China is facing its worst economic collapse of the last decades. Is one coming crisis like that of Japan in the ’90s?

Let’s look at the 30-year government bond yields. China and Japan:

BOGGIANO TASA JAPAN.jpg

It is the first time in recent history that Japan has higher rates than China. Not even in the 2008 crisis did that happen.

In Japan, implicit bond rates are rising because the market, after decades of deflation and low growth, expects a recovery, with a rebound in inflation and a tighter labor market.

On the contrary, in China, he bond yields are falling sharplybecause investors fear a weakened economy due to deflation, the fall of the real estate sector and the lack of domestic demand.

What happened to Japan in the 90s?

The collapse of Japan in the 90s originated in a real estate and stock market bubble that exploded after years of unbridled growth. The Real estate prices and stocks plummetedleaving banks and individuals with debts that are impossible to pay off. Deflation was the protagonist, reducing consumption and preventing growth.

Added to this was the demographic problem, with an aging population and a declining workforce. His Economic stagnation lasted for more than 20 years.

Interest rates remained near zero, and the Bank of Japan implemented unprecedented stimulus. However, the economy never regained the dynamism of the years before the crisis.

It took 35 years for the Nikkei (Japan index) to return to the 1989 highs:

NIKKEI INDEX.jpg

And what is happening today with China?

China, the second largest economy in the world, faces today challenges similar to those that sank Japan.

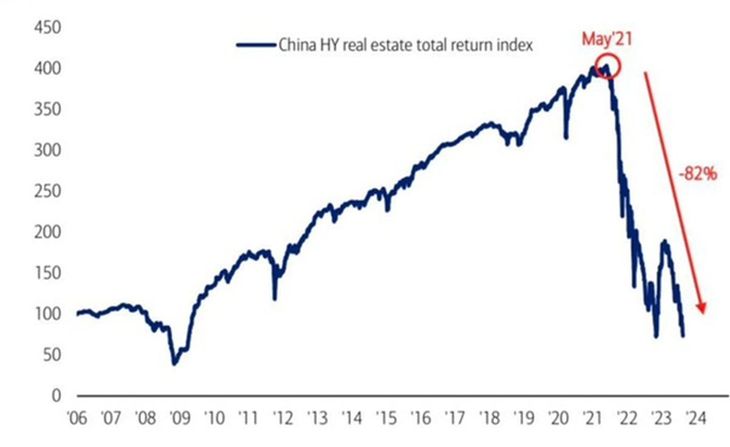

Since 2021, the fall in the Chinese real estate sector has been brutal. The Real Estate index fell 82% from its highs:

CHINA.jpg

Furthermore, the country accumulates six consecutive quarters of deflationn, a phenomenon that It hasn’t happened since 1999. Low prices and weak demand reflect a fragile economic system, despite government stimulus efforts.

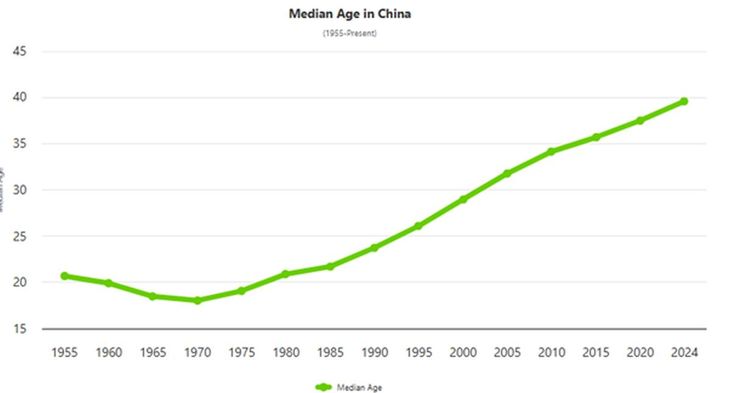

However, the most critical problem is demographic. Thanks to the one-child policy, The Chinese population is aging rapidly.

MEDIAN AGE CHINA.jpg

The average age in China is currently 40 years old. In 2005 it was 32. And by 2050 it is expected to exceed 50 years. Furthermore, in 2050, 39% of citizens will be of retirement age. This structural change affects both productivity and consumption, just as it happened in Japan.

Why aren’t we seeing an immediate global impact?

Despite the similarities, the current context has important differences. In the 1990s, Japan was already a developed economy and was not as dependent on global trade as China is today. So far, global markets have not felt the expected repercussions of the Chinese collapse. Although this is momentary and could worsen quickly.

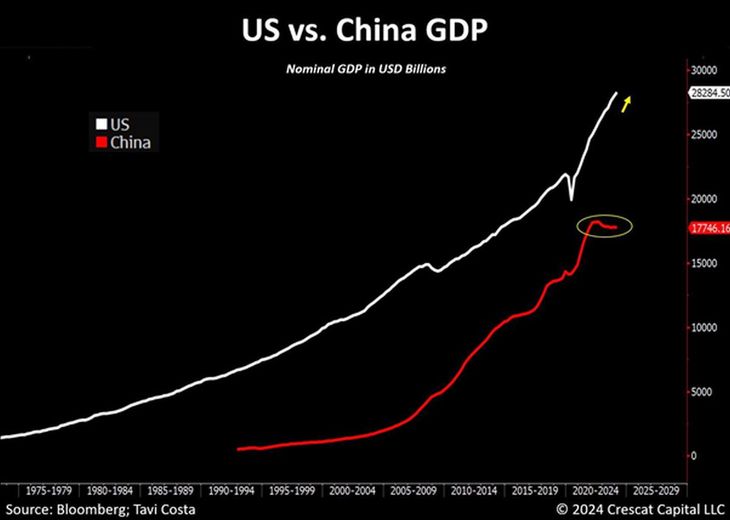

Let us keep in mind that the global economy faces opposite dynamics: while China is in deflation, the US is fighting inflation. Let’s see the comparison of the GDP of both countries:

US CHINA GDP.jpg

He China’s economic future will depend on how it addresses three key challenges: the reactivation of the consumption internal, management real estate crisis and the management of their demographic problems. So far, stimulus measures have failed to make a significant impact. In the long term, the demographic challenge will require policies that promote birth rates and immigration, although this implies a significant cultural change for a society accustomed to demographic stability.

He risk of China experiencing “Japanization”that is, decades of economic stagnation with deflation and low growth, It’s on the table.

Furthermore, the possibility of a new trade war with the US under the Trump administration adds uncertainty to the Chinese future.

Therefore, you have to be careful with Chinese stocks, as they may continue to decline. Let us remember that Japan (Nikkei) took more than three decades to surpass historical highs.

If you want to learn more about investments, I invite you to our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.