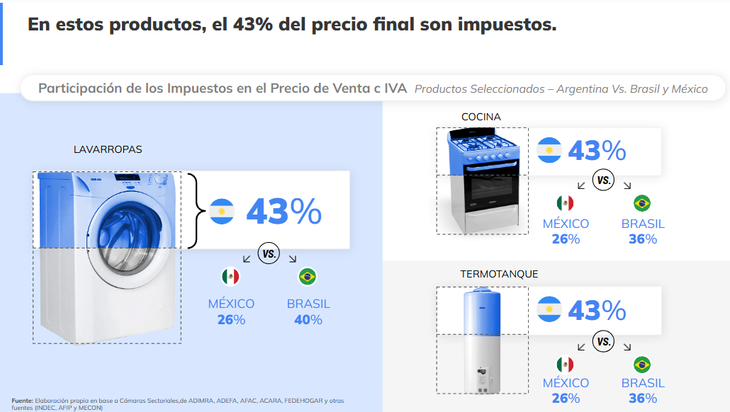

A report from the main metallurgical chambers ensures that the tax burden reaches an average of 32% of the factory gate price, not including VAT. At the same time, they point out the need to improve competitiveness.

A report prepared by a group of metal industry chambers exposed the impact of taxes in the final price of the products. Companies from various sectors participated in the study, such as agricultural machinery, trailers, tubes and profiles, light steel constructions, white goods, household appliances, gas appliances, auto parts and steel packaging. These industries, along with the automotive sectorbring together more than 17,000 companies, mostly small and medium-sized (SMEs), which generate more than 11.5 billion dollars in exports and They employ more than 350,000 people directly.

The content you want to access is exclusive to subscribers.

According to the report, the The tax burden borne by metallurgical products in Argentina reaches an average of 32% on the ex-factory price, excluding VAT. This percentage is more than double that of countries such as Brazil and Mexico, which represents a significant challenge for the competitiveness of the sector.

Screenshot 2025-01-05 110127.png

According to the report, the tax burden borne by metallurgical products in Argentina reaches an average of 32%

“An orderly macroeconomy is essential to recover business competitiveness. We value the efforts of the government and the commitment of Argentines in this transition to a new economic regime, but macroeconomic stability is just the beginning,” highlight the chambers participating in the survey.

Besides, underline the need for concrete microeconomic policies to build a competitive environment. Among the priority measures are reducing the tax burden, lowering non-wage labor costs, promoting financing to the private sector and reducing logistics costs. Likewise, they valued initiatives such as the recent draft Investment and Employment Promotion Law for SMEs, pointing it out as a step in the right direction.

Taxes that impact Argentine products

The report highlighted that the Argentine industry faces serious difficulties in growing and competing due to high tax pressure. ““Of all the challenges, this is the most pressing.”the sector cameras warned.

Likewise, they highlight that the country is among the nations with the highest tax burden globally, aggravated by a complex tax system that includes more than 155 taxes and fees.

Screenshot 2025-01-05 110146.png

The report revealed that labor taxes represent the largest tax burden for metallurgical activity

The report revealed that labor taxes represent the largest tax burden for metallurgical activity, adding to Gross Income and Profits, which together make up two thirds of the total fiscal weight. Furthermore, it highlights that a third of this burden corresponds to distortive taxes, which do not exist in countries like Brazil and Mexico. “On average, taxes represent 44% of the final price of metallurgical goods, including VAT,” the sector cameras specified.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.