The brand new Agency Collection and Customs Control (ARCA) reported this Friday that the collection Tax revenue climbed to $12.8 billion in October, which marked a real decrease of around 2.4%, compared to the same month in 2023. In this way, in nominal terms the collection It rose 186.2%, against an estimated inflation for the period of 193%.

The result was influenced by new special money laundering tax and a strong improvement of VAT, which would have been just 0.4% compared to last year. The Income Tax, meanwhile, had a decrease of around 20% in real terms.

ARCA reported regarding the tax for the regularization of assets that “$252,778 million were collected by this regime.” It is worth remembering that last month it was found in force adhering to the regime and entering the advance payment of no less than 75% of the Special Tax of Regularization.

ark.jpeg

In that sense, on the side of the moratorium, the organization indicated that “$310,936 million were collected in the month corresponding to payments on account, cash payments for October and membership fees for August and September.” Also the Special Regime for the Entry of Personal Property (REIBP) contributed another $137,708 million.

Regarding the usual taxes, The VAT collected $4.38 billion and had a nominal interannual variation of 188.9%. He VAT Tax increased 194.5%while the Customs VAT increased by 182%. The component of the tax that is directly linked to consumption would have been equal to last year’s collection, when discounting the effect of accumulated inflation, which would be 193% based on estimates from the Libertad y Progreso Foundation.

In the case of the Tax on Profits were raised $2.2 billion which represents a nominal increase of 132.7%. ARCA stated that “this month the exceptional update of deductions and scales for the fourth categorybased on the variation of the CPI for the period June-August 2024″.

Regarding the Tax ons Bank Debits and Credits, generated $951,252 million, lor that marked a nominal increase of 169.1%, while the Social Security deposited $2.8 billion into the treasury with an increase of 221%. Of them, $1 billion came from personal contributions and $1.7 from employer contributions.

On the foreign trade side, the Export duties collected $575,606 millionwith a nominal increase of 384%, while the tariffs of imports left $422,664 million, with a nominal increase of 173.1%. The Tax PAIS generated $393,825 with a nominal improvement of 67%.

As for the Personal Property Tax, ARCA recorded receipts of $229,038 millionwhich indicated a nominal growth of 145.2%.

The view of the consultants

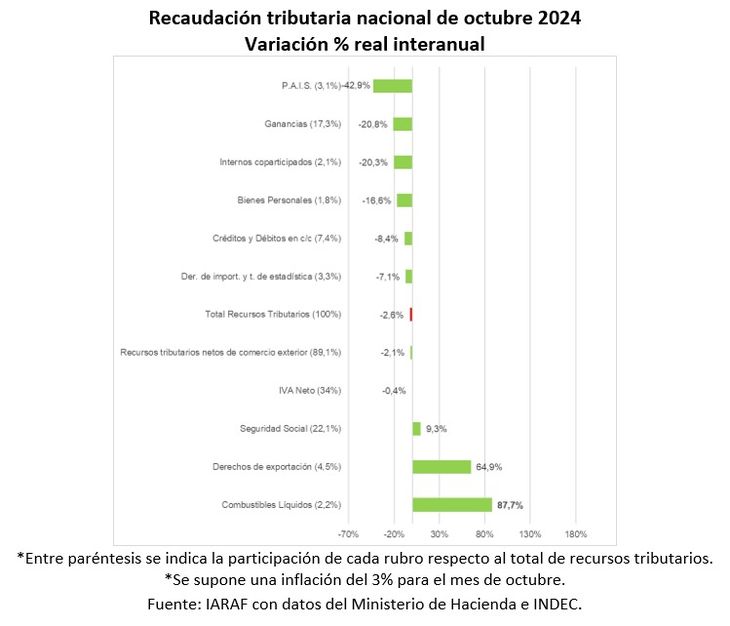

According to the Argentine Institute of Fiscal Analysis (IARAF)In October, national tax collection would have decreased by 3% in real terms year-on-year. “If extra income from moratorium, Personal Assets and money laundering are excluded, the drop would have been 8%,” the entity points out.

The participation of theExtra income due to moratorium, personal assets and money laundering in tax collection was 5.5%, what in terms ofGDP would be equivalent to 0.12%.

iaraf-reca-oct.jpeg

“As far as the inextra income from Personal Property, it is relevant to mention that part of what is collected now will no longer be collected in the coming years, being an advance payment of income, with its financial impact for both the Nation and the provinces in this year 2024. Through this special regime, $1,018,000 million (0.18% of GDP) entered between September and October,” the private analysis indicates. .

According to the report, the collection that would have increased the most in real terms It would be the fuel tax with 87.7%, followed by export duties (65%) and Social Security (+9.3%).

For the third time this year, The real monthly collection of the PAIS tax decreased in year-on-year terms, with a drop of 43%. It is important to remember that, Starting in October of this year, the interannual comparison of the PAIS tax will be under the same level of tax burdendue to the reduction of the rate on the import of goods from 17.5% to 7.5%. VAT collection improved its performance compared to previous months, remaining practically constant compared to October 2023.

At the far end, The collection that would have fallen the most would be the PAIS tax, followed by Profits with 20.8% and Internal co-participation with 20.3%.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.