Since July 16, the S&P 500 has lost $3 trillion in market capitalization amid record volatility and a market deeply concerned about signs of recession.

Volatility, as measured by the VIX, hit a record for the past year and a half:

syp2.png

In addition, manufacturing activity data came in very weakly and unemployment rose to 4.3%, when 4.1% was expected. This created a lot of fear in the market due to a possible recession and, consequently, interest rates fell sharply, amid a very violent fall in stocks.

However, MercadoLibre experienced a different reality. It presented its balance sheet with spectacular figures and seems to be oblivious to all this loss.

Sales continued to grow, reaching $5.1 billion, marking a 42% increase compared to the previous year. Net profits increased by 103%, reaching $531 million, with a margin of 10.5%, the highest recorded in the last eight years.

How are sales distributed in different countries? Brazil leads with US$2.786M, coming from its Ecommerce business (US$1.701M) and Fintech (US$1.085M). This country continues to be the main market for MercadoLibre, showing a clear advantage over the others.

Mexico ranks second with US$1.201M in sales, distributed between Ecommerce (US$799M) and Fintech (US$402M). For its part, Argentina contributes US$863M, where the digital wallet represents the largest part with US$556M, compared to the US$307M generated by the marketplace.

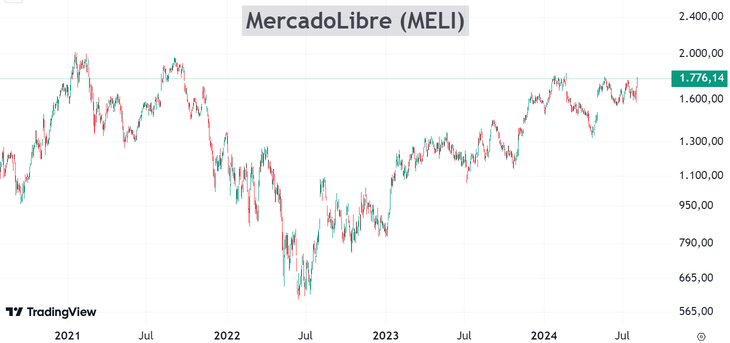

These figures exceeded market expectations, which is why the shares rose by 10% the following day:

syp3.png

In a week where technology companies suffered record falls, MercadoLibre emerged unscathed with an incredible balance sheet, which positions it as the most valuable company in Latin America.

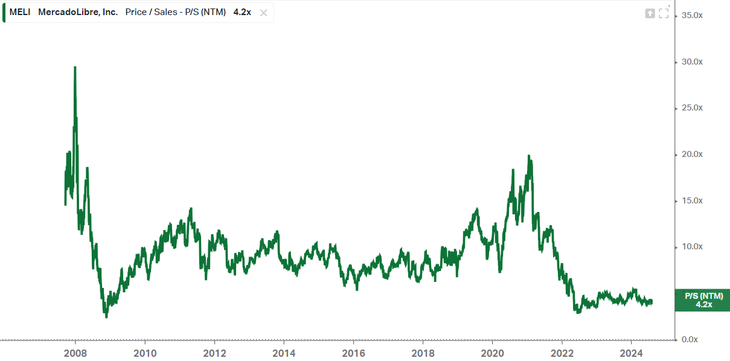

Even though it rose sharply, is it still an opportunity? Let’s look at the Price-to-sales ratio:

syp4.png

Currently, Mercado Libre’s Price-to-Sales (P/S) is 4.2, a figure lower than it had in January 2023 (4.5). Despite the increase of more than 50% in its share price, the company’s valuation is more attractive now (“cheaper”) compared to January 2023, given that sales grew even more

Looking back, buying MercadoLibre shares for the long term in early 2021 would have been a big mistake, when the stock surpassed $2,000. Because? Because, even though the trend was clearly bullish, its P/S was 20, a completely high level.

Now the situation is different: its price has risen considerably, but its valuation is close to the lowest levels in its history. That is why it remains a great opportunity, and even more so after the balance sheet it presented. Are there risks? Yes, of course. The context is not the most friendly, especially for technology companies. So, be careful.

If you want to know more about investments, I invite you to visit our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be construed in any way as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents only the opinion of the author. In all cases it is advisable to seek professional advice before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.