Public salaries vs. private salaries: how much was the real fall

image.png

Regarding the evolution of public vs. private incomethe fall in public sector salaries was 22.1% between November and January, much greater than that of the private sector (12%).. “The recovery was also much weaker,” they explained from Fundar. If the accumulated between December and September 2024 is taken into account against that same period last year, there was a contraction of between 23% and 25%.

Teacher salaries: the most affected among the public

The salaries of university professors were cut even more than average, the study found. The fall in purchasing power between November and January for this segment of workers it was 30.3% and, although it had a slight recovery afterwards, “it was as weak as the public sector average (21.9%)”, it was analyzed.

If the interannual variation between December and September 2023 is taken into account, against that same period but in 2024, The loss is 25%, in real terms.

Private salaries by parity: the most favored

image.png

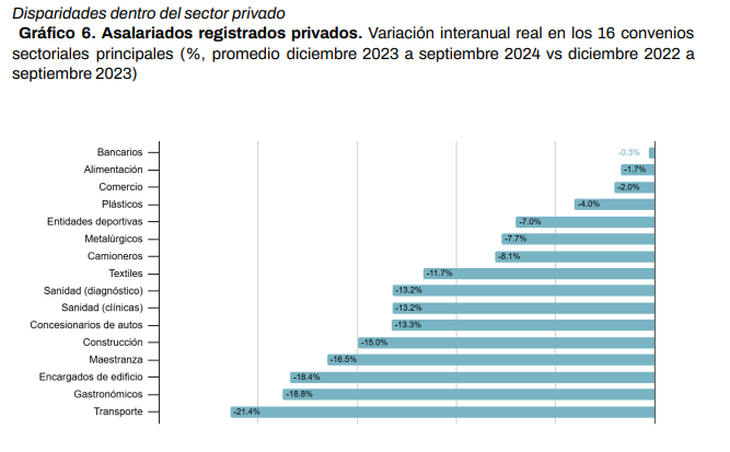

Private companies with joint ventures are at the lowest level since 2007, the report notes, however, it is the sector that, on average, defended itself the most. “The internal heterogeneity of the private sectors also accounts for a wide range of performance. Although they all fall during the analysis period, some sectors managed to practically stabilize purchasing power, while others had drops of around 20%“, they explain from Found.

If the period between December and September 2024 is taken into account, compared to 2023, there was an average drop of 8%. The latest data available, however, speaks of a gap of 3% compared to November of last year.

“The less favorable performances are explained by the delay in the signing of the agreements and by intermittent increases that did not reach past inflation (underindexed). The most favorable ones were instead due to a shortening of agreements and the inclusion of monthly increases“, they detailed.

Retirements: the freezing of the bonus complicated the recovery

image.png

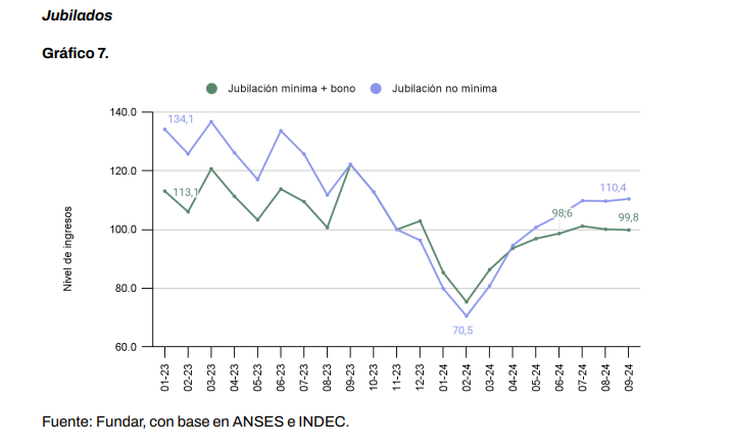

The retirements They showed two negative but differentiated trajectories. Those of the minimum amount (47% of the total) began to be updated monthly by the Consumer Price Index (CPI) in April 2024, with an extraordinary increase of 12.5%. “This modification allowed a rapid recovery of purchasing power. But, the freezing of the bonus (which in the previous period had allowed inflation to be leveled) prevented this recovery from reaching the levels prior to the devaluation jump“, they detail.

According to Fundar, The rest of the retirements, governed solely by the mobility formula, had a more accelerated recovery. In any case, “without a bonus, the fall compared to the inflationary acceleration after the December devaluation was much more abrupt and the loss of income produced in the middle accounts for the greater deterioration.”

AUH and Alimentar Card: disparate evolutions

It should be noted that in January 2024, the Government decided to double the amount of the AUH, which implies that it recovered its purchasing power to levels similar to those of 2020; and in July it began to be updated for inflation. So, From December to September 2023, compared to 2024, it rose 27%.

“Despite this positive balance, it is pertinent to evaluate its performance together with that of the Feed Cardsince more than 80% of the beneficiaries of the AUH are also beneficiaries of this benefit. We found that, although there was an increase in February and another in June, in the first ten months of government, the amount in real values fell 23.8%“, they explain.

Therefore they conclude that, While on the one hand the AUH was strengthened, on the other the purchasing power of the Alimentar Card was cut. Furthermore, it is important to note that both policies considered together do not cover the line of indigence of an adult.

Minimum vital and mobile wage: the one that fell the most

The minimum wage (SMVM), if September is taken against November, had a drop of 63%. “The strong erosion of this policy is explained in the framework of tension between the Government and social movements, generally mediators for the application of this policy,” they determine.

The National Council of Employment, Productivity and the Minimum, Vital and Mobile Wage, a body with representation of the State, unions and companies, met three times: in February, in May and in July. On none of the occasions was it possible to reach consensus regarding the determination of the SMVM, so The Executive Branch decided to unilaterally resolve the increase in the legal minimum.

Teaching parity: a loss of almost 29%

The National Teacher Parity guarantees a minimum floor for teacher salaries throughout the country, compensates the provinces with lower income that cannot pay that salary and regulates a national contribution to all teachers via the National Teacher Incentive Fund (FONID).

It should be noted that in March, The new Government decided to remove from the joint venture the budgetary allocation allocated to the National Teacher Incentive Fund (FONID). During the entire first half of the year, no meetings were called for this negotiation instance. During the month of August, without having reached an agreement, the Executive Branch opted for a retroactive update that reached the month of April, allowing a slight recovery of what was lost.

Despite this update, the average drop for the period is 28.8%. “The level’s performance remains similar to that of the average public sector salary; however, the loss in the period is much greater,” they explain.

Private homes: they cannot recover what was lost

After an unstoppable decline between December and January, which deteriorated the purchasing power of private household workers by 28.6%, salaries began to recover slightly. Despite this, The period presents a drop of 20.8%.

Conclusions: what happened in 2024 in terms of salaries

“The arrival of Javier Milei to the government implied an important shift in economic policy. The protection of jobs in a context of high inflation and macroeconomic instability was replaced by a program that attempts to slow down prices through strong monetary and fiscal adjustment. The choice to carry out a program that centrally attacks inflation without major compensation is the main key to understanding what happened to income in the first ten months of Government,” Fundar maintains.

That is why they conclude that the change in the macroeconomic and political context resulted in a significant shock to income. “The most affected groups were those most exposed to inflation, the level of economic activity, those dependent on public spending, and those who saw their institutional income umbrellas dismantled. Those who had institutional tools (such as private joint ventures), even registering significant falls , they were able to defend themselves better,” they close.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.