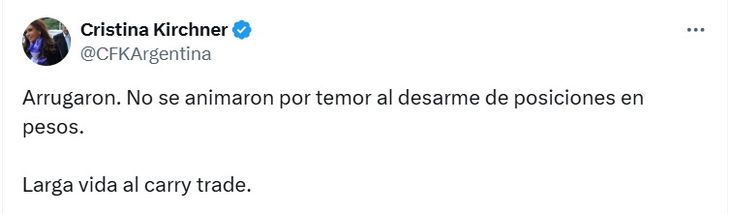

The former president pointed out against the national government’s “fear of disarmament of positions in pesos,” following the latest announcements regarding monetary policy.

The Government is finally moving forward in a week of important definitions of monetary policy and the market observes greater intervention and cracks to obtain dividends from the “carry trade“While the administration seeks to achieve a balance, opposition leaders emphasize that financial speculation occurs on public funds. In this framework, Cristina Fernández de Kirchner reappeared on social networks.

The content you want to access is exclusive to subscribers.

“They wrinkled. They did not dare for fear of the disarmament of positions in pesos. Long live the carry trade”, was the publication of the former president, who alluded to the Government’s latest decision.

The viability of the strategy “carry trade” o financial bicycle faces new challenges after the announcement of the Central Bank of the Argentine Republic (BCRA) to reduce the rate of devaluation of the peso with respect to the dollar from 2% to 1% monthly (a measure called “crawling peg”). Although the Government’s measure seeks yessoften inflationary expectations and improve the perception of control over monetary policyskepticism survives intrinsic and historical volatility of the local market.

Cristina Kirchner Carry trade.png

Dollar and “carry trade”: the BCRA decided to maintain the interest rate

After the announcement Tuesday of a halving of the rate of devaluation of the official exchange rate starting in February, andThe Central Bank decided this Thursday to maintainat least for now, unchanged monetary policy rate. The entity tries to avoid further pressure on the dollar financial.

The decision comes at a time when a good part of the market expected that the confirmation that the “crawling peg” (the monthly rhythm set by the exchange rate table for the official dollar) will drop from 2% to 1% starting in February will translate into a new rate cut administered by the BCRA.

However, in line with the signal given by the Ministry of Economy in the first debt tender in pesos of the year, the Central Bank seemed to show that it does not want to add a new factor of possible tension to the exchange gap. Both instances contribute to reinforcing the incentive for “carry trade”: a bet to try to prevent there from being more pesos that will put pressure against the dollar and that the purchase of foreign currency in the official market does not stop.

The truth is that the decision coincides with the expansion of BCRA intervention on financial dollarswhich became systematic in the last wheels and reflects the same concern. Based on the increase in the traded volumes of the AL30 and GD30 bonds (the most used to make MEP and CCL), Portfolio Personal Inversiones (PPI) estimated that In the last four days, it allocated some US$250 million of reserves to intervene on the exchange gap.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.