarkable 38.7% in the year. It is dedicated to the business of gathering and processing natural gas, condensate, natural gas liquids and crude oil. It has a Market Cap of US$ 15.3 billion.

- Diamondback Energy (FANG) – Oil and gas exploration and production: +26.7%

Diamondback Energy has seen its shares grow by 26.7% this year. The company is engaged in oil and gas exploration and production in Texas. Its focus on cost reduction and production optimization was key. It has a Market Cap of US$ 35.8 billion.

- Imperial Oil (IMO) – Oil and gas integrated: +21%

Imperial Oil has recorded a 21% growth in 2024. This Canadian oil and gas company has benefited from the stability and growth of the energy market in Canada. It has a Market Cap of US$ 37.9 billion.

- Williams Companies (WMB) – Midstream Oil & Gas: 18.7%

Williams Companies, with a yield of 18.7%, is primarily engaged in the transportation and processing of natural gas. The company has invested significantly in infrastructure and sustainable projects. It has a Market Cap of US$51.3 billion.

And how did oil fare?

energy4.png

The reality is that, despite having had a positive year, at the moment it seems very uncertain.

The interesting thing is that there are always stocks that are on an upward trend, just like all those in the ranking. Imagine the performance these companies could have if the price of oil starts to rise sharply. Without a doubt, they are a great opportunity.

If you want to know more about investments, I invite you to visit our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be construed in any way as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents only the opinion of the author. In all cases it is advisable to seek professional advice before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.