He HSBC Bank analyzed the situation of the Argentine macroeconomy in its latest report, in which it ruled out a prompt dismantling of exchange restrictions and warned of some possible turbulence on the horizon for the economic plan, although it also applauded the measures of the Executive and He was “surprised” by the stabilization in such a short time.

The report is known after President Javier Milei promised that, if the good trend continues for two more months and the “1% crawling peg” and, if it is maintained for three months at that percentage, “We will proceed to free the exchange market and eliminate the stocks“.

“Positive data helps stabilization”

The Hong Kong bank’s document is titled “Positive surprises help stabilization.” It stands out that inflation decreased, which allowed the Central Bank (BCRA) cut rates. In this context, it recognizes that the net foreign exchange reserve position, although still negative, “evolved better than expected“.

The “Midweek” of Econviews points out, for its part, that the Central accumulates purchases for more than US$800 million in November. “With the expectation that the stocks will continue and crawling will decreasethe dynamics of the external sector changed,” he says.

However, the HSBC is conclusive by stating that he hopes that “most currency controls persist. “We expect an uneven recovery in economic activity, with the primary sectors as the clear leaders towards 2025,” he adds.

Dollar stocks

“We hope that the Government will continue with a gradual easing of exchange restrictions in the coming months, but we anticipate that some of these measures will remain throughout 2025, probably until the midterm elections in October,” the report concludes..

HSBC2.jpeg

Likewise, he assures that there are no indications that the Government will eliminate the obligation for exporters to sell foreign currency in the short term. “We also believe that Importers will continue to be limited in their foreign currency purchaseswhich they can currently do a month after imports,” he says.

Therefore, consider that limits on dividend payments and retail currency purchases likely to remain through the official market, in the short term.

About the rhythm of the “crawling peg”

There are indications that the Government could reduce the current monthly devaluation rate of 2% against the dollar in the coming months, but for the bank “what happens next is still uncertain“. It happens that, to lower the “crawling peg” to 0%, reserves would be required in case of need for intervention, and, for the bank, on that side, it is weak.

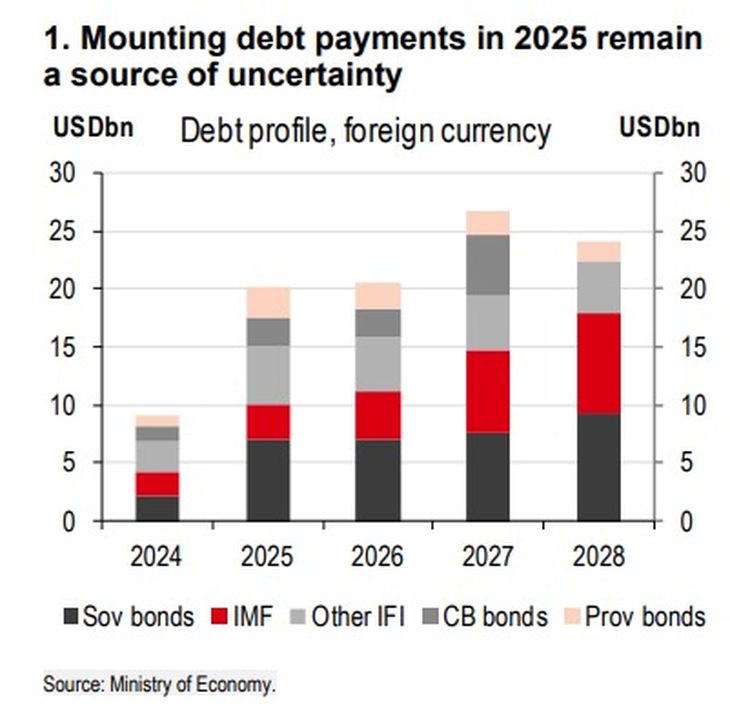

He explains that the level of foreign exchange reserves is a concern given the amount of debt payments that will be made in 2025, Argentina’s lack of access to debt markets currently and the perception that, “At the current level of the exchange rate, local residents would buy foreign currency if they were allowed. These factors also represent constraints to eliminating most foreign exchange controls.“, that is, the stocks.

However, the document also highlights that “Argentina will be able to advance, even with exchange controls“Well, the Hong Kong giant expects an improvement in the trade surplusdespite the fact that the recovery of economic activity will increase imports and the deficit in services (mainly tourism and freight). That said, real exchange rate appreciation may have long-term constraints on the trade balance.

HSBC1.jpeg

The bank also assumes that a new agreement with the International Monetary Fund (IMF) will allow the refinancing of upcoming obligations, similar to agreements already reached with other multilateral institutions. And that the government “access financial markets through a repurchase agreement and potentially refinance second half 2025 obligations“. They also assume that the provinces will be able to refinance part of their upcoming obligations. “We expect an improvement in gross foreign exchange reserves, with net foreign exchange reserves probably close to zero,” they anticipate.

What are the risks?

The financial institution states that the risks to the current economic plan “they are considerable”. In the first instance, he mentions that maintaining capital controls in the midst of a stronger real currency and without foreign exchange reserves is risky. “We believe that this strategy is open to vulnerabilities, since a potential deterioration of external accounts, whether due to internal or external factors, could undo most of the ongoing stabilization effort“warns the bank.

Also, it analyzes risks in the external environment, in particular, in a scenario of a strong dollar, as is expected to happen under a Donald Trump presidency. “Emerging market currencies could also depreciate, adding downward pressure on the Argentine peso in an environment of low foreign exchange reserves,” he slips.

Internally, he highlights that the key is “the popularity of the administration, especially how the population values the decrease in inflation in a scenario of slow recovery.” Finally, he also warns that ““an excessively strong currency could mean that such growth is achieved without a corresponding improvement in employment and wages.”

Therefore, if the government’s popularity declines, pointing to a weak performance in the midterm elections, ““Uncertainty about the political implications could begin to cloud the economy’s performance.” and asset prices, even as early as early 2025.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.