Purchases in the MULC and the Repo help the Central to meet the large debt maturities that are approaching.

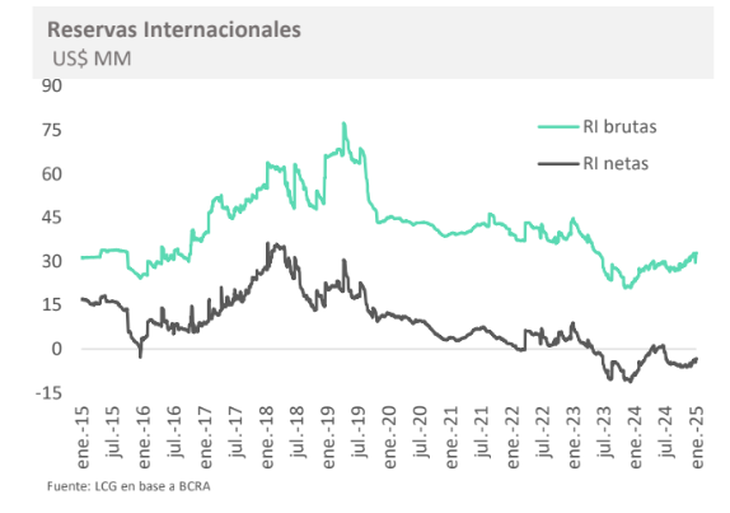

The Gross international reserves reached their highest value in the Milei era this Tuesdayvery close to US$33,000 million, largely thanks to the Repo obtained by the Government recently. However, in the coming days they would lose everything they gained in the first days of the year due to the debt obligations that the Treasury must face.

The content you want to access is exclusive to subscribers.

So far in January, the monetary authority’s coffers have grown by almost US$3.3 billion. This happened mainly due to the usual movements on the first business day of the month, which compensate for the declines on the last day of the previous month, and due to the Repo that the Government signed with five international banks for US$1,000 million. Additionally, the Central Bank (BCRA) has been exhibiting a daily net purchase of US$84.5 millionon average, by operations in the official exchange market.

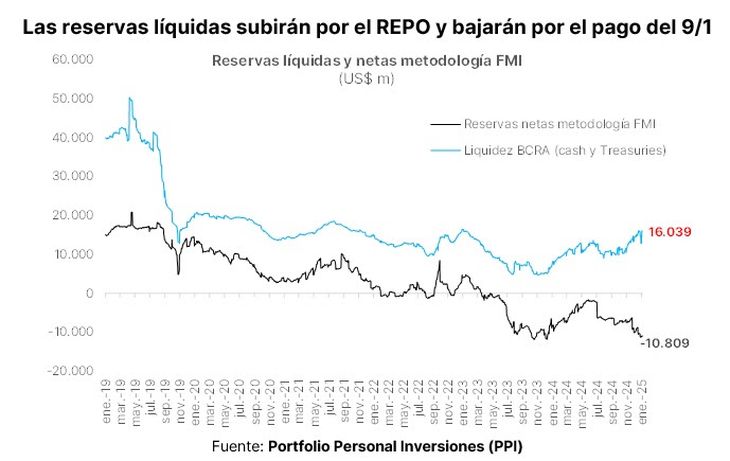

“The Repo was carried out for a term of two years and four months at a SOFR-USD rate plus a spread of 4.75%. Given that the liability matures in a term greater than 12 months, it also net reserves improved in US$1,000 million,” they said from the stockbroking company. Personal Investment Portfolio (PPI).

image.png

The consultant LCG maintained that this line of credit will help the BCRA face a beginning of the year with an increasing demand for dollarsdue to the effect of the elimination of the PAIS Tax on imports, the pressure of the exchange rate delay on the tourist balance, and debt obligations. Regarding the debt, this Thursday US$4,340 million in capital and interest expire of the bonds restructured in 2020 by the management of Martín Guzmán.

PPI Reserves

PPI detailed that “the payment of coupons and amortizations on January 9 will cause a drop in liquid reserves (today close to US$16,000 million) of about US$3,300 million (corresponding to the capitalbecause the interests are already deposited abroad), although it will leave the net amounts unchanged, since the Treasury deposits in the BCRA are already deducted as short-term liabilities.” Consequently, the reserves would decrease by the same magnitude as what they increased so far in 2025.

BCRA purchases, new Repo and agreement with the IMF: the three pillars to increase reserves

In the same sense, the economist Jorge Neyro He clarified in dialogue with this medium that part of the debt with private bondholders has already been paid in advance, which is why “the Government is going to have a decrease in reserves, but it is not going to be very strong.” The analyst highlighted the relatively positive trajectory that the monetary authority maintains at the beginning of the year in terms of currencies and estimates that the Government will seek to combine these purchases in the summer with a new Repo, more so if the country risk continues to decline, which would reduce the cost of the loan.

LCG also stressed that “The systematic reduction of country risk increases the chances that the Treasury will regain access to international debt markets“. “Official reports speak about a possible placement to repurchase Non-Transferable Letters, which would imply raising the stock of reserves in the BCRA’s assets at the cost of the most expensive debt for the Treasury,” he added.

In this framework, PPI pointed out that, under the methodology of the International Monetary Fund (IMF), which includes as short-term liabilities the Treasury deposits in dollars in the BCRA for US$5,977 million and the obligations of BOPREAL for US$ s2,055 million, Net reserves are estimated at -US$10.8 billion. It should be noted that those Treasury deposits in the Central Bank are accounted for in the gross reserves and will be used both to pay this week’s maturities and the US$650 million that must be paid to the IMF on the first day of February.

The swings in reserves occur while the Government seeks to seal in the first quarter a new agreement with the Fund, a necessary condition for the lifting of the stocks under the strategy of the Ministry of Economy. At the end of last year, Minister Luis Caputo assured that in order to eliminate exchange restrictions the BCRA must be recapitalized and that this could occur through new disbursements by the multilateral credit organization.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.