According to the report accessed Energy Reportsodium carbonate (Na2CO3) is used in the process of extracting and purifying lithium from mineral sources (“carbonate process”).”), which involves the conversion of lithium ore into lithium carbonate, which is a more soluble and easily processable chemical form.

Sodium carbonate reacts with the lithium brineresulting in the formation of lithium carbonate (Li2CO3), which precipitates as a solid. This lithium carbonate is then separated and subjected to further purification processes.

Once obtained the lithium carbonate -or purified lithium hydroxide- is used as a raw material for the manufacture of intermediate products, such as cathode and anode materials, electrolytes and other components of the famous “lithium ion batteries”.

image.png

These intermediate products are crucial for the production of batteries and other electronic devices that use lithium as a power source, such as mobile phones, laptops, electric vehicles, energy storage systems and medical devices, among others.

Who is the world’s largest producer of “soda ash”?

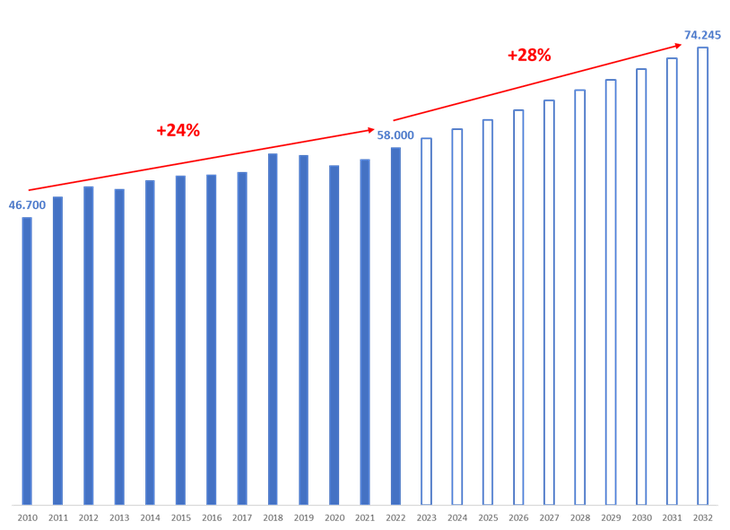

Globally, 58 million tons of carbon were produced in 2022. “soda ash”a global historical record. Of that total, 30% is natural sodium carbonate and the other 70% is synthetic.

The United States is the world’s largest producer of natural sodium carbonate.: In 2022, the United States produced 11 million metric tons. Of this total, it consumed 4.6 million tons in its territory, for which it also used 100,000 imported tons. The remaining balance (about 6.5 million tons) was mostly exported to the rest of the world. In fact, the United States imports glass containers from Mexico and Asia (on average cheaper than its own production) and therefore a large part of its soda ash supply is available for sale abroad (in particular, to glass factories).

Soda ash sodium carbonate

The natural sodium carbonate market in the United States has as its main competitors the Chinese synthetic sodium carbonate industry. But it also competes with a “ghost” market: China may also have the largest reserves of natural sodium carbonate in the world, a figure that has not yet been properly measured and quantified.

For now, the Chinese are at a disadvantage: According to Ramirez, the manufacturing process in synthetic plants requires more energy from an economic point of view than natural trona mining.

Another challenge for American companies is Turkish production, which has the fourth largest natural reserves, after China (if confirmed), the United States and Botswana. This input for the lithium chain is so fundamental that by 2032 production is estimated to grow by up to 28%, which would mean reaching 74 million tons of lithium. “soda ash” worldwide.

Considering that in 2022 they were sold globally US$12.7 billion of “soda ash”and according to estimates from specialized consulting firms, by 2032 that amount would rise to US$21.6 billionwith an average growth rate of 6% per year.

The reasons for the growth in global demand for “soda ash”

According to the private report, the drivers of the increase in demand for “soda ash” They will be most widely used in the manufacture of products such as flat glass (automotive and construction), soda silica glass and glass containers (food and beverages), lithium batteries for electromobility and in detergents.

Projections indicate that global demand for lithium batteries would grow from 700 GWh in 2022 to 4.7 TWh in 2030, with the majority of this coming from batteries for electric vehicles, which would require 4.3 GWh by 2030.

image.png

Data and projection of world production of sodium carbonate or “soda ash” between 2010 and 2032.

What are the main soda ash producing companies?

The company Tata Chemicals It is the world’s third largest producer of sodium carbonate. Its operations in the US and Kenya benefit from natural trona deposits, which allow it to have low conversion costs.

Another company is the Indian chemical company DCW, Genesis Energy, Novacap Group, JM Lover Ridge and Nirmawhich with the acquisition of Searles Valley Minerals increased its sodium carbonate production capacity to 1.9 million tonnes per year, making it the world’s seventh largest producer.

They also produce “soda ash” the firm Ciner Groupwhich is among the world’s three largest producers of natural sodium carbonate, which it controls WE Soda; CIECH SAwhich is the second largest producer of sodium carbonate in Europe, with installed capacity for 2.6 million tons in its plants in Poland, Germany and Romania; and Shandong Haihua Groupthe leading sodium carbonate production company in China.

Soda ash sodium carbonate Tronox factory

Finally, another of the giants of the sector is Tronox Limited, which has a global share of 28% in production and the capacity to produce around 4 million tons of sodium carbonate per year.

Who produces “soda ash” in Argentina?

Ramírez assured that Argentina has scarce mineral concentrations of trona, from which natural sodium carbonate could be obtained and warned that currently “There are currently not enough reserves identified to meet local demand.”

However, Argentina has historically had a significant presence in the production of artificial sodium carbonate since 2005, when the company began producing Alkalis of Patagonia (Alpat). At the beginning, it only supplied the local glass industry and other sectors, but did not focus on lithium, which require this chemical input.

Today Alpat is the only producer of sodium carbonate in South America. Its plant is located in Punta Delgado, 2.5 km from San Antonio Oeste, in Río Negro, and has the capacity to produce 250,000 tons per year. By using the ammonia-soda process, the product known as “soda ash” It also received the alternative name of “Solvay soda”.

Alpat lithium plant San Antonio Oeste.jpg

The company belongs to the Indalo Group since 2006 and currently employs 448 people directly and 600 indirectly, distributed between the plant in San Antonio Oeste, an administrative headquarters in the Autonomous City of Buenos Aires, a quarry and crushing plant in Aguada Cecilio (also in Río Negro) and the “El Gualicho” salt mine, from which it obtains its raw materials.

Currently, the plant is designed to produce annually 250,000 tons of “soda ash” at a rate of 771 tons per day. But in 2023, Alpat announced a Strategic investment plan of US$250 million to expand its production capacity to meet the increased demand in the lithium chain.

These improvements and investment plan aim to increase production to 250,000 sustained tons per year, and then, in 2027, make another investment to increase production to 550,000 tons per year.

alpat.jpg

While until now most of the production of Alpat Although lithium is destined for the glass industry, a strong rise in domestic demand for battery-grade lithium carbonate is expected in the future. “As projects that are in the start-up phase (construction, expansion, etc.) are incorporated into lithium production, the consumption of soda ash will increase significantly, so the demand for lithium will be the main driver of this consumption,” highlighted the study to which this medium had access.

In fact, according to the economist’s estimates, the expansion of the extraction, processing and eventual subsequent transformation of lithium in Argentina allows us to estimate that The country could import around US$120 million of sodium carbonate annually in the next ten yearsif the current national production of is not increased 250,000 tons.

What is the cost of the “soda ash” in the production of lithium carbonate

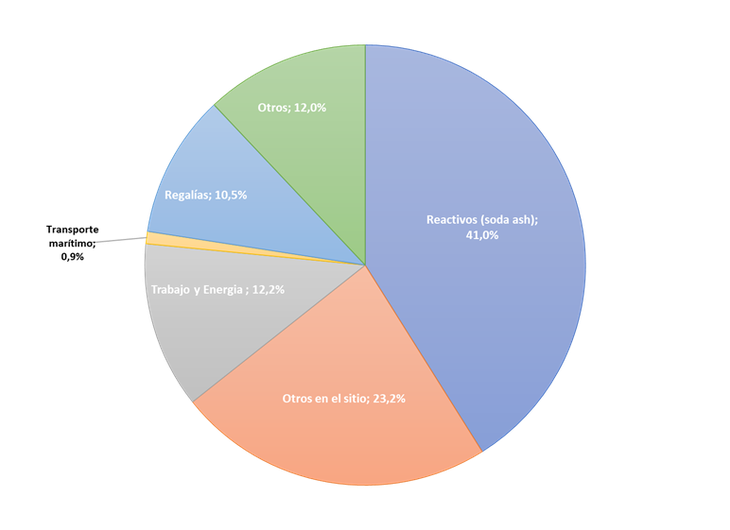

Capital costs for the production of lithium carbonate from brine in Argentina stabilized around US$4,000 per tonne of lithium carbonate equivalent (LCE). But according to sectoral research from 2023, the main cost is that of reagents, with more than 40% of the total, which corresponds to US$1,918.35 for that ton. Therefore, the “soda ash” It is one of the main capital expenditures for lithium brine projects, both in Argentina and worldwide.

image.png

Composition of lithium brine production expenditure for Argentina in 2023.

Yes ok Alpat It is far from the salt flats of the NOA, one of the advantages of having a national plant is that the product reaches the processing plants in the shortest possible time, taking into account that it is a highly hygroscopic compound (it absorbs water) and its purity decreases very quickly.

But at the same time, the possibility of producing sodium carbonate domestically favors a process of import substitution, with the aim of reducing costs in the lithium and glass sector value chains.

How many tons of “soda ash” are imported into Argentina?

From 2016 to 2023 only Lithium mining imported 600,000 tons41% of the total imports of this chemical compound. Purchases from abroad were made at an average price US$350 per ton. The country’s main global suppliers are ANSAC and Solvay.

“Based on a theoretical chemical analysis, 1.4 tons of soda ash are required to obtain one ton of LCE. Thus, during the period 2016-2022, on average, about 2 tons of soda ash were used for each ton of LCE produced,” highlighted the analytical work.

Soda ash sodium carbonate

In recent years due to the pandemic and the war between Russia and Ukraine, the implicit price of The imported ton grew by US$260 in 2018 to US$485 in 2023, This meant an increase of 86.2%, generating an increase in the cost of the supply chain and more foreign currency outflow from the country. In addition, according to the regulations in force in the country since 2007, imported sodium carbonate must pay a 9% tariff, which cannot be reimbursed when the processed product is exported.

Among the six main importers of the chemical input are three mining companies and three glass producers: The six concentrate 80% of external purchasesThe remaining 20% of imports are distributed among 27 companies.

How much will lithium production grow and how much “soda ash” It is necessary

For the next five years it is estimated that national production of lithium carbonate could reach the 200,000 tons of LCE, 373% more than current values, with only three projects in production (Olaroz and Phoenixfrom Arcadium Lithium, and Caucharí-Olarozfrom Minera EXAR) and a fourth to start commercial activity (Centenary Micefrom Eramine South America).

But if the expansions and new lithium projects are carried out, only in Argentina would they be consumed 1,000,000 tons of soda ash per yearwhile consumption at a regional level (Brazil, Chile and Peru combined) demand would triple to 3,000,000 tonsdriven mainly by the Brazilian industrial hub that only consumes 1.5 million annually.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.