The Center for Economic Research pointed out in its latest report that electoral uncertainty affects inflation projections in the country.

He Economic Research Center (Cinve) published a new monthly report of inflation, in which they projected a monthly variation of the 0.41% in November, and 5.1% year-on-year; although they did not fail to point out the uncertainty generated in the estimates by the electoral climate, soon to be defined in the 2024 runoff.

The content you want to access is exclusive to subscribers.

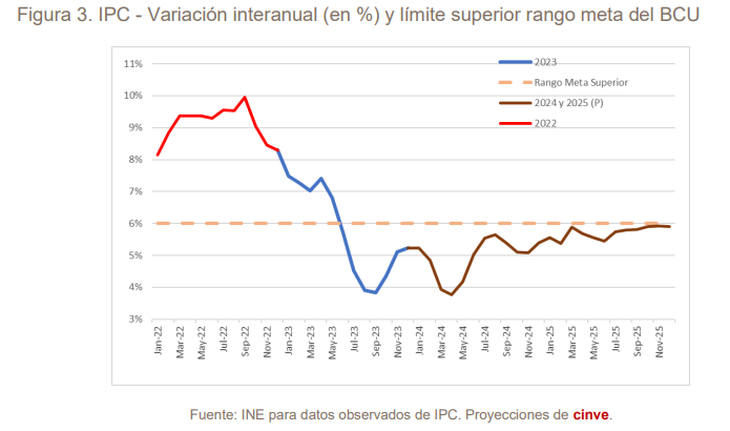

The inflation will close the year within target range, although close to its ceiling, as analysts have been warning for months. According to the latest Cinve projections – in the report prepared by economists Adrián Fernández, Iahel Rocca and Silvia Rodríguez—, he Consumer Price Index (CPI) It will be 0.41% in November, while at an interannual level it will reach 5.1%.

Both figures would be similar to those recorded during 2023, and the same would happen in December. Likewise, at the end of the year the accumulated inflation It would be at 5.4%, within the target range but close to its ceiling of 6%.

Cinve inflation projections.png

Cinve projects inflation very close to the ceiling of the target range by the end of 2025.

Five

Next year, meanwhile, no major movements are expected with respect to 2024 and the objective of maintaining pressure on prices within the range of 3%-6% would continue to be met; although inflation would be quite close to the limit, closing 2025 at 5.9%.

What will happen with the elections?

The Cinve report, however, points out that there is still difficulty around accurate projections due to the uncertainty generated by the electoral climate that, finally, this Sunday will culminate with the definition of the next president in the runoff.

In fact, he gives as an example that the center’s CPI projection for October had been 0.43%, but that this ended up being below, with 0.33%, according to data from the National Institute of Statistics (INE).

“Possibly, once the election resultsuncertainty is reduced and tends to return to usual levels,” contemplated the economists who prepared the document. This would also imply levels of inflation which could be lower.

This reading can even be made with respect to the results of October, when it was the first electoral round, which was marked by nervousness regarding the approval of the social security plebiscite driven by the PIT-CNT —and its eventual effects on the economy—; and that, once it became evident that the initiative would not obtain the votes necessary for its implementation, the business expectations They were regulated and influenced the final prices.

The definition of the next president will also bring certainty in that sense, since the winning sector will be able to give clear and concrete definitions about how the monetary policy starting next March 1, among other economic guidelines of the country.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.