Fiscal adjustment: an objective achieved with social costs

The second pillar of the program was the fiscal adjustment, which allowed primary balance to be reached in January 2024, just one month after the new government began. This achievement was achieved through a drastic reduction in public spending in a context of falling revenue. The adjustments included significant cuts in energy and transportation subsidies, as well as a freeze on infrastructure investment.

The magnitude of the adjustment was such that the fiscal deficit ceased to be a source of inflationary pressure. This meant the closure of one of the main monetary issuance channels, by eliminating the need for Treasury financing by the Central Bank. However, the social cost was high: private consumption contracted significantly, deepening the recession and especially affecting the most vulnerable sectors.

Monetary policy: the strategy to contain issuance

The third pillar of the program was a strictly controlled monetary policy, designed to eliminate issuance as a source of inflation. In mid-2024, the Central Bank adopted a new monetary policy: fixing the broad monetary base and established a monetary rule by committing to sterilize any issuance derived from the purchase of dollars. This implied that each peso issued had to be absorbed through the sale of reserves in the financial market.

The adjustment on income: the fourth inflationary anchor

Although less recognized, income policy became a fourth key anchor for containing inflation. The government actively intervened in salary negotiations, imposing ceilings on private sector joint ventures, limiting the salary recomposition of the public sector and adjusting the pension update formula to slow down income growth. These measures, combined with high initial inflation, eroded the purchasing power of wages and contributed to cooling aggregate demand.

graphic_BUTELER-02.jpg

Control over income had a direct effect on slowing prices by limiting the ability of companies to pass on higher labor costs to consumers. However, the social impact was significant, since it widened the gap between inflation and the growth of real wages, deepening inequalities in a context where in the second half of 2024 more than 50% of the population lives below the poverty line.

The fight against inflation: progress and limits

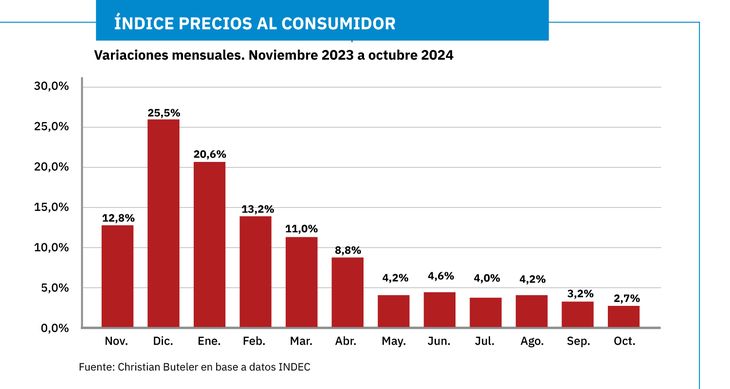

The slowdown in inflation became one of the central objectives of the economic program. Although in the first months of 2024 monthly inflation remained at high levels, the combination of fiscal adjustment, monetary control and economic contraction began to show results. For the period from May to August, monthly inflation fell to a range of 4% to 5%, consolidating around 3% in the last quarter of the year. However, this reduction was slower than projected, evidencing the rigidity of inflation expectations and the difficulty of breaking with the structural levels of price indexation.

graphic_BUTELER-03.jpg

The sectoral panorama: fragmented recovery and social challenges

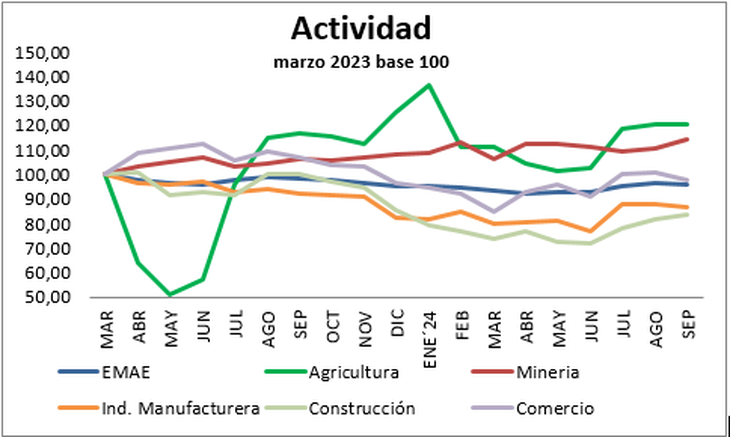

The sectoral analysis of the Argentine economy reflects an uneven recovery. According to the Monthly Economic Activity Estimator (EMAE), in September 2024, total activity was just 3.8% below March 2023, when the recession began. However, the averages hide significant disparities. Sectors such as agriculture (+20.7%) and mining (+14.5%) showed notable progress, driven by the end of the drought that had affected last year and specific sectoral policies. In contrast, construction (-16.3%), manufacturing industry (-13.4%) and commerce (-1.9%) continue to decline, which especially affects the most vulnerable jobs and the domestic economy. .

Buteler4.png

This heterogeneity highlights the structural fragility of the Argentine economy. While some sectors manage to adapt and grow, the most employment-intensive sectors face significant barriers, amplifying inequality and making an inclusive recovery difficult. With a level of poverty that affects more than 50% of the population, the challenge of reactivating these sectors is as urgent as it is complex.

The Exchange Stock: an obstacle to sustainable growth

Exchange rate policy represents the most critical challenge of the economic program. Although in December 2023 a devaluation of the peso of more than 50% was carried out, the real multilateral exchange rate is at levels similar to those of a year ago, the exchange rate delay is evident in a global context where the dollar has strengthened against to the main currencies. Current exchange restrictions, designed to prevent massive capital outflows, limit the economy’s capacity for sustained growth and generate distortions in relative prices.

Buteler5.jpg

The lifting of the exchange rate is inevitable, but its implementation requires a careful strategy to avoid a new inflationary shock. In addition, the excess weight in the system, estimated at 20 billion dollars, makes an orderly transition difficult. Without a significant reduction in this surplus, any attempt to normalize the foreign exchange market risks causing a sharp depreciation.

Buteler6.png

Outlook for 2025: between stability and growth

The year 2025 is presented as a crucial period for the Argentine economy, in which the achievements made in terms of macroeconomic stabilization will be tested against the structural challenges that remain unresolved. Although the government has made important progress in reducing inflation and fiscal balance, exchange rate delays and exchange rate restrictions are emerging as the main threats to sustainable economic recovery. This section will analyze in detail the risks associated with exchange rate policy, the impact on economic activity and the strategic importance of the value of the dollar in the local economy.

The risk of continuing to delay the exchange rate

One of the most pressing problems is the persistent appreciation of the peso in real terms. Although the crawling peg regime allowed some control of inflation expectations during 2024, the multilateral real exchange rate is practically at the same levels as at the end of 2023. This reflects an exchange rate delay that, if not corrected, could become a obstacle to external competitiveness and the recovery of economic activity.

The appreciation of the peso makes many products cheaper to import than to manufacture locally, aggravating the structural weaknesses of the Argentine economy. As the exchange rate is kept artificially low, these distortions affect not only the trade balance, but also investment decisions in strategic sectors.

In addition, the exchange rate delay could limit the recovery capacity of exports, a fundamental engine for the economy. Agriculture and mining, which led the recovery in 2024, could see their competitiveness reduced in international markets if the exchange rate does not adequately reflect domestic costs and global trends. This would be especially harmful in a global context marked by the strength of the dollar, which has caused devaluations in other currencies in the region.

The danger of a disorderly exit from the stocks

Another central challenge is the need to lift exchange restrictions in a controlled manner and adapt monetary policy to the new conditions. A bad exit, characterized by an abrupt jump in the exchange rate, could trigger a new inflationary acceleration, reversing the progress made in correcting relative prices and controlling monetary issuance.. In practical terms, this would mean returning to a spiral of price increases that would directly impact the purchasing power of salaries and the already weakened domestic demand.

An exchange rate jump could also have devastating effects on the financial system, generating a loss of confidence in the local currency and exacerbating the dollarization of savings. This would further limit the Central Bank’s ability to intervene in the markets and stabilize the economy. Likewise, real interest rates—which currently remain at negative levels thanks to exchange restrictions—would have to adjust significantly upwards, affecting both public and private sector financing.

Therefore, the strategy to normalize the exchange market must include not only an exchange rate adjustment, but also a coherent monetary policy that guarantees price stability during the transition. This will involve coordinating the management of the economy’s excess pesos—estimated at 20 billion dollars—with the accumulation of international reserves and the strengthening of external accounts.

The value of the dollar and its strategic importance

In Argentina, The price of the dollar has a strategic importance that goes beyond its role as a reference currency. The high sensitivity of the local economy to exchange rate variations is reflected in both internal prices and economic activity. Each movement of the dollar directly impacts production costs, prices of goods and services, and the expectations of economic agents.

The dollar also plays a central role in forming inflationary expectations. Despite progress in reducing inflation, a sudden correction in the exchange rate could revive these expectations, generating a domino effect that would compromise the stability achieved so far. This is particularly relevant in a country where inflationary memory is deeply rooted and economic agents react quickly to any sign of volatility.

Furthermore, the stability of the dollar is crucial to sustaining confidence in the economy. The perception of a reasonable and stable exchange rate is a determining factor in attracting investments, both local and foreign, and in promoting a business climate that boosts economic activity. In this sense, the government faces the challenge of finding a balance between correcting the exchange rate delay and the need to avoid a shock that could destabilize the economy.

Towards a 2025 of challenges and opportunities

The success of the economic strategy in 2025 will largely depend on the government’s ability to address these challenges in a coordinated and sustainable manner. The correction of the exchange rate must be carried out with a comprehensive approach that contemplates both macroeconomic stability and the recovery of productive activity.. This will involve not only adjusting the exchange rate regime, but also strengthening economic fundamentals through consistent fiscal and monetary policies.

The lifting of the stocks will be inevitable, but its implementation will have to be carefully planned to avoid the mistakes of the past. A successful transition will require not only accumulating reserves and reducing excess pesos, but also generating a social and political consensus that allows the necessary reforms to be sustained.

Despite the risks, 2025 also offers significant opportunities. The slowdown in inflation and fiscal balance have laid the foundation for a stronger recovery, provided the remaining issues are addressed with determination and prudence. If the government manages to overcome these challenges, Argentina could finally move towards a more stable and inclusive growth model.

Financial analyst

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.